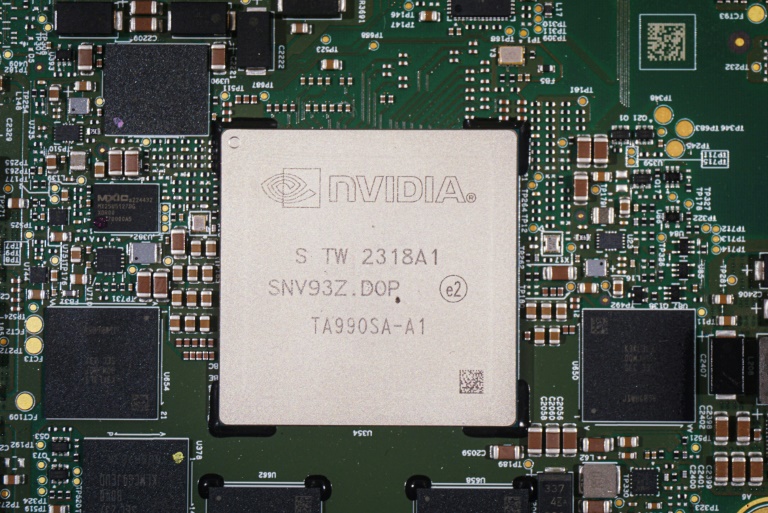

Paris (AFP) – Asian stock markets wavered but Europe advanced on Thursday, with Frankfurt hitting a new record, as investors digested earnings results by US chip titan Nvidia. Investors had been keenly awaiting the release from Nvidia, which has become a bellwether for the tech sector owing to its huge role in the development of AI chips. The firm, whose market capitalisation now exceeds $3 trillion, has accounted for a third of the broad-based S&P 500 index’s gains this year.

The company reported after US markets closed on Wednesday that its sales more than doubled to $30 billion in the second quarter, but at a slower pace than in previous quarters. Its profits also doubled, to $16.5 billion, but Nvidia’s shares slipped in after-hours trading as traders had hoped for even better results from one of the world’s most valuable companies. “The AI juggernaut delivered some stellar figures, but let’s be real — it didn’t exactly knock socks off,” said independent analyst Stephen Innes. “Investors have become spoiled, expecting Nvidia not just to meet but obliterate expectations,” he said.

Nvidia shares fell by as much as eight percent in after-hours trading, but they pared back losses and were down around three percent ahead of Wall Street’s opening bell on Thursday. Asian equities were divided, with Tokyo closing flat, Hong Kong rising, and Shanghai falling. In Europe, the Frankfurt DAX reached an intra-day record of 18,912.47 points. It eased a bit but was still up 0.6 percent at 18,891.77 points around lunchtime. London gained 0.3 percent and Paris added 0.7 percent.

Swissquote Bank analyst Ipek Ozkardeskaya said traders were turning their attention back to interest rates and slowing inflation. “It means that investors give more importance to the rate cut story than to Nvidia earnings,” she told AFP, noting that Wall Street stock futures were up ahead of the opening bell. US Federal Reserve chief Jerome Powell gave markets a boost last week when he declared that the central bank was ready to finally cut borrowing costs, which sit at a 23-year high.

Investors will pore over a raft of data in the coming days for an idea of how big the rate cut might be when the Fed meets on September 17-18. A second estimate of US second-quarter economic growth and weekly jobless claims are due later Thursday, followed by the Fed’s favoured gauge of inflation on Friday and key jobs data next week. In Europe, official data showed inflation fell in Spain for the third consecutive month in August and in several major German states. The European Central Bank, which cut rates in June for the first time since 2019, will also decide next month whether to reduce them again.

In Asia, tech shares were among the worst performers in the wake of Nvidia’s results, with chipmakers taking a hit. SK Hynix fell more than five percent in Seoul, where Samsung was also down more than three percent. The wider Seoul stock market finished in the red. Taipei-listed TSMC, a key producer of semiconductors, sank more than two percent and Taiwan’s stock exchange fell. Tokyo Electron was down 1.8 percent in Tokyo.

Key figures around 1040 GMT are as follows: London – FTSE 100: UP 0.3 percent at 8,367.03 points; Paris – CAC 40: UP 0.7 percent at 7,628.13; Frankfurt – DAX: UP 0.6 percent at 18,891.77; Tokyo – Nikkei 225: FLAT at 38,362.53 (close); Hong Kong – Hang Seng Index: UP 0.5 percent at 17,786.32 (close); Shanghai – Composite: DOWN 0.5 percent at 2,823.11 (close); Dollar/yen: UP at 144.54 yen from 144.50 yen on Wednesday; Euro/dollar: DOWN at $1.1097 from $1.1119; Pound/dollar: DOWN at $1.3192 from $1.3194; Euro/pound: DOWN at 84.12 pence from 84.27 pence; West Texas Intermediate: UP 0.1 percent at $74.64 per barrel; Brent North Sea Crude: FLAT at $78.67 per barrel; New York – Dow: DOWN 0.4 percent at 41,091.42 (close).

© 2024 AFP