London (AFP) – Stock markets hit record highs Wednesday thanks to optimism over US trade deals, the AI sector, and an expected interest-rate cut by the US Federal Reserve. On Wall Street, both the S&P 500 and Nasdaq Composite set record highs as trading started, following fresh peaks set in London and some Asian markets as US President Donald Trump voiced optimism on the eve of crunch talks with China’s President Xi Jinping.

Investors are looking ahead to a meeting of the Federal Reserve, which observers expect will unveil a quarter-percentage-point cut to borrowing costs, as well as earnings reports from tech heavyweights Meta, Microsoft, and Google-parent Alphabet after trading closes in New York. “Risk appetite remained firm heading into a busy 48-hour period for markets, where major central banks decide on interest rates, technology companies will report their quarterly results, and more to the point, Trump will meet Xi Jinping in a meeting expected to last three hours,” said City Index and FOREX.com analyst Fawad Razaqzada. The European Central Bank and the Bank of Japan are expected to hold interest rates steady this week.

Ahead of meeting Xi, Trump indicated that a trade deal had been reached with South Korea’s President Lee Jae Myung. Ahead of his arrival in South Korea, Trump told reporters he expects “a lot of problems are going to be solved” during his first in-person discussion with Xi since returning to the White House this year. The two leaders are set to meet Thursday in Busan, a southern port city not far from the APEC summit attended by Trump.

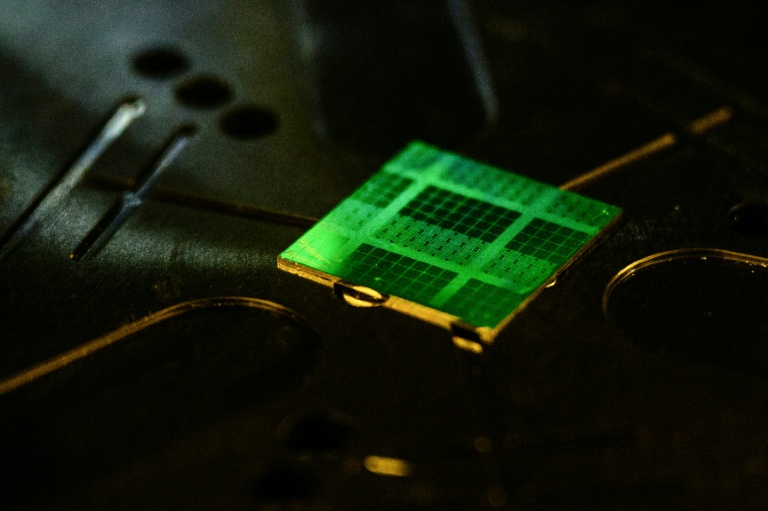

Geopolitical hopes have added to an already jubilant atmosphere on Wall Street, where highlights during Tuesday’s record-breaking day included a five-percent leap for artificial intelligence giant Nvidia. The company’s shares climbed another 4.5 percent as trading got underway, with analysts saying the shares are benefiting from Trump saying he would talk about the company’s chips with Xi. Benchmark stock indices in Tokyo and Seoul each reached record highs Wednesday.

After Seoul closed, the United States and South Korea reached an agreement to maintain reciprocal tariffs at 15 percent and to reduce levies on automobiles and auto parts. Taipei gained more than one percent on the day and Shanghai tracked moderate gains, while Hong Kong was closed for a public holiday. In company news, shares in UK drugmaker GSK jumped 6.2 percent in London after it raised its full-year guidance on strong sales growth. Shares in Mercedes-Benz rose around six percent after the company reassured investors it faces no immediate production shutdowns due to microchip shortages, even though third-quarter net profits plunged more than 30 percent due to Trump’s tariff blitz as well as slumping sales in China. The price of copper reached a record high Wednesday, with the metal boosted also by tight supply concerns.

– Key figures at around 1330 GMT –

New York – Dow: UP 0.2 percent at 47,813.81 points

New York – S&P 500: UP 0.3 percent at 6,908.52

New York – Nasdaq Composite: UP 0.7 percent at 23,981.99

London – FTSE 100: UP 0.7 percent at 9,765.12

Paris – CAC 40: DOWN 0.3 percent at 8,194.76

Frankfurt – DAX: DOWN 0.2 at 24,223.96

Tokyo – Nikkei 225: UP 2.2 percent at 51,307.65 (close)

Hong Kong – Hang Seng Index: Closed for a holiday

Shanghai – Composite: UP 0.7 percent at 4,016.33 (close)

Euro/dollar: DOWN at $1.1643 from $1.1656 on Tuesday

Pound/dollar: DOWN at $1.3214 from $1.3336

Dollar/yen: DOWN at 151.91 yen from 152.06 yen

Euro/pound: UP at 88.11 from 87.80 pence

Brent North Sea Crude: FLAT $63.84 per barrel

West Texas Intermediate: FLAT at $60.13 per barrel

© 2024 AFP