London (AFP) – The dollar and gold gained Friday amid escalating tensions in the Russia-Ukraine war, while stocks got a boost from data. Bitcoin pushed on further with its march towards the $100,000 mark, as the cryptocurrency benefits from US president-elect Donald Trump’s pledge to ease regulation around digital tokens.

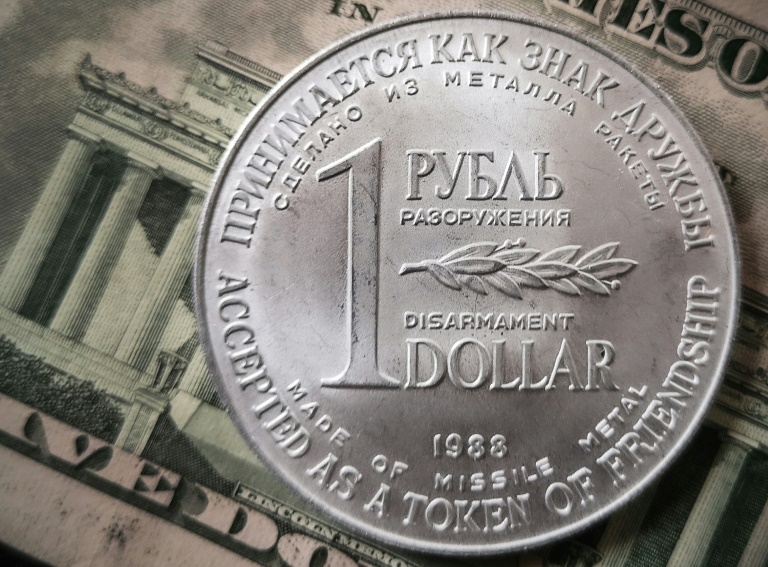

The dollar, considered a safe haven asset, was bolstered by geopolitical uncertainty after Russia said the conflict in Ukraine had the characteristics of a “global” war and did not rule out strikes on Western countries. Meanwhile, the Russian ruble slumped to its lowest level since March 2022 against the US dollar, a day after Moscow fired a hypersonic missile on Ukraine and Washington sanctioned a key Russian bank. Yields on government bonds, another safe haven asset, fell as investors snapped them up, while the gold price rose.

“Escalating tensions between Russia and Ukraine, which triggered safe haven gold inflows, pushed the precious metal price to new all-time highs in euros and the pound sterling,” said IG analyst Axel Rudolph. Gold also posted strong gains in US dollars. The euro sank to a two-year-low against the dollar and the pound retreated after closely watched surveys showed contractions in business activity in November in the eurozone and Britain.

Paris and Frankfurt stocks initially fell after a survey showed that Germany and France, the eurozone’s two biggest economies, were once again driving the weakness, with the latter posting the fastest fall in activity since January. But as the euro fell, both Paris and Frankfurt stocks managed to recover their losses and advance. “The eurozone data has increased the chance of more rate cuts from the ECB next year,” said Kathleen Brooks, research director at XTB, as well as a cut of 50 basis points next month. “Investors have been jolted into recalibrating interest rate expectations on the back of this bleak economic news,” she added.

London managed to gain 1.4 percent despite data showing that retail sales figures for October undershot forecasts, as the pound fell against the dollar. Wall Street stocks mostly advanced, comforted by positive economic data. “US indices were propped up by the strongest US private sector growth since 2022,” said IG’s Rudolph. In Asia, Tokyo climbed as the government prepared to announce a $140 billion stimulus package to kickstart the country’s stuttering economy.

However, Hong Kong and Shanghai sank on a sell-off in tech firms caused by weak earnings from firms including Temu-owner PDD Holdings and internet giant Baidu. Bitcoin set a new record high of $99,505.45 Friday morning before easing back slightly. It is broadly expected to soon burst through $100,000 as investors grow increasingly hopeful that Trump will pass measures to deregulate the crypto sector. Bitcoin has soared more than 40 percent since his election victory this month and has more than doubled since the turn of the year.

The recent surge has also been “driven by news that Trump could set up an official crypto department that would sit in the heart of US government,” said XTB’s Brooks. In a further boost, the top US securities regulator Gary Gensler, who oversaw measures to rein in cryptocurrencies, announced Thursday that he intends to step down when Trump takes office in January. The move clears the way for the president-elect to pick Gensler’s successor.

– Key figures around 1630 GMT –

New York – Dow: UP 0.6 percent at 44,113.57 points

New York – S&P 500: UP 0.1 percent at 5,956.74

New York – Nasdaq Composite: DOWN 0.2 percent at 18,944.74

London – FTSE 100: UP 1.4 percent at 8,262.08 (close)

Paris – CAC 40: UP 0.6 percent at 7,255.01 (close)

Frankfurt – DAX: UP 0.9 percent at 19,322.59 (close)

Tokyo – Nikkei 225: UP 0.7 percent at 38,283.85 (close)

Hong Kong – Hang Seng Index: DOWN 1.9 percent at 19,229.97 (close)

Shanghai – Composite: DOWN 3.1 percent at 3,267.19 (close)

Euro/dollar: DOWN at $1.0396 from $1.0476 on Thursday

Pound/dollar: DOWN at $1.2513 from $1.2587

Dollar/yen: UP at 154.88 yen from 154.54 yen

Euro/pound: DOWN at 83.10 pence from 83.20 pence

West Texas Intermediate: UP 0.9 percent at $70.75 per barrel

Brent North Sea Crude: UP 0.8 percent at $74.81 per barrel

burs-rl/sbk

© 2024 AFP