Hong Kong (AFP) – Most Asian markets rose Monday following a rally on Wall Street and a record-breaking day in Europe, with sentiment boosted by positive talks between Donald Trump and Chinese President Xi Jinping that soothed worries about the incoming US leader’s second term. A sense of caution has permeated trading floors ahead of the tycoon’s inauguration later in the day after he warned he would impose hefty tariffs on imports, fanning fears of another debilitating trade war between the economic superpowers.

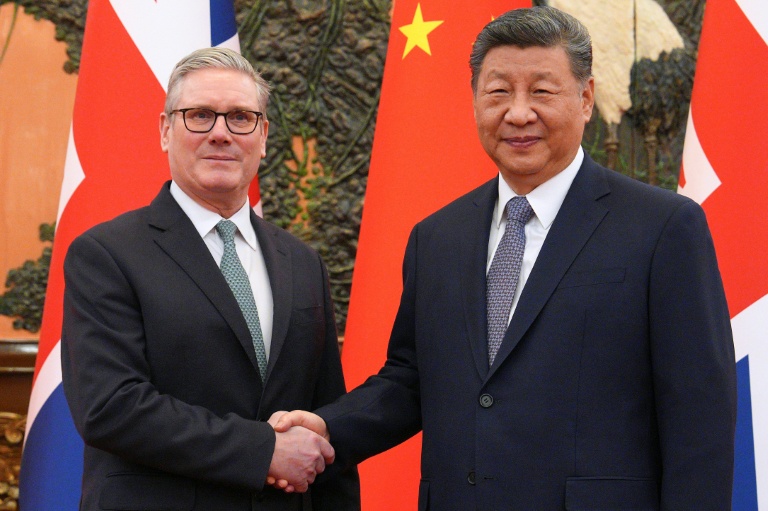

Pledges to slash taxes, regulations, and immigration have also led to concerns that inflation could be reignited and force the Federal Reserve to hold off cutting interest rates further, with some observers even flagging possible hikes. Still, while dealers nervously eye the next four years, there was some relief after news of the phone call on Friday. Trump and Xi vowed to improve ties between Washington and Beijing, with the Chinese leader hoping for a “good start” to relations, and the president-elect saying, “it is my expectation that we will solve many problems together.”

On his Truth Social media platform, Trump added: “We discussed balancing Trade, Fentanyl, TikTok, and many other subjects. President Xi and I will do everything possible to make the World more peaceful and safe!” Their comments provided some cheer to markets, with the S&P 500 ending up one percent and Nasdaq 1.5 percent. London and Frankfurt had earlier chalked up fresh all-time highs.

“The start of a new presidency often brings fresh energy — and uncertainty — to the financial markets,” said Saxo Markets chief investment strategist Charu Chanana. “With Donald Trump’s inauguration, investors are bracing for significant policy shifts. This could mean changes in taxes, spending, and trade agreements.”

Hong Kong led gains in Asia amid hopes that the feared trade war can be averted, with Tokyo, Shanghai, Sydney, Taipei, Manila, Mumbai, Bangkok, Singapore, and Jakarta also rising. Manila and Wellington were down. Seoul slipped after the Bank of Korea cut its 2025 economic growth forecast owing to weakening sentiment and political risks following last month’s brief declaration of martial law by President Yoon Suk Yeol and the political crisis it has sparked.

There was little relief from news that the South Korean central bank had unveiled a $250 billion support package for its exporters, citing the risk of possible tariffs by Trump. On currency markets, the yen edged up against the dollar ahead of the Bank of Japan’s policy meeting this week, with expectations that it will hike rates for the third time since March. Economists at Moody’s Analytics said the central bank has “struggled to provide consistent guidance on policy,” but that recent hawkish comments from the governor and deputy governor “suggest further tightening is on the horizon.”

“The yen has weakened significantly since the BoJ decided to skip a rate hike in December. This, combined with a series of hotter-than-expected inflation prints for consumer, producer and import prices, raises the odds of monetary policy action in January,” they added.

– Key figures around 0710 GMT –

Tokyo – Nikkei 225: UP 1.2 percent at 38,902.50 (close)

Hong Kong – Hang Seng Index: UP 1.9 percent at 19,946.51

Shanghai – Composite: UP 0.1 percent at 3,244.38 (close)

Euro/dollar: UP at $1.0311 from $1.0272 on Friday

Pound/dollar: UP at $1.2216 from $1.2168

Dollar/yen: DOWN at 156.10 yen from 156.20 yen

Euro/pound: DOWN at 84.40 pence from 84.41 pence

West Texas Intermediate: DOWN 0.3 percent at $77.67 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $80.43 per barrel

New York – Dow: UP 0.8 percent at 43,487.83 (close)

London – FTSE 100: UP 1.4 percent at 8,505.22 (close)

© 2024 AFP