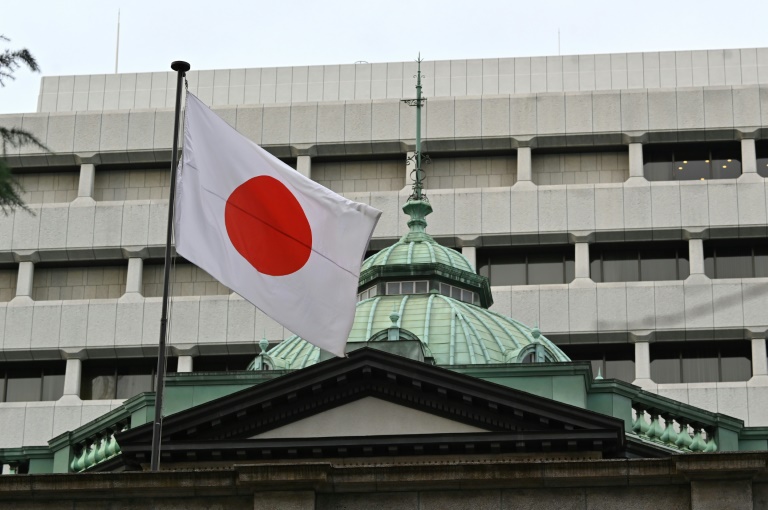

Tokyo (AFP) – Japan’s central bank on Tuesday scrapped its negative interest rate as it finally began unwinding one of the world’s most aggressive monetary easing programmes.

The maverick policy dating back to 2013 was aimed at jump-starting economic growth and inflation after the country’s “lost decades” of stagnant activity and prices in the world’s number four economy.

In its first increase in 17 years, the Bank of Japan said it was lifting its short-term policy rate from -0.1 percent to between zero and 0.1 percent.

Officials “assessed the virtuous cycle between wages and prices, and judged it came in sight that the price stability target of two percent would be achieved in a sustainable and stable manner”, it said.

The bank also said it would call an end to other unorthodox policies including its yield curve control programme on bonds and the purchase of risk assets such as exchange-traded funds (ETFs), saying they had “fulfilled their roles”.

The Federal Reserve and other central banks yanked up rates to rein in galloping inflation after Russia’s 2022 invasion of Ukraine.

But the BoJ kept its main rate negative, as it has been since 2016.

The last hike was in 2007.

Raising the rate will make loans more expensive for consumers and businesses.

It will also increase Japan’s bill for servicing the national debt, which at around 260 percent of national output is one of the world’s highest.

Because negative interest rates mean banks lose out by parking capital with the BoJ, the policy was aimed at encouraging them to lend to businesses and thereby jump-start the economy and inflation.

The BoJ has also spent vast amounts buying up bonds and other assets to pump liquidity into the financial system.

The policy has sharply weakened the yen against the dollar, which is good news for exporters but not for consumers as it made imports more expensive.

The yen dropped sharply against the dollar after the announcement, to around 149.80 per dollar from around 149.30 before.

Inflation has been at or above the BoJ’s target of two percent for almost two years.

But despite some tweaks around the edges — such as more flexibility with regard to its target range for bond yields — the main interest rate has remained negative.

This is because the BoJ wanted more evidence of a “virtuous cycle” of rising wages and inflation driven by demand and not temporary factors.

The final piece of the jigsaw appears to have come on Friday when Japan’s largest trade union secured a wage hike of 5.3 percent from employers, the biggest since 1991.

“Japan’s in the ballpark of what’s needed to sustain two percent inflation domestically,” Stefan Angrick at Moody’s Analytics said Monday.

© 2024 AFP