Hong Kong (AFP) – Asian markets stuttered Friday as data showing a pick-up in Chinese consumption was offset by concerns about US interest rates after Fed boss Jerome Powell indicated a slower pace of cuts. The uncertain performance came at the end of a painful week fuelled by worries about another disruptive China-US trade war. The dollar dipped against its peers after rallying since Trump’s election win last week.

China’s retail sales expanded 4.8 percent on-year in October, data showed Friday, speeding up from September and far better than expected, lifting hopes for the world’s number two economy. It is also the best performance since February. The figures provided some much-needed optimism that the country’s consumers are becoming more confident and follows a slew of measures out of Beijing in recent weeks aimed at kickstarting growth.

“The economy stabilised in October because of the policy shift in late September,” Zhang Zhiwei, president and chief economist of Pinpoint Asset Management, said. But he warned that the “property sector has not turned around”. And Erin Xin and Taylor Wang at HSBC Global Research said: “With external uncertainty looming, policymakers will need to continue to provide decisive support to sustain the momentum.”

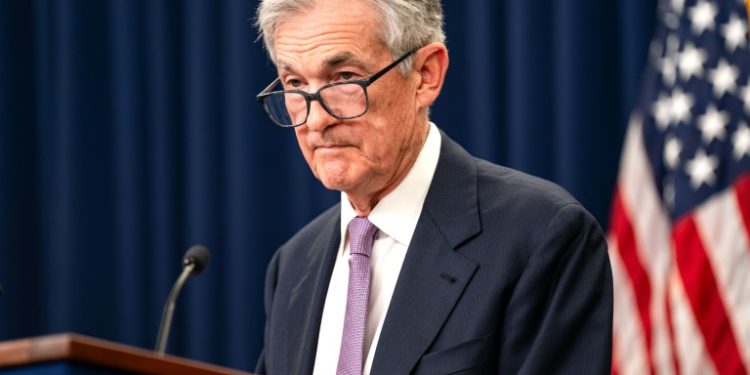

The reading came after the US Federal Reserve boss dampened rate cut hopes. In a speech Thursday, Powell played up the performance of the world’s top economy and policymakers’ progress in bringing inflation down towards their two percent target. That had allowed officials to start lowering borrowing costs in September, with a follow-up last week. However, while the bank is expected to cut again next month, Powell warned that the path “is not preset”, adding that “the economy is not sending any signals that we need to be in a hurry to lower rates”.

The remarks followed warnings of caution from other decision-makers this week, with investors already worried that tax cuts and tariffs planned by US President-elect Donald Trump could reignite inflation. Investors are now scaling back their bets on how many cuts will be made next year. Figures Thursday showed an uptick in wholesale price inflation, a day after news that consumer prices rose in line with forecasts. The readings further weighed on cut hopes.

The prospect of rates staying higher than previously thought has added to downward pressure on stocks. Hong Kong, Sydney, Singapore, Taipei, and Manila all rose, though Shanghai, Seoul, Jakarta, Bangkok, and Wellington slipped. Tokyo rose even as data showed a slowdown in Japanese economic growth. London fell as data showed the UK economy grew less than expected in the third quarter. Paris and Frankfurt also fell.

“The (Trump) administration’s renewed focus on tariffs could weigh heavily on currencies of trade-exposed economies, particularly those in Asia and the eurozone,” said Charu Chanana, chief investment strategist at Saxo Markets. “The appointment of China hawks to the cabinet is spelling a clear near-term focus on trade and tariff policy, which is dollar-positive.” She added that “rising yields, particularly in the US, increase the relative appeal of the dollar against lower-yielding currencies, further boosting demand for the dollar”.

Bitcoin sat around $87,900 after striking a record of $93,462 on Wednesday. However, observers have predicted the unit could soon break the $100,000 mark after Trump’s pro-crypto comments during his election campaign.

– Key figures around 0815 GMT –

Tokyo – Nikkei 225: UP 0.3 percent at 38,642.91 (close)

Hong Kong – Hang Seng Index: DOWN 0.1 percent at 19,426.34 (close)

Shanghai – Composite: DOWN 1.5 percent at 3,330.73 (close)

London – FTSE 100: DOWN 0.4 percent at 8,037.68

Dollar/yen: DOWN at 155.80 yen from 156.28 yen on Thursday

Euro/dollar: UP at $1.0558 from $1.0524

Pound/dollar: UP at $1.2671 from $1.2662

Euro/pound: UP at 83.33 pence from 83.11 pence

West Texas Intermediate: DOWN 1.6 percent at $67.58 per barrel

Brent North Sea Crude: DOWN 1.6 percent at $71.41 per barrel

New York – Dow: DOWN 0.5 percent at 43,750.86 (close)

© 2024 AFP