London (AFP) – Eurozone stock markets rebounded Thursday as France’s political stand-off showed signs of easing, while Chinese equities fell despite reports the United States may be less stringent than feared with its curb on tech equipment to China. Wall Street had ended lower Wednesday as traders booked profits ahead of the Thanksgiving holiday, with US markets closed on Thursday.

The profit-taking was spurred by US inflation that edged up, cementing expectations that the Federal Reserve would still cut interest rates in December but make fewer reductions than thought next year. With New York markets quiet, “the focus is on where the dollar will go next, whether or not the stock market rally will broaden out to Europe in 2025, and if global interest rates will continue to fall in the coming months,” said Kathleen Brooks, research director at XTB.

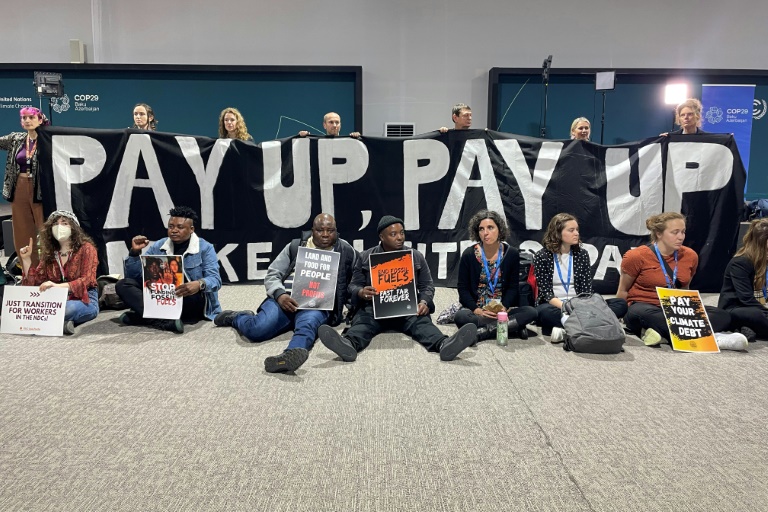

In Europe, investors remained focused on France, where the technocratic government of Prime Minister Michel Barnier gave ground to the far right in a bid to have its 2025 budget passed in parliament. Uncertainty over the budget cuts to reduce France’s huge deficit — and the chances for Barnier’s government surviving a no-confidence vote by opposition on both the right and left — have also kept investors wary. Economic weakness in Germany in particular has also dampened enthusiasm in Europe, even as inflation remains above the European Central Bank’s target of two percent.

The ECB has “every reason” to cut its benchmark interest rate at its next meeting on December 12, Governing Council member Francois Villeroy de Galhau of France said Thursday. “The European economy is achieving a soft landing, but a take-off is not yet in sight,” he added. “If growth remains weak, then we think there could be further rate cuts to 1.5 percent, as the ECB may have to take an accommodative stance in order to boost the economy,” Brooks said in a research note.

European stock markets recovered from the previous day’s losses caused also by concerns that Europe could be the next target for tariffs by US president-elect Donald Trump. ECB chief Christine Lagarde said the European Union must cooperate with Trump to avoid a trade war. “This is a better scenario than a pure retaliation strategy, which can lead to a tit-for-tat process where no one is really a winner,” she said in an interview with The Financial Times.

Rising tariff fears have weighed on Asian markets after Trump flagged they would target China and appointed several hawks to his cabinet. Hong Kong and Shanghai retreated as Bloomberg reported that Washington was considering escalating its crackdown on tech supplies to China by putting fresh sanctions on sales of semiconductor equipment and AI chips to the country.

Oil prices retreated from early gains as the OPEC+ alliance postponed a weekend meeting to December 5 in what analysts said were signs of disagreement among the group over plans to increase output. The 22-member OPEC+ group led by Saudi Arabia and Russia was due to decide on its 2025 output policy at a ministerial meeting originally scheduled for Sunday.

In the crypto sphere, bitcoin was hovering around $95,100, having bounced back from just below $90,300 earlier in the week following its worst run since Trump’s electoral success. Still, it is widely tipped to top $100,000 on expectations the new president will ease restrictions on the digital currency market.

– Key figures around 1645 GMT –

London – FTSE 100: UP 0.1 percent at 8,281.22 (close)

Paris – CAC 40: UP 0.5 percent at 7,179.25 (close)

Frankfurt – DAX: UP 0.9 percent at 19,425.73 (close)

Tokyo – Nikkei 225: UP 0.6 percent at 38,349.06 (close)

Hong Kong – Hang Seng Index: DOWN 1.2 percent at 19,366.96 (close)

Shanghai – Composite: DOWN 0.4 percent at 3,295.70 (close)

New York – Closed

Euro/dollar: DOWN at $1.0552 from $1.0565 on Wednesday

Pound/dollar: UP at $1.2687 from $1.2678

Dollar/yen: UP at 151.51 yen from 151.17 yen

Euro/pound: FLAT at 83.18 pence

Brent North Sea Crude: FLAT at $72.30 per barrel

West Texas Intermediate: DOWN 0.01 percent at $68.64 per barrel

© 2024 AFP