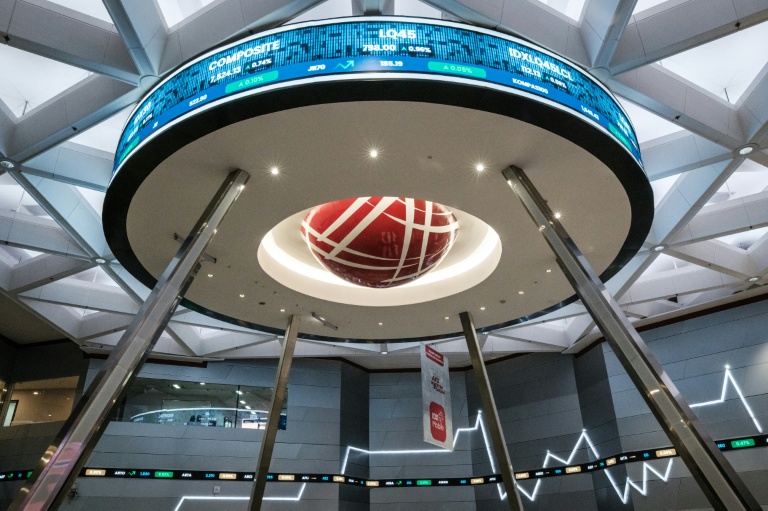

London (AFP) – Stock markets advanced on Tuesday following news that Donald Trump plans to spare automakers from some of his wide-ranging tariffs, boosting hopes of a less combative approach to his trade war. Signs of easing trade tensions are also spurring sentiment, as governments line up to negotiate deals with Washington to avert the full force of sweeping tariffs.

“On tariffs, the latest newsflow was actually fairly positive at face value, as US officials continued to sound optimistic about potential trade deals,” said Deutsche Bank managing director Jim Reid. “The rhetoric from the administration is still pointing towards negotiations, rather than further escalation,” he added.

European markets also reacted to a wave of first-quarter company earnings, with investors closely watching for signs of how tariffs are impacting business outlooks. Frankfurt rose 0.5 percent and London advanced 0.2 percent. Paris, however, slipped. Market sentiment was buoyed after the Wall Street Journal reported that the White House will spare automakers — already facing 25-percent tariffs — from further levies, such as those on steel and aluminium. The move is aimed at making sure the various tariffs Trump has unveiled do not stack up on top of each other.

While uncertainty still rules on trading floors, most Asian markets also made tentative gains on Tuesday. Hong Kong stocks advanced while Shanghai dipped after US Treasury Secretary Scott Bessent told CNBC that negotiations with China were ongoing but said that the ball was in Beijing’s court. Seoul rose as auto makers Hyundai and Kia were boosted by the auto tariff news. Tokyo was closed for a holiday.

Investors are also awaiting earnings from US tech titans this week, including Amazon, Apple, Meta, and Microsoft. Also on the agenda are key economic indicators, including job creation and the Federal Reserve’s preferred gauge of inflation amid warnings the tariffs could reignite prices.

On currency markets, Canada’s dollar held steady against its US counterpart as Prime Minister Mark Carney’s Liberal Party won Canada’s election. In company news, French electrical equipment company Schneider Electric shed almost eight percent in Paris after its results fell short of expectations. In London, oil major BP and retailer Associated British Foods both missed earnings estimates, shedding over three percent and six percent, respectively. British pharmaceutical giant AstraZeneca also lost over three percent as its increase in first-quarter profits failed to reassure investors.

Oil prices fell further on Tuesday on fears that global trade tensions may lead to a slowdown in economic activity that would hamper energy demand.

– Key figures at 1055 GMT –

London – FTSE 100: UP 0.1 percent at 8,426.81 points

Paris – CAC 40: DOWN 0.3 percent at 7,550.11

Frankfurt – DAX: UP 0.5 percent at 22,383.41

Hong Kong – Hang Seng Index: UP 0.2 percent at 22,008.11 (close)

Shanghai – Composite: DOWN 0.1 percent at 3,286.65 (close)

Tokyo – Nikkei 225: Closed for a holiday

New York – Dow: UP 0.3 percent at 40,227.59 (close)

Euro/dollar: DOWN at $1.1377 from $1.1424 on Monday

Pound/dollar: DOWN at $1.3384 from $1.3441

Dollar/yen: UP at 142.71 yen from 142.04 yen

Euro/pound: FLAT at 84.99 pence from 84.99 pence

West Texas Intermediate: DOWN 1.8 percent at $60.95 per barrel

Brent North Sea Crude: DOWN 1.7 percent at $63.66 per barrel

© 2024 AFP