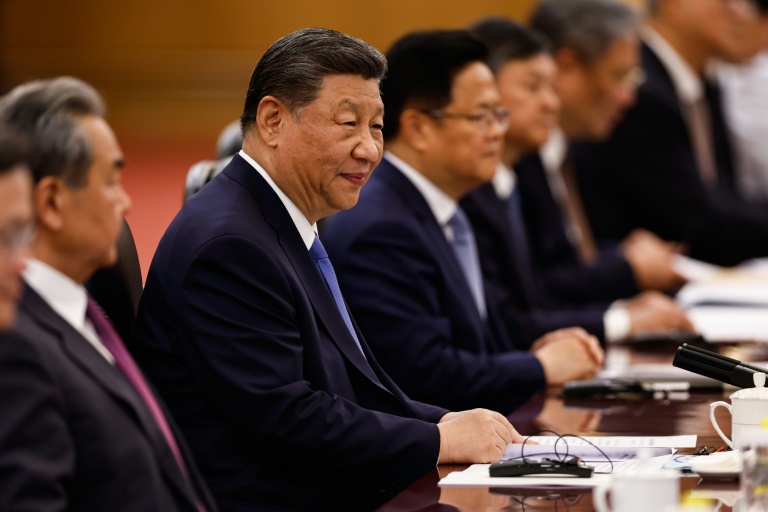

New York (AFP) – Global stocks were mixed Wednesday as euphoria over easing US-China trade tensions petered out while markets looked ahead to key US economic data. While the April volatility stemming from President Donald Trump’s tariff blitz appears to have halted, analysts warned that Washington still needed to reach trade deals with countries to instil a sense of stability.

The S&P 500 finished narrowly positive after a meandering session while the Nasdaq advanced and the Dow retreated modestly. Markets are looking ahead to reports Thursday on US wholesale prices and retail sales for April, as well as earnings from retail behemoth Walmart. In a further boost for the US-China trade truce, Beijing said Wednesday it was suspending some non-tariff countermeasures on US entities for 90 days. However, the market relief that followed news of a de-escalation in the US-China trade war at high-level talks over the weekend looked to have run its course.

“After a powerful rally to start the week, the stock markets are consolidating,” said Fawad Razaqzada, market analyst at City Index and FOREX.com. In Europe, the Paris, Frankfurt and London stock markets all closed lower. Chinese indices closed with sizeable gains on rallies for tech stocks. The Hong Kong stock market jumped more than two percent. After Asian markets closed, Chinese internet giant Tencent reported a better-than-expected increase in revenue for the first quarter, propelled by growth in gaming.

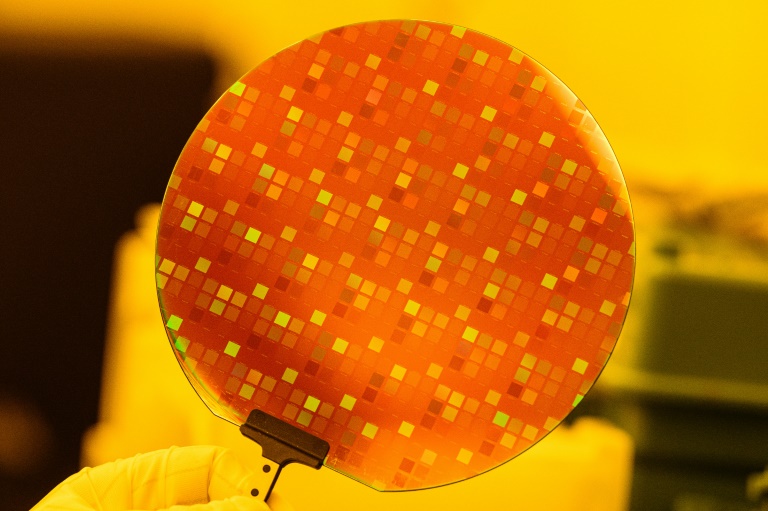

Tech darling Nvidia meanwhile extended its gains Wednesday, trading up 4.2 percent after adding nearly six percent Tuesday. That comes after Trump unveiled agreements Tuesday with Saudi Arabia on a visit to the Gulf, including a huge chip deal for Nvidia and Advanced Micro Devices. “The key theme for global stocks this week is the resurgence of big tech,” said Kathleen Brooks, research director at traders XTB. “So far this week, the Magnificent 7 (of blue-chip tech stocks) is outperforming the overall S&P 500…as the US improves its trading partnerships with key nations and President Trump sells Nvidia chips to leaders of the Middle East.”

Boeing shares also climbed after Trump announced in Doha what he called a record Qatar Airways order. Under a deal announced by Trump, Qatar Airways will acquire up to 210 Boeing 787 Dreamliner and 777X aircraft. Tokyo ended in the red, even as electronics titan Sony surged 3.7 percent as it announced a record annual profit. However, Sony did warn that profits could fall in this financial year and said it was hoping to manage the impact of Trump’s tariffs.

In other company news, Burberry shares soared 17 percent after the British luxury fashion group announced more cost-saving measures, putting one-fifth of its workforce at risk, to help curb losses. French train maker Alstom shares plunged 17 percent as its financial target disappointed investors, despite reporting a return to profit last year. Oil prices retreated after enjoying a four-day rally on demand optimism and Trump’s warnings to Iran over a nuclear deal.

– Key figures at around 2100 GMT –

New York – Dow: DOWN 0.2 percent at 42,051.06 (close)

New York – S&P 500: UP 0.1 percent at 5,892.58 (close)

New York – Nasdaq Composite: UP 0.7 percent at 19,146.81 (close)

London – FTSE 100: DOWN 0.2 percent at 8,585.01 (close)

Paris – CAC 40: DOWN 0.5 percent at 7,836.79 (close)

Frankfurt – DAX: DOWN 0.5 percent at 23,527.01 (close)

Tokyo – Nikkei 225: DOWN 0.1 percent at 38,128.13 (close)

Hong Kong – Hang Seng Index: UP 2.3 percent at 23,640.65 (close)

Shanghai – Composite: UP 0.9 percent at 3,403.95 (close)

Euro/dollar: DOWN at $1.1178 from $1.1185 on Tuesday

Pound/dollar: DOWN at $1.3268 from $1.3306

Dollar/yen: DOWN at 146.65 yen from 147.48 yen

Euro/pound: UP at 84.21 pence from 84.06 pence

West Texas Intermediate: DOWN 0.8 percent at $63.15 per barrel

Brent North Sea Crude: DOWN 0.8 percent at $66.09 per barrel

burs-jmb/dw

© 2024 AFP