Hong Kong (AFP) – Most markets gained Friday after a bounce on Wall Street, while bitcoin continued its march higher to move within touching distance of the $100,000 mark. Rising geopolitical tensions tempered the atmosphere and lifted oil again after Russia hit Ukraine with a new-generation intermediate-range missile and sent a warning to the West.

The gains in equities followed a retreat in most regional bourses Thursday after a forecast-topping earnings report from chip titan Nvidia still fell short of investors’ hopes and sparked worries that a tech-fuelled surge in markets may have run its course. However, all three main indexes on Wall Street ended on a positive note, with observers saying traders had dialled back their gloom over Nvidia as they digested pledges by the firm over production of its keenly anticipated Blackwell line-up.

Investors also took heart from comments by Chicago Federal Reserve chief Austan Goolsbee, who said he saw interest rates coming down more as the US central bank makes progress in bringing inflation down to its two percent target. He pointed out that regarding the jobs market and prices, “things are getting close to where we want to settle,” adding that “it follows that we will probably need to move rates to where we think they should settle, too.”

“If we look out over the next year or so, it feels to me like rates will end up a fair bit lower than where they are today,” he said. The remarks helped temper recent worries that the Fed will have to scale back its rate plans if US President-elect Donald Trump pushes through his promised tax cuts and import tariffs, which some warn could reignite inflation.

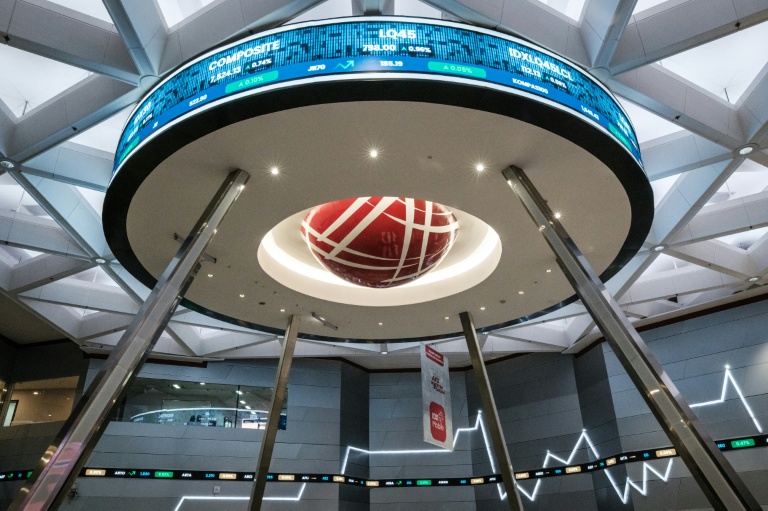

The gains in New York filtered through to Asia. Tokyo climbed as the government prepared to announce a $140 billion stimulus package to kickstart the country’s stuttering economy, while Sydney, Seoul, Singapore, Wellington, Mumbai, Bangkok, Taipei, and Jakarta also rose. However, Hong Kong and Shanghai sank on a sell-off in tech firms caused by weak earnings from firms including PDD and Baidu. Manila also slipped.

London and Paris opened higher while Frankfurt also advanced, even after data showed Germany’s economy grew less than initially thought in the third quarter. Bitcoin, meanwhile, set a new record high of $99,505.44. While it later eased back slightly, there is a broad expectation that it will soon burst through $100,000 as investors grow increasingly hopeful that Trump will pass measures to deregulate the crypto sector.

Bets on an easier environment for digital units in a Trump White House have seen bitcoin soar more than 40 percent since his election victory this month, while it has more than doubled since the turn of the year. Adding to the positive vibes was news that Securities and Exchange Commission chair Gary Gensler — who oversaw measures to rein in cryptocurrencies — intends to leave when Trump takes office on January 20, Bloomberg reported.

Oil prices extended the previous day’s gains on rising Ukraine worries after Russian President Vladimir Putin said Thursday that the conflict had characteristics of a “global” war and did not rule out strikes on Western countries. His comments came after Moscow test-fired a new missile at its neighbour, which Ukraine President Volodymyr Zelensky called a major ramping up of the “scale and brutality” of the war.

Both main crude contracts extended the two percent gains seen Thursday when natural gas prices also hit their highest level in a year.

– Key figures around 0810 GMT –

Tokyo – Nikkei 225: UP 0.7 percent at 38,283.85 (close)

Hong Kong – Hang Seng Index: DOWN 1.9 percent at 19,229.97 (close)

Shanghai – Composite: DOWN 3.1 percent at 3,267.19 (close)

London – FTSE 100: UP 0.7 percent at 8,202.86

Euro/dollar: UP at $1.0487 from $1.0476 on Thursday

Pound/dollar: DOWN at $1.2574 from $1.2587

Dollar/yen: UP at 154.72 yen from 154.54 yen

Euro/pound: UP at 83.40 pence from 83.20 pence

West Texas Intermediate: UP 0.7 percent at $70.56 per barrel

Brent North Sea Crude: UP 0.6 percent at $74.65 per barrel

New York – Dow: UP 1.1 percent at 43,870.35 (close)

© 2024 AFP