Paris (AFP) – Stock markets diverged Tuesday in directionless trading as investors awaited signs on how much interest rates might be cut next month and the latest results from tech heavyweight Nvidia. In New York, the main indexes were all slightly lower in early trading, while at mid-afternoon in London the FTSE 100 and Frankfurt’s DAX were up slightly, with Paris’s CAC 40 little changed. Oil prices gave up some of their recent gains, and the dollar remained under pressure from expectations of narrowing interest rate differentials.

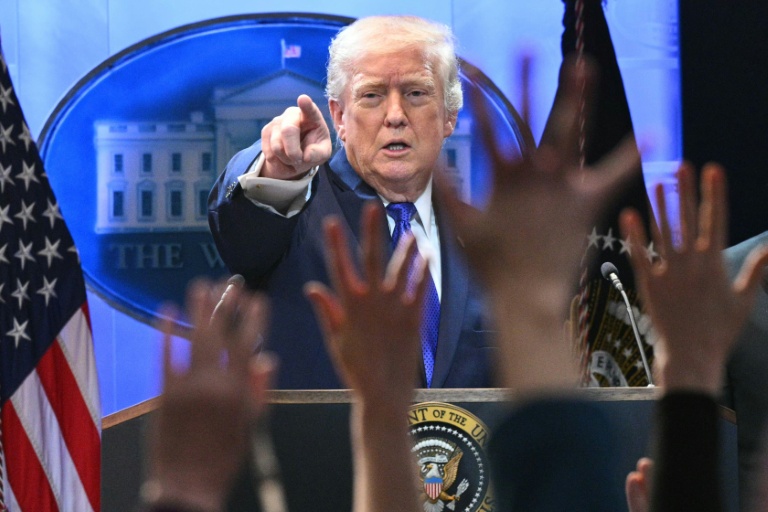

The markets are seeking “more clarity from US economic data about the amount that the Fed may be prepared to ease in September and in the coming months,” Jane Foley, head of foreign exchange strategy at Rabobank London, told AFP. After US Federal Reserve chairman Jerome Powell sent stock markets soaring and the dollar plunging Friday when he signalled that a rate cut was coming, attention this week has turned to how deep the cut could be. US second-quarter economic growth figures are due Thursday, followed by the Fed’s preferred gauge of inflation on Friday and jobs data next week. Investors will pore over the figures for clues about the size of the promised rate reduction, which the Fed is expected to deliver at its next meeting on September 17-18.

Traders are also eagerly awaiting the latest earnings results from chip titan Nvidia, which will be released Wednesday and could provide more clues about demand for the hardware powering the AI boom. Patrick O’Hare, an analyst at Briefing.com, said the market could be “stuck in a rut” until the Nvidia results. “That report, and the response to it, has market-moving capability,” he said.

In Asia, Hong Kong rose despite losses in the tech sector that came after Temu owner PDD posted disappointing revenue figures and warned on the outlook for future growth. The e-commerce firm’s shares, which are listed in New York, were down one percent on Tuesday, extending losses after tanking Monday by a record 28.5 percent, wiping tens of billions off its market capitalization. In Hong Kong, rivals Alibaba and JD.com both sank around four percent.

– Middle East fears – Oil had risen Monday after Sunday’s exchange of fire between Iran-backed Lebanese militant group Hezbollah and Israel raised fears of a broader conflict. Prices dropped a bit Monday, but Brent remained above $80 a barrel. The decline was a “likely technical correction” as price “held on to most of the recent gains driven by ongoing supply-side concerns amid a near total production stoppage in Libya, along with escalating tensions between Israel and Hezbollah,” Trading Economics said in a comment. The eastern-based administration in oil-rich Libya said Monday it will close fields under its control and suspend production and exports “until further notice” amid rising tensions with the UN-recognised government based in Tripoli.

– Key figures around 1340 GMT –

New York – Dow: DOWN 0.1 percent at 41,205.85

New York – S&P 500: DOWN 0.3 percent at 5,600.04

New York – Nasdaq Composite: DOWN 0.6 percent at 17,623.30

London – FTSE 100: UP 0.4 percent at 8,357.80 points

Paris – CAC 40: DOWN 0.1 percent at 7,585.75

Frankfurt – DAX: UP 0.5 percent at 18,713.30

Tokyo – Nikkei 225: UP 0.5 percent at 38,288.62 (close)

Hong Kong – Hang Seng Index: UP 0.4 percent at 17,874.67 (close)

Shanghai – Composite: DOWN 0.2 percent at 2,848.73 (close)

Dollar/yen: DOWN at 144.44 yen from 144.53 yen on Friday

Euro/dollar: DOWN at $1.1159 from $1.1166

Pound/dollar: UP at $1.3214 from $1.3184

Euro/pound: DOWN at 84.43 pence from 84.64 pence

West Texas Intermediate: DOWN 0.7 percent at $76.88 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $80.98 per barrel

© 2024 AFP