Hong Kong (AFP) – Asia’s markets rally stuttered Friday after early gains as traders struggled to keep up with another Wall Street record following the Federal Reserve’s interest rate cut. They were also weighing the outlook with another Trump administration.

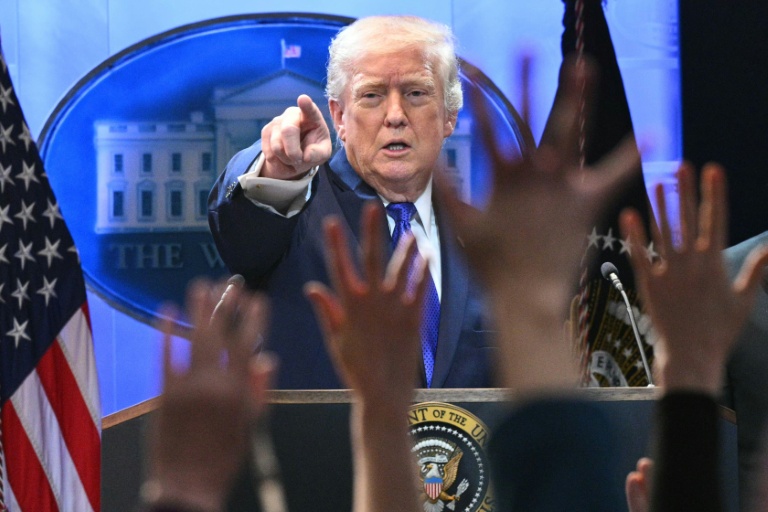

Traders were waiting for the end of a week-long meeting of key Chinese officials who have been hammering out a major stimulus package for the world’s number two economy with an eye on the US election result. While there are concerns that another four years of Donald Trump could see a rise in tensions between Beijing and Washington, investors are optimistic that his plans to slash taxes and push through more deregulation will boost companies’ bottom lines.

However, there are worries that the Republican’s policies could stoke inflation again, dealing a blow to the Fed’s long-running battle against prices. Central bank boss Jerome Powell added to the upbeat mood Thursday by insisting that the outcome of this week’s vote would have no impact on policymakers’ decision-making, stating that they would make their decisions based on data.

After the policy board cut rates 25 basis points to 4.50-4.75 percent, as expected following September’s 50-point reduction, Powell emphasized: “We don’t guess, we don’t speculate, and we don’t assume.” The Fed’s post-meeting statement noted that “labor market conditions have generally eased” since earlier in the year and acknowledged progress in bringing inflation down to its two percent target. Traders are now trying to ascertain the outlook for another cut in December.

“With Powell squarely focused on labor, the combination of an inflation rate now in the realm of the Fed’s target means it can easily justify further cuts,” said Robert Tipp and Tom Porcelli at PGIM Fixed Income. “Although uncertainty abounds, the Fed’s year-end 2025 forecast for a Fed funds rate of 3.5 percent is still a useful starting point for where this cycle is going.”

On Wall Street, the S&P 500 and Nasdaq rallied again to hit fresh records, helped by strong performances by tech titans Apple, Google parent Alphabet, and Facebook’s Meta. Asia took up the baton in early trade but some markets fell away in the afternoon. Tokyo, Sydney, Singapore, Wellington, Taipei, and Jakarta rose, while Hong Kong and Shanghai turned negative along with Seoul, Manila, Mumbai, and Bangkok. London edged up at the open while Paris and Frankfurt were flat.

On currency markets, the dollar fell against the yen, extending Thursday’s losses in reaction to the Fed cut, while bitcoin hit another all-time peak of more than 76,956 on hopes of more support from a crypto-friendly Trump White House. After markets closed, Chinese media reported that officials in Beijing would raise the debt ceiling for local governments by $840 billion in a bid to boost the country’s faltering economy. Broadcaster CCTV described the move as China’s “most powerful debt reduction measure in recent years,” adding that it would free “up space for local governments to better develop the economy and protect people’s livelihood.”

The meeting came amid uncertainty about the outlook for China after the election of Trump, who warned during his campaign that he would hit imports from the country with huge tariffs of up to 60 percent. “On balance, it is likely that Trump’s electoral victory presents additional downward pressure to China’s growth in the next few years (depending on various policy responses in both the US and China),” said National Australia Bank’s Gerard Burg.

However, Michael Hewson at MCH Market Insights added: “There is a sense of deja vu with respect to Donald Trump winning the US presidential election, both politically as well as from a market point of view. On the one hand, we have some serious hand-wringing going on as some parts of the political spectrum go into a collective pearl-clutching meltdown at the prospect of four years of unfettered Trumpism. As far as the markets are concerned, the response has been more tempered to the one we observed eight years ago, when the volatility was much more pronounced.”

**Key figures around 0710 GMT**

Tokyo – Nikkei 225: UP 0.3 percent at 39,500.37 (close)

Hong Kong – Hang Seng Index: DOWN 1.1 percent at 20,728.19 (close)

Shanghai – Composite: DOWN 0.5 percent at 3,452.30 (close)

London – FTSE 100: UP 0.2 percent at 8,155.56

Euro/dollar: DOWN at $1.0779 from $1.0801 on Thursday

Pound/dollar: DOWN at $1.2965 from $1.2985

Dollar/yen: DOWN at 152.62 yen from 152.92 yen

Euro/pound: DOWN at 83.15 pence from 83.18 pence

West Texas Intermediate: DOWN 0.9 percent at $71.74 per barrel

Brent North Sea Crude: DOWN 0.7 percent at $75.09 per barrel

New York – Dow: FLAT at 43,729.34 (close)

© 2024 AFP