London (AFP) – Stock markets retreated and the dollar steadied Friday before US jobs data that could play a key role in the Federal Reserve’s plans for cutting interest rates, with the central bank’s next policy decision looming.

Europe’s main stock markets slid nearing the half-way stage and following mixed showings in Asia and on Wall Street. Europe was closing out the week with losses, one day after the European Central Bank cut interest rates for the first time since 2019 but warned that the path ahead was unclear as inflation will remain above its two-percent target next year.

“With the ECB joining Canada, Sweden and Switzerland in cutting rates and beginning the easing cycle in developed markets, speculation will now return to the timing of the first Federal Reserve cut, currently believed as most likely to happen in September,” noted Richard Hunter, head of markets at Interactive Investor.

“Recent economic data, especially within the labour market, has shown signs of stalling, which adds particular significance to today’s non-farm payrolls number.”

A weak US jobs reading would put pressure on the Fed to cut rates this year, according to economists. Bank officials have long-argued that a softening on the jobs front and lower inflation were their main tests when deciding on when to cut rates.

“We expect the overall message from the non-farm payrolls report to be one of strength, albeit ebbing,” said Commonwealth Bank of Australia’s Joseph Capurso. “Consequently, market pricing for the… first rate cut in September may be pushed out.”

The jobs reading will be followed by the Fed’s next interest-rate decision Wednesday, which will be accompanied by its latest “dot plot” of expectations for borrowing costs. Its previous guidance in March was for three cuts this year, but many are preparing for that to be whittled down to two at most in light of recent data showing inflation remains sticky and decision-makers’ reluctance to move too early.

– Saudi shares deal –

Elsewhere Friday, Saudi oil giant Aramco said it would price its secondary stock offering at 27.25 Saudi riyals ($7.27) per share, in the lower end of its range, allowing it to raise $11.2 billion. The mostly state-owned jewel of the Saudi economy announced last week it would sell 1.545 billion shares, or approximately 0.64 percent of its issued shares, on the Saudi stock exchange. The move follows an initial public offering in December 2019 that raised $25.6 billion, the biggest flotation in history, and will offer a short-term boost to Saudi Arabia’s finances as the Gulf kingdom builds large-scale projects including resorts and stadiums as part of ambitious economic reforms.

– Key figures around 1015 GMT –

London – FTSE 100: DOWN 0.6 percent at 8,240.73 points

Paris – CAC 40: DOWN 0.6 percent at 7,993.21

Frankfurt – DAX: DOWN 0.7 percent at 18,524.64

EURO STOXX 50: DOWN 0.5 percent at 5,046.28

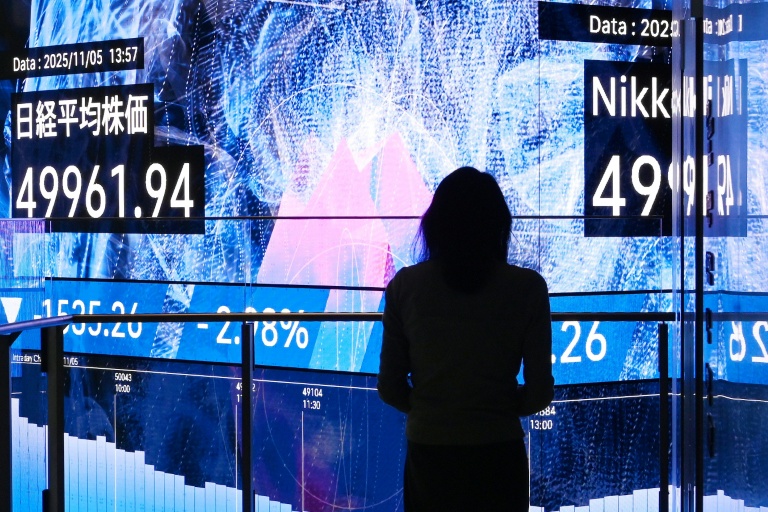

Tokyo – Nikkei 225: DOWN 0.1 percent at 38,683.93 (close)

Hong Kong – Hang Seng Index: DOWN 0.6 percent at 18,366.95 (close)

Shanghai – Composite: UP 0.1 percent at 3,051.28 (close)

New York – Dow Jones: UP 0.2 percent at 38,886.17 (close)

Euro/dollar: DOWN at $1.0893 from $1.0896 on Thursday

Pound/dollar: UP at $1.2796 from $1.2794

Dollar/yen: DOWN at 155.51 yen from 155.59 yen

Euro/pound: UNCHANGED at 85.14 pence

Brent North Sea Crude: FLAT at $79.90 per barrel

West Texas Intermediate: FLAT at $75.58 per barrel

© 2024 AFP