Hong Kong (AFP) – Equities rose and the dollar slipped further on Thursday as investors welcomed more data pointing to a softening labour market that gives the Federal Reserve room to cut interest rates, with another key jobs report due.

The advances saw Tokyo end at all-time highs following another record day on Wall Street, while national elections in Britain and France are also on the radar over the next few days.

After a recent poor run for stocks, the mood on trading floors has lightened this week thanks to figures indicating the US labour market was tightening and inflation retreating.

Figures on Wednesday showed the private sector created fewer jobs than expected last month, while first-time and continuing claims for jobless benefits also topped forecasts.

A survey also showed services sector activity contracted in June at the fastest pace in four years.

That all came after news Friday that the personal consumption expenditures (PCE) index — the Fed’s preferred gauge of prices — had dipped further in May.

Adding to the feel-good factor were comments this week from Fed chief Jerome Powell, who said the battle against inflation had made “progress” and “substantial” work had been done on softening the labour market.

Markets are pricing in nearly two rate reductions this year, starting in November. Still, minutes from the central bank’s June policy meeting showed officials remained cautious about cutting too soon and wanted to see more evidence prices were under control.

While inflation remains sticky and is tempering expectations, softening data in May “adds to our growing confidence that price rises won’t reaccelerate from here”, said Henk-Jan Rikkerink of Fidelity International.

“The range of outcomes when it comes to the magnitude of potential rate cuts by the Fed have narrowed significantly since the start of the year. We think that the bar for the cutting cycle to start remains high but recent progress on the inflation front has been encouraging.”

On Wall Street, the Dow ended slightly lower but the S&P 500 and Nasdaq chalked up more record highs.

And the gains filtered through to most of Asia, with Tokyo’s Nikkei topping the all-time high hit in March while the Topix closed at a record for the first time since late 1989.

There were also gains in Hong Kong, Sydney, Singapore, Seoul, Taipei, Manila, Mumbai, Bangkok and Jakarta.

However, Shanghai bucked the trend again, with traders still on edge about the state of the world’s number two economy.

Zhiwei Zhang at Pinpoint Asset Management warned “people don’t have strong confidence in economic outlook. Stronger policy support would help, from both monetary and fiscal fronts. China has a high real interest rate and a conservative fiscal policy stance for now”.

And Capital Economics’ Thomas Mathews said there were concerns among Chinese investors domestically and globally, and while they could ease over time “Chinese equities seem set to go their own way for a while yet”.

London, Paris and Frankfurt rose in the morning.

The dollar dipped further against its major peers after the jobs readings, with the euro getting a little help from news that more than 200 centrist and left-wing candidates had pulled out of Sunday’s legislative election runoff in France in a bid to beat the far right.

President Emmanuel Macron hopes the move will unify the vote and thus block the far-right National Rally of Marine Le Pen from gaining power after it saw massive gains in the first round Sunday.

However, analysts warned that France — the second-biggest economy in the European Union — could be headed for a period of political deadlock if there is no overall winner in the polls.

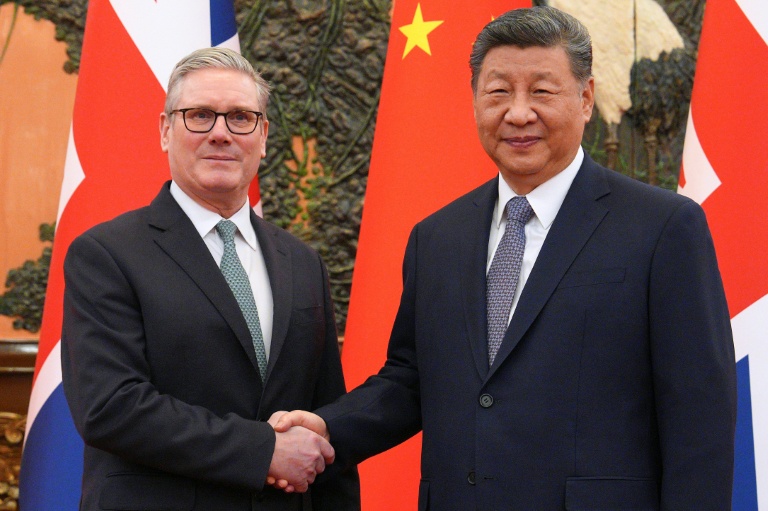

The pound was enjoying support as Britons began voting in a general election, which is expected to see the opposition Labour Party win a landslide against the Conservatives after 14 years in government.

– Key figures around 0810 GMT –

Tokyo – Nikkei 225: UP 0.8 percent at 40,913.65 (close)

Hong Kong – Hang Seng Index: UP 0.3 percent at 18,028.28 (close)

Shanghai – Composite: DOWN 0.8 percent at 2,957.57 (close)

London – FTSE 100: UP 0.6 percent at 8.217.80

Euro/dollar: UP at $1.0796 from $1.0786 on Wednesday

Pound/dollar: UP at $1.2754 from $1.2737

Dollar/yen: DOWN at 161.29 yen from 161.52 yen

Euro/pound: DOWN at 84.64 pence from 84.65 pence

West Texas Intermediate: DOWN 0.9 percent at $83.10 per barrel

Brent North Sea Crude: DOWN 0.9 percent at $86.60 per barrel

New York – Dow: DOWN 0.1 percent at 39,308.00 (close)

© 2024 AFP