London (AFP) – Despite oil trading low at $60, OPEC+ this week is expected to continue to further open the taps. This follows pressure from US President Donald Trump and group leader Saudi Arabia’s quest to penalise allies that breach the cartel’s quotas. In past months, Saudi Arabia, Russia, and six other OPEC+ members have surprised markets by announcing a sharp increase in oil production for May and June despite the low prices. Numbering a total of 22 countries, most of which are highly dependent on oil revenues, the group has long been exploiting supply scarcity to boost prices, holding millions of barrels in reserve.

This week, the cartel will hold two meetings — one online on Wednesday with all OPEC+ members to discuss the group’s common strategy, and one on Sunday with just the eight member states — known as the “V8” — that have made the largest cuts in recent years. “What’s most interesting is the V8 decision” in Sunday’s meeting regarding production for July, UBS analyst Giovanni Staunovo told AFP. Analysts expect the V8 to up production by 411,000 barrels a day for July — the same as in May and June — whereas the initial plan called for an increase of just 137,000 barrels. This could further weigh down prices already slumping to lows last seen during the pandemic, which hit global demand.

– Internal disagreements –

The Organization of the Petroleum Exporting Countries and their allies — collectively known as OPEC+ — have justified their change in strategy by citing “current healthy market fundamentals, as reflected in the low oil inventories”. But observers are sceptical, given concerns about global demand due to the trade war that Trump has unleashed. Since late 2022, the cartel had slashed production, with Riyadh, Moscow, and the six other OPEC+ members withholding 2.2 million barrels per day. At the start of the year, the group said it would reintroduce some of the oil kept underground, but it has significantly accelerated the pace.

With this, OPEC leader Saudi Arabia effectively puts pressure on members that have failed to cut back their production as agreed, reducing their profits. Behind the quota violations, there are “people who make investments and want to monetise the benefit,” Lawrence Haar, an associate professor at the University of Brighton, told AFP. For Kazakhstan, the main offender within the group, the increase in recent production is linked to the Tengiz project, whose main operator is the American group Chevron, according to Francis Perrin, a senior research fellow at the Institute for International and Strategic Relations (IRIS). Other countries, such as Iraq or the United Arab Emirates, have also increased output more than agreed, but Riyadh targets especially Astana. “Kazakhstan continues to overproduce massively above its OPEC+ quota, and Saudi cannot walk back on its threats of punishing the cheaters without losing credibility, so it leaves Saudi with no choice,” DNB Carnegie analysts said.

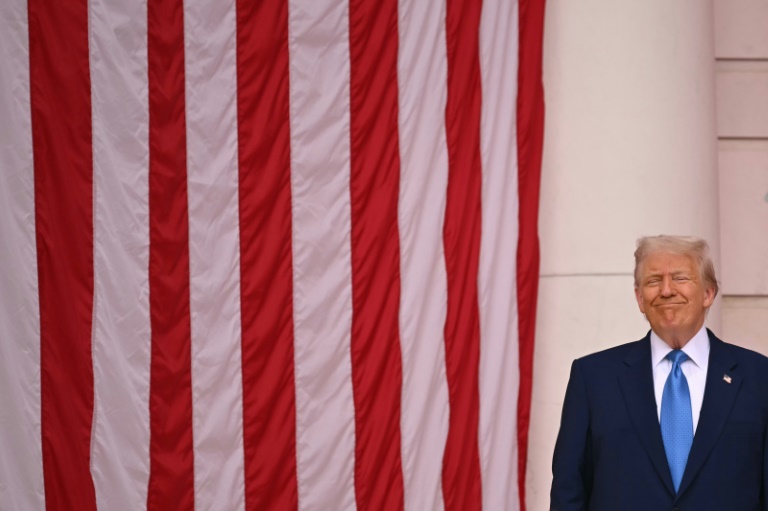

– Pressure from Trump –

Beyond these internal disputes, “it is absolutely impossible to interpret the change in position of the eight OPEC+ countries without referring to the pressure from Donald Trump,” according to Perrin. The US leader — aiming to drive down prices to combat inflation being stoked domestically — said in late January that he would ask Saudi Arabia and other OPEC nations “to bring down the cost of oil”. During Trump’s recent diplomatic tour of Gulf countries, “none of that has been mentioned”, suggesting that “he seems to be happy with the actions” of OPEC+, said Carole Nakhle, an economist at the Surrey Energy Economics Centre.

OPEC+ is also no doubt keeping an eye on the outcome of discussions between Tehran and Washington on the Islamic republic’s nuclear programme. If a deal on that were reached — and sanctions lifted — OPEC member Iran’s oil would also come onto the global market. Excessively low oil prices do present a challenge for Saudi Arabia, the world’s largest oil exporter, to finance its ambitious plan aimed at diversifying the economy. “The Saudi Arabian economy depends on oil,” Nakhle stressed.

© 2024 AFP