Seoul (AFP) – The operating profit of South Korean tech giant Samsung Electronics sank almost a third in the fourth quarter owing to spending on research, the company said Friday, as analysts said it was struggling to meet demand for chips used in AI servers. The news comes as industry leaders try to assess the outlook for the sector after Chinese startup DeepSeek unveiled a groundbreaking chatbot that performed as well as artificial intelligence pacesetters — apparently for a fraction of the cost.

The world’s largest memory-chip maker had already acknowledged in October that it was facing a “crisis”, and raised concerns about its “fundamental technological competitiveness and the future of the company.” It stated that operating profit fell to 6.5 trillion won ($4.5 billion) in October-December, down from 9.18 trillion won in the previous three months. However, it was up 130 percent year-on-year. Sales rose 11.8 percent to 75.78 trillion won, and net profit increased by 22.2 percent to 7.75 trillion won year-on-year, exceeding forecasts according to Yonhap News Agency.

The firm noted that the fourth-quarter decline was attributed to “soft market conditions especially for IT products, and an increase in expenditures including R&D”, along with the “initial ramp-up costs to secure production capacity for cutting-edge nodes.” It warned that in the first three months of 2025, “overall earnings improvement may be limited due to weakness in the semiconductors business.”

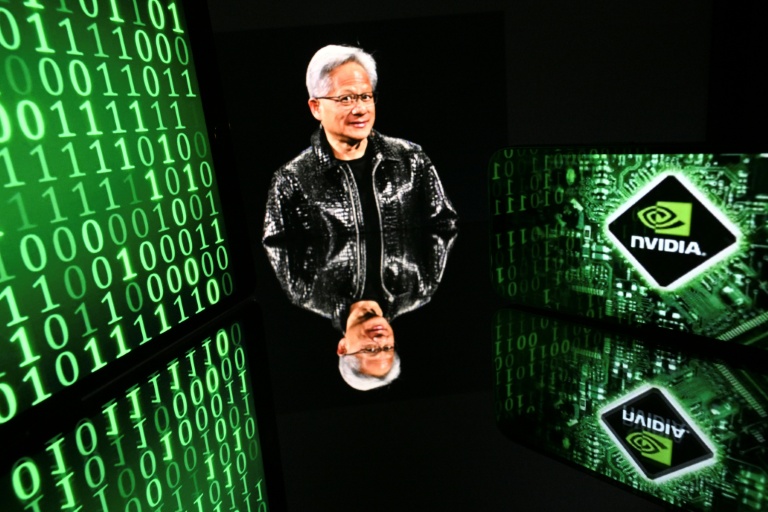

US titan Nvidia, whose semiconductors power the AI industry, has been depending on SK Hynix as its primary supplier of high-bandwidth memory (HBM) chips for its AI graphics processing units (GPU). However, Samsung, the world’s largest memory chip maker, has been struggling to meet Nvidia’s requirements. Gloria Tsuen, a Moody’s Ratings vice president and senior credit officer, told AFP that Samsung’s technology leadership “in the semiconductor market has been eroded over the last few years.”

“The rapidly increasing demand for AI chips also heightens the technological difficulty in developing new, custom-made chips for customers in a timely manner,” she added. Neil Shah of Counterpoint Research indicated that Samsung’s “conservative” focus on costs, in contrast to more challenging customer demands, had been “key factors for the headwinds.”

Still, Bloomberg reported Friday that Samsung had received approval to supply a “version of its fifth-generation high-bandwidth memory (HBM) chips” to Nvidia, citing sources familiar with the matter. Samsung declined to comment when asked by AFP about the report.

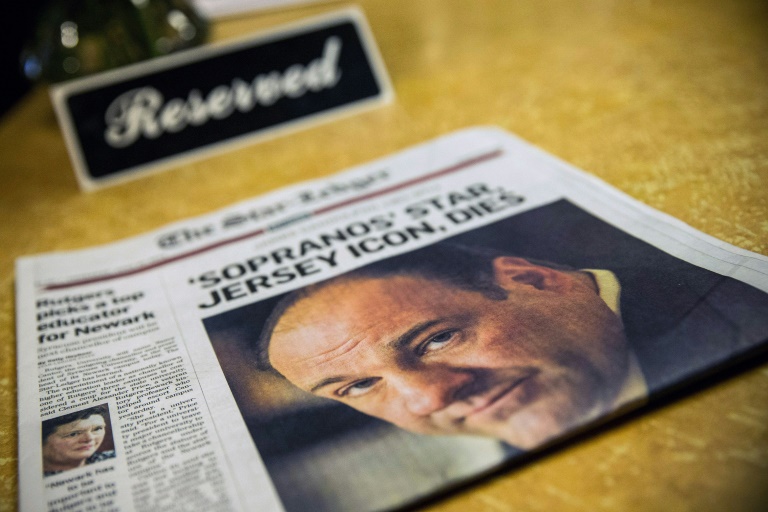

The earnings figures come as the tech world is shaken by news of DeepSeek’s new R1 chatbot, which caused a downturn in tech titans — Nvidia dived 17 percent Monday — and raised concerns about the hundreds of billions of dollars invested in AI in recent years. The Chinese startup has claimed it utilized less-advanced H800 chips — which were permitted for export to China until late 2023 — to power its large learning model.

Worries about the impact of DeepSeek sent stocks plummeting in Seoul as the market reopened after an extended break on Friday. Samsung ended down more than two percent, while SK Hynix lost 9.9 percent, having earlier plunged almost 12 percent.

Jaejune Kim, executive vice president of Samsung’s memory business, stated in an earnings call that the company was “monitoring industry trends considering various scenarios,” as it continues to supply HBM chips used in GPUs to various clients. “While it is premature to make judgements based on the currently limited information, we anticipate that long-term opportunities and short-term risks will coexist in the market,” he said.

He added that Samsung was determined to “actively respond to the rapidly evolving AI market.” While Samsung faces fundamental technology challenges, DeepSeek’s claims have “challenged the fundamental economics and investments for ongoing AI waves,” said Counterpoint’s Shah. “This ‘frugal innovation’ could potentially slow down or stretch the hundreds of billions of dollars in AI infrastructure investments over the years,” he said. “So, this could be a ‘blessing in disguise’ for Samsung, allowing them to take the time needed to perfect their solution or to lower costs,” he concluded.

© 2024 AFP