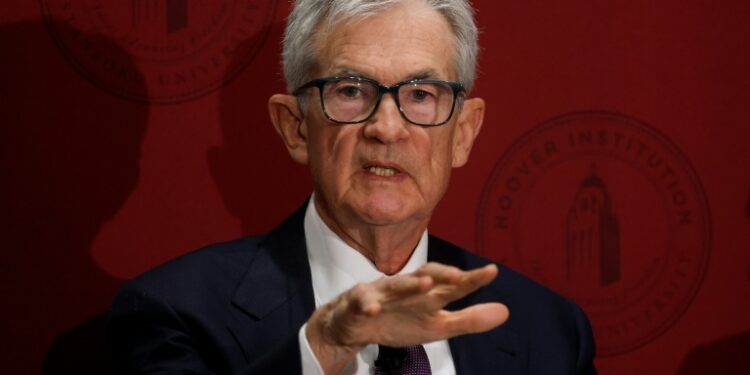

Washington (United States) (AFP) – While the US Federal Reserve’s final interest rate meeting this year could see an unusual amount of division, financial markets view a third straight interest rate cut as nearly certain. When the Fed last met in October, Chair Jerome Powell asserted that another rate cut in December was “not a foregone conclusion,” pointing to “strongly differing views” within the central bank.

Minutes from the Fed’s most recent meeting showed many officials expect a further uptick in underlying goods inflation as President Donald Trump’s tariffs bite. But recent comments from leading Fed officials also reflected support for cutting again because of a weakening labor market, even though inflation is still above the Fed’s two percent target. Next week’s outcome in the “deeply divided” Fed was “too close to call,” UniCredit said, also acknowledging that favorable comments from New York Fed bank chief John Williams towards a cut were a notable “intervention.” “As one of the most senior members of the (Fed committee), it seems unlikely Williams would have said this without Powell’s prior approval,” UniCredit said.

Policymakers generally hold rates at a higher level to tamp down price increases, but a rapidly deteriorating jobs market could nudge them to slash rates further to boost the economy. “Usually, as you get closer to a policy meeting, it becomes quite apparent and transparent what the Federal Open Market Committee is going to do,” said Nationwide Chief Economist Kathy Bostjancic, referring to the Fed’s rate-setting committee. “This time is very different,” she told AFP late last month.

Financial markets rallied following Williams’ statement on November 21 that rates could go lower in the “near term.” Futures markets currently show more than 87 percent odds that the Fed will cut rates to between 3.50 percent and 3.75 percent, according to CME FedWatch.

– Dearth of data –

The Fed moved into rate cutting mode this fall, with rate cuts both in September and October. But a government shutdown from October 1 through November 12 sapped the central bank of most of the key data points for assessing whether inflation or employment is now the bigger priority. The latest available government data showed the jobless rate crept up from 4.3 percent to 4.4 percent in September, even as hiring beat expectations. While delayed publications on September’s economic conditions have trickled out, the US government has canceled full releases of October jobs and consumer inflation figures because the shutdown hit data collection.

Instead, available figures will be published with November’s reports, but only after the Fed’s upcoming rate meeting. The US personal consumption expenditures price index rose to 2.8 percent on an annual basis in September, from 2.7 percent in August, according to delayed data released on Friday. The “Fed faces a bit of a paradoxical situation,” said EY-Parthenon Chief Economist Gregory Daco. “The Fed says these decisions will be data-dependent, but there isn’t a lot of data to go on.” Daco expects a “weak majority” to favor another interest rate cut, but believes there could be multiple dissents.

– Looking beyond Powell –

Besides Wednesday’s decision, the Fed will also release projections for its 2026 economic and monetary policy outlook. Next year will already mark a period of significant change with the conclusion of Powell’s tenure as chair in May. Trump, who has relentlessly criticized Powell for not cutting rates more aggressively, signaled this week that his chief economic adviser Kevin Hassett could succeed Powell. Hassett has appeared to be in lockstep with Trump on key economic questions facing the Fed.

But if appointed, Hassett could also face pressure from financial markets to buck the White House on interest rates if inflation worsens. “The institutional constraints often end up leading appointees towards some level of political independence,” said Daco, noting decisions require a board majority. Whomever Trump picks will need to be confirmed in the US Senate. While UniCredit predicted “political interference will have a modest impact on Fed policy,” deeper consequences cannot be ruled out. “We have not assumed Trump will get de-facto control of the Fed,” UniCredit said, adding that such an outcome is “a non-negligible risk.”

© 2024 AFP