Hong Kong (AFP) – Asian markets were mostly up Friday morning ahead of a pivotal speech by the US central bank chief, expected to shed light on possible interest rate cuts in the world’s top economy. Recent days have seen cautious trading as investors parse a mixed outlook for the global economy, beset by worries over inflation even as a boom in tech — especially artificial intelligence — continues.

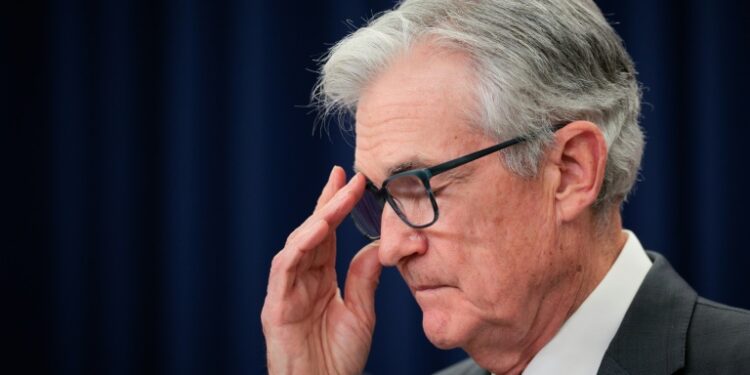

US Federal Reserve Chairman Jerome Powell is set to deliver remarks during an annual gathering of central bankers in Jackson Hole, Wyoming on Friday, a key event for observers weighing the chances of a rate cut at a September meeting of policymakers. Powell has come under intense public pressure this year from President Donald Trump to lower rates — an unusual political intervention at the independent central bank.

Stock markets across Asia were up narrowly on Friday, roughly 12 hours before Powell’s speech. Tokyo’s Nikkei index was barely above flat during morning trading, an improvement from Thursday’s 0.7 percent drop. Japan announced Friday that its core inflation rate had eased to 3.1 percent in July from 3.3 percent the previous month — still above its central bank’s two-percent target and boosting expectations of an October rate hike. Stocks in Hong Kong, Shanghai, Seoul, and Taipei were also up. Sydney and Bangkok were slightly down.

After a shaky few days on Wall Street, Asia “should act as a safe harbour while the Fed’s credibility is under the spotlight,” said Chris Weston, head of research at Pepperstone, in a note. Still, “hesitation to push risk higher will remain,” he said, adding that there is “a very low probability” of Powell calling explicitly for rate cuts in his speech later in the day.

Also weighing heavily on investors’ minds is the potential for a peace deal in Ukraine more than three years after Russia’s invasion. Trump on Thursday set a two-week time frame for assessing peace talks between Moscow and Kyiv, following days of high-stakes diplomacy that saw him meet in person with Russian and Ukrainian counterparts Vladimir Putin and Volodymyr Zelensky, as well as several European leaders. Observers have been speculating lately about the impact on oil markets of the possible lifting of sanctions on Russia, a major producer.

Oil prices were down slightly on Friday morning, paring back gains over recent days.

– Key figures at around 0215 GMT –

Tokyo – Nikkei 225: UP 0.1 percent at 42,634.00

Hong Kong – Hang Seng Index: UP 0.5 percent at 25,232.39

Shanghai – Composite: UP 0.3 percent at 3,783.76

Euro/dollar: UP at $1.1611 from $1.1604 on Thursday

Pound/dollar: UP at $1.3414 from $1.3412

Dollar/yen: UP at 148.52 yen from 148.37 yen

Euro/pound: UP at 86.57 pence from 86.52 pence

West Texas Intermediate: DOWN 0.3 percent at $63.35 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $67.46 per barrel

New York – Dow: DOWN 0.3 percent at 44,785.50 (close)

London – FTSE 100: UP 0.2 percent at 9,309.20 (close)

© 2024 AFP