Paris (AFP) – The valuation of ChatGPT developer OpenAI soared to a chart-topping $500 billion in a deal for employees to sell a limited number of shares, financial media reported Thursday. If confirmed, OpenAI workers’ sale of a reported $6.6 billion in shares to investors would make the company the world’s most valuable startup, overtaking Elon Musk’s rocket company SpaceX — valued at around $400 billion, according to Bloomberg.

A gaggle of investors snapping up the shares included Japanese investment giant SoftBank, the Financial Times and Bloomberg reported, citing people familiar with the transaction. OpenAI’s French spokespeople declined to comment on the reports when contacted by AFP, while its US press office did not immediately respond to a request for comment. Softbank declined to comment on the reports.

Known for making high-stakes bets on tech, SoftBank had already committed to ploughing $40 billion into OpenAI by the end of 2025 if the startup met certain conditions. That March deal valued the US company at $300 billion, less than three years after its flagship chatbot ChatGPT wowed the public with its ability to generate convincing text responses.

Other investors cited by the FT and Bloomberg Thursday included venture capital firms Thrive Capital and Dragoneer and Abu Dhabi’s AI investment company MGX. In the first six months of 2025, OpenAI pulled in around $4.3 billion in revenue, specialist outlet The Information reported this week.

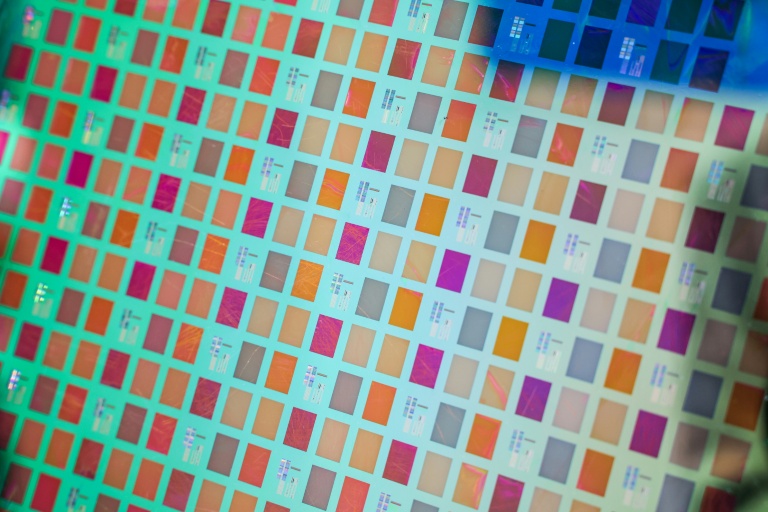

But like other generative AI developers, OpenAI has spending plans running into the hundreds of billions over the coming years to build the computing infrastructure needed to develop and operate its services. Some industry observers raised concern last week at its receipt of an investment pledge worth up to $100 billion from chip giant Nvidia.

Once known for PC gaming hardware, Nvidia has soared to become the world’s most valuable company, worth around $4.5 trillion, on the back of the generative AI boom, with much of the software running on its graphics processing units (GPUs). Nvidia chief Jensen Huang has been ploughing some of the company’s cash into firms buying its own products, including OpenAI and cloud computing providers such as Coreweave.

But while some have flagged such deals as potential warning signs of a bubble in the generative AI sector, investors have continued piling in — with OpenAI rival Anthropic raising $13 billion at a $183 billion valuation last month.

© 2024 AFP