Beijing (AFP) – China said Friday sales to the United States slumped last month while its total exports topped forecasts, as Beijing fought a gruelling trade war with its superpower rival. Trade between the world’s two largest economies has nearly skidded to a halt since US President Donald Trump imposed various rounds of levies on China that began as retaliation for Beijing’s alleged role in a devastating fentanyl crisis. Tariffs on many Chinese products now reach as high as 145 percent, with cumulative duties on some goods soaring to a staggering 245 percent.

Beijing has responded with 125 percent tariffs on imports of US goods, along with other measures targeting American firms. Against that backdrop, analysts polled by Bloomberg had expected exports to rise just 2.0 percent year-on-year last month. But they beat expectations, coming in at 8.1 percent. However, exports to the United States — one of China’s top trading partners — fell 17.6 percent month-on-month, data showed.

“The damage of the US tariffs has not shown up in the trade data in April,” Zhiwei Zhang, president and chief economist at Pinpoint Asset Management, said in a note. “This may be partly due to transshipment through other countries, and partly because of trade contracts that were signed before the tariffs were announced,” he added. “I expect trade data will weaken in the next few months gradually.”

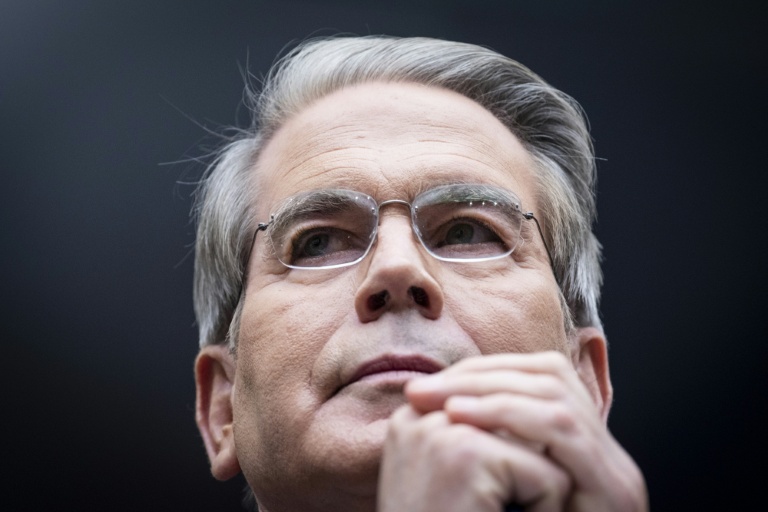

US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer are set to meet Chinese Vice Premier He Lifeng in Switzerland on Saturday and Sunday, marking the first talks between the superpowers since Trump unveiled his tariffs. April imports also beat expectations, dropping 0.2 percent, compared with the 6.0 percent slide analysts had estimated. Purchases from overseas were also being closely watched as a key gauge of consumer demand in China, which has remained sluggish.

Policymakers this week eased key monetary policy tools in a bid to ramp up domestic activity. Those included cuts to a key interest rate and moves to lower the amount banks must hold in reserve in a bid to boost lending. A persistent crisis in the property sector — once a key driver of growth — also remains a drag on the economy. In an effort to help the sector, Pan also said the bank would cut the rate for first-time home purchases with loan terms over five years to 2.6 percent, from 2.85 percent.

The moves represent some of China’s most sweeping steps to boost the economy since September. But analysts pointed to a continued lack of actual stimulus funds needed to get the economy back on track.

© 2024 AFP