Hong Kong (AFP) – Asian markets started the first full week of 2025 on a shaky note as traders struggled to track a healthy run-up on Wall Street, with minds turning to Donald Trump’s second presidency. Concerns about China’s stuttering economy, the outlook for US interest rates, and the wars in Ukraine and the Middle East were also causing a sense of uncertainty.

As Trump prepares to return to the White House on January 20, investors are steeling themselves for another four years of friction with China, particularly after he warned he would impose hefty tariffs on imports from the country and other key trade partners. Those fears were being compounded by warnings that his pledges to cut taxes and remove regulations could reignite inflation, although there is hope such moves could boost profits.

The prospect of prices spiking again has caused traders to pare bets on how many rate cuts the Federal Reserve will make this year, with a hawkish pivot last month taking the wind out of the sails of an equity rally. Richmond Fed boss Tom Barkin stoked worries that borrowing costs will remain elevated on Friday when he indicated his backing for a slower pace of reductions. “I think there is more upside risk than downside risk,” he said. “So I put myself in the camp of wanting to stay restricted for longer.” US jobs data at the end of this week will provide the latest snapshot of the world’s top economy and could play a key role in officials’ decision-making. All three main indexes on Wall Street ended last week on a positive note, with the S&P 500 and Nasdaq both adding more than one percent.

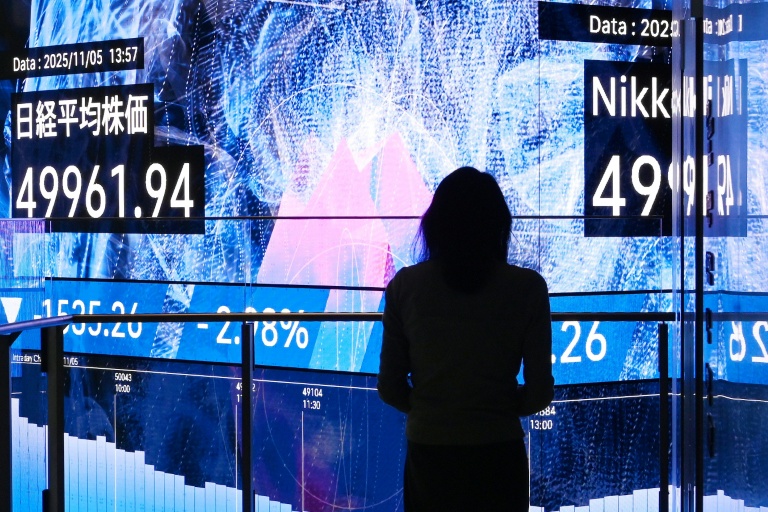

But Asia’s early gains ran out of gas as the day wore on. Sydney, Singapore, Manila, Taipei, and Wellington edged up, while Seoul piled on 1.9 percent even as South Korea remains gripped by political uncertainty following last month’s brief martial law attempt by President Yoon Suk Yeol. Anti-graft investigators asked police on Monday to arrest the impeached and suspended leader. Tokyo retreated more than one percent, with Nippon Steel taking a hit after US President Joe Biden blocked its proposed $14.9 billion purchase of US Steel, saying that it would “create risk for our national security and our critical supply chains”. There were also losses in Hong Kong, Shanghai, Mumbai, Bangkok, and Jakarta. London opened in the red but Paris and Frankfurt rose.

“We view 2025 as a year with greater uncertainty given increasing concerns over Trump’s tariffs and an escalating trade war,” said Kai Wang, Asia equity market strategist at Morningstar. Focus is also on Beijing as it tries to kickstart growth with a series of stimulus measures aimed particularly at boosting consumption and supporting the battered property sector. However, analysts pointed out that their work could be made harder by Trump.

“For 2025, China’s economy will likely be stuck between the rock of higher trade tariffs and the hard place of a domestic crisis of confidence,” analysts at Moody’s Analytics wrote. “China’s Houdini act to escape without much economic injury is unfolding via stimulus announcements. Big promises of new stimulus lie ahead, with details likely to come at the Two Sessions meetings in March.”

– Key figures around 0810 GMT –

Tokyo – Nikkei 225: DOWN 1.5 percent at 39,307.05 (close)

Hong Kong – Hang Seng Index: DOWN 0.4 percent at 19,688.29 (close)

Shanghai – Composite: DOWN 0.1 percent at 3,206.92 (close)

London – FTSE 100: DOWN 0.2 percent at 8,210.40

Euro/dollar: UP at $1.0323 from $1.0307 on Friday

Pound/dollar: UP at $1.2454 from $1.2425

Dollar/yen: UP at 157.63 yen from 157.33 yen

Euro/pound: DOWN at 82.88 pence from 82.95 pence

West Texas Intermediate: DOWN 0.2 percent at $73.81 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $76.35 per barrel

New York – Dow: UP 0.8 percent at 42,732.13 (close)

© 2024 AFP