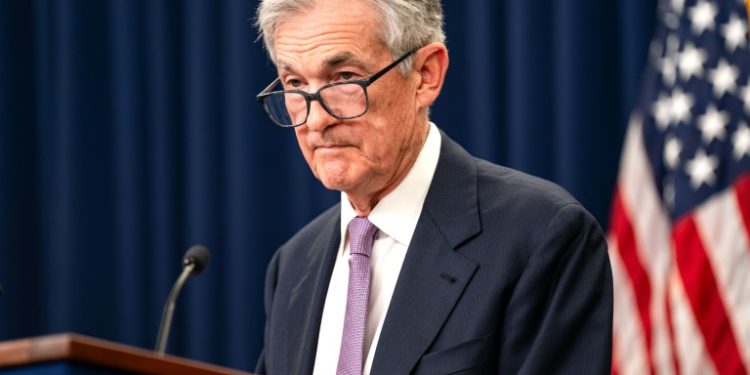

Washington (AFP) – Global stock markets ended the week on a sour note Friday as traders mulled Federal Reserve Chair Jerome Powell’s comments that the US central bank was not on a preset path to cut interest rates. After Powell indicated the Fed was in no hurry to cut rates as it monitors inflation’s downward trajectory, Wall Street turned red, with all three major indices closing lower.

“Certainly Powell’s speech has triggered some skepticism about the path of rates, with potentially December being a skip instead of another cut,” Edward Jones senior investment strategist Angelo Kourkafas told AFP. “But we do have another inflation and jobs report before that, so there is still a good sense we might see another rate cut in December,” he added.

Leading the way down were a clutch of vaccine-makers’ stocks after US President-elect Donald Trump indicated he would appoint vaccine skeptic Robert F. Kennedy Jr. as his health secretary. Tokyo ended the day just in the green, with other major Asian markets stalling. In Europe, London was off just 0.1 percent, digesting disappointing growth data. Frankfurt and Paris also ended in the red to round off a painful week fueled by worries over another disruptive China-US trade war under Trump. Disappointing US retail sales in October did not help overall sentiment as oil prices also drifted down.

In a speech Thursday, Powell said that “the economy is not sending any signals that we need to be in a hurry to lower rates.” While the US central bank is expected to cut interest rates again next month, investors are scaling back their bets on how many cuts will be made next year. Investors are worried tax cuts and tariffs planned by Trump could reignite inflation. “The (Trump) administration’s renewed focus on tariffs could weigh heavily on currencies of trade-exposed economies, particularly those in Asia and the eurozone,” said Charu Chanana, chief investment strategist at Saxo Markets.

European markets stuttered as the European Commission predicted economic growth would pick up slightly and inflation would keep falling in the eurozone next year, but warned of growing risks linked to geopolitical tensions. In Asia, Shanghai shed 1.5 percent but Tokyo rose despite data showing a slowdown in Japanese economic growth. China’s retail sales beat expectations, expanding 4.8 percent year-on-year in October, according to data published Friday, lifting hopes for the world’s number two economy. It was the best performance since February. The figures provided optimism that the country’s consumers are becoming more confident and follow a slew of measures out of Beijing in recent weeks aimed at kickstarting growth.

In the cryptocurrency markets, Bitcoin clambered back above $90,000, two days after striking a record high of $93,462. Observers have predicted it may soon break the $100,000 mark after Trump’s pro-crypto comments during his election campaign.

– Key figures around 2130 GMT –

New York – Dow: DOWN 0.7 percent at 43,444.99 points (close)

New York – S&P 500: DOWN 1.3 percent at 5,870.62 (close)

New York – Nasdaq Composite: DOWN 2.2 percent at 18,680.12 (close)

London – FTSE 100: DOWN 0.1 percent at 8,063.61 (close)

Paris – CAC 40: DOWN 0.6 percent at 7,269.63 (close)

Frankfurt – DAX: DOWN 0.3 percent at 19,210.81 (close)

Tokyo – Nikkei 225: UP 0.3 percent at 38,642.91 (close)

Hong Kong – Hang Seng Index: DOWN 0.1 percent at 19,426.34 (close)

Shanghai – Composite: DOWN 1.5 percent at 3,330.73 (close)

Euro/dollar: UP at $1.0536 from $1.0524

Pound/dollar: DOWN at $1.2611 from $1.2662

Dollar/yen: DOWN at 154.32 yen from 156.28 yen on Thursday

Euro/pound: UP at 83.52 pence from 83.11 pence

West Texas Intermediate: DOWN 2.5 percent at $67.02 per barrel

Brent North Sea Crude: DOWN 2.1 percent at $71.04 per barrel

© 2024 AFP