London (AFP) – Major stock markets mostly rose Thursday following Donald Trump’s election win that is set to see the returning president unveil US tax cuts and import tariffs. The dollar retreated after surging Wednesday on news of Trump’s win, while bitcoin came off record highs.

Wall Street stocks surged to all-time records Wednesday after it emerged the tycoon would return to the White House having beaten his Democratic rival Kamala Harris. The S&P 500 and Nasdaq Composite continued rising Thursday with investors looking towards the Federal Reserve interest rate announcement later in the day, while the Dow wobbled.

“With a 25-basis-point rate cut fully priced in, the focus will shift to the Fed’s tone on future cuts,” said City Index and FOREX.com analyst Fawad Razaqzada. “If the Fed hints at slowing rate cuts in response to Trump’s pro-growth policies, bond yields could remain elevated, potentially cooling investor enthusiasm for stocks in the short term,” he said. “For now, markets are still buzzing from the post-election rally, but as the initial excitement fades, a pullback may be in the cards.”

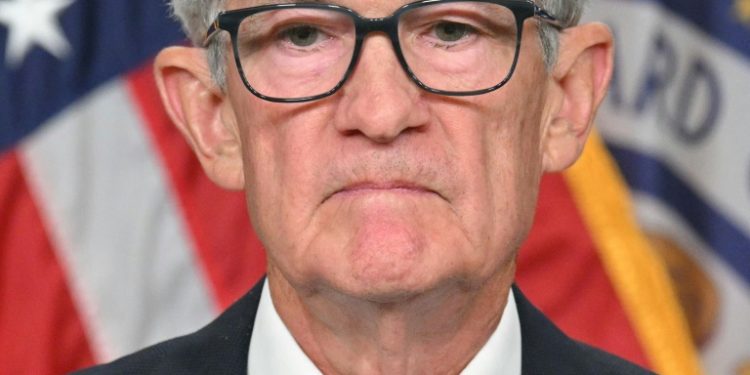

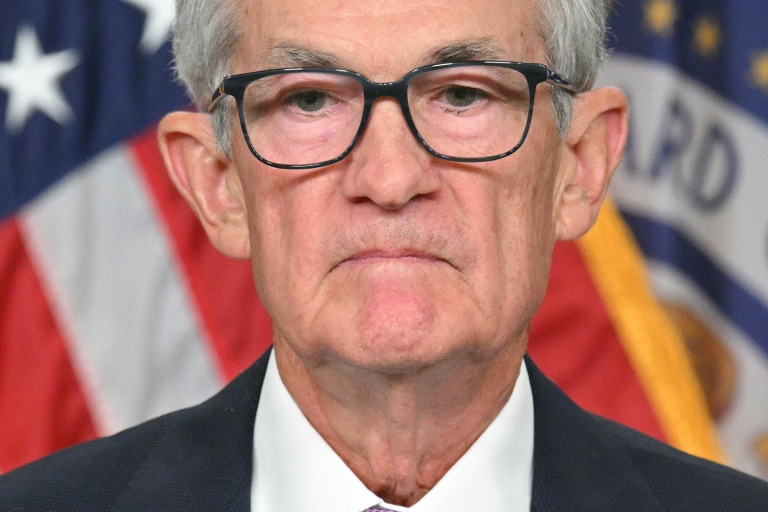

Trump’s decisive win is expected to pave the way for a series of business-friendly measures such as tax cuts and deregulation, though analysts warn that such moves — along with the pledge to impose import duties — could relight inflation. The prospect of higher inflationary pressure could complicate matters for Fed boss Jerome Powell.

Earlier, the Bank of England (BoE) announced a widely expected 25-basis-point cut, its second reduction since August, as inflation in Britain fell below its target rate. Sweden’s central bank also dropped borrowing costs by 50 basis points, its biggest reduction in a decade, while Norway made no change.

Frankfurt stocks rose by 1.7 percent as the conservative opposition heaped pressure on Chancellor Olaf Scholz’s crisis-hit government to allow for speedy elections by calling a confidence vote next week rather than in 2025. Christian Democrats chief Friedrich Merz made the demand after Scholz’s three-party coalition imploded Wednesday over the 2025 budget and fiscal policy.

In Asia on Thursday, Chinese stocks rallied as investors brushed off concerns that China in particular would be the target of Trump’s tariffs. Bitcoin traded close to $75,700, having touched a new high close to $76,475 Wednesday. Ahead of his election win, Trump pledged to make the United States the “bitcoin and cryptocurrency capital of the world.”

**Key figures around 1630 GMT:**

New York – Dow: DOWN less than 0.1 percent at 43,707.86 points

New York – S&P 500: UP 0.6 percent at 5,963.76

New York – Nasdaq Composite: UP 1.3 percent at 19,221.36

London – FTSE 100: DOWN 0.3 percent at 8,140.74 (close)

Paris – CAC 40: UP 0.8 percent at 7,425.60 (close)

Frankfurt – DAX: UP 1.7 percent at 19,362.52 (close)

Tokyo – Nikkei 225: DOWN 0.3 percent at 39,381.41 (close)

Hong Kong – Hang Seng Index: UP 2.0 percent at 20,953.34 (close)

Shanghai – Composite: UP 2.6 percent at 3,470.66 (close)

Euro/dollar: UP at $1.0786 from $1.0732 on Wednesday

Pound/dollar: UP at $1.2982 from $1.2880

Dollar/yen: DOWN at 153.17 yen from 154.62 yen

Euro/pound: DOWN at 83.09 pence from 83.30 pence

West Texas Intermediate: DOWN 0.2 percent at $71.57 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $74.81 per barrel.

© 2024 AFP