London (AFP) – European and Asian stock markets started the first full week of 2025 on a mixed note, with traders’ minds turning Monday to Donald Trump’s second US presidency. Concerns about China’s stuttering economy, the outlook for US interest rates, and the wars in Ukraine and the Middle East were causing a sense of uncertainty ahead of Trump’s return to the White House on January 20.

Investors are steeling themselves for another four years of US friction with China, particularly after Trump warned he would impose hefty tariffs on imports from the country and other key trade partners. The US dollar dropped half a percent versus its Canadian counterpart as reports said Canada’s Prime Minister Justin Trudeau may resign as soon as Monday. The Canadian dollar firmed “on the back of a broadly softer US dollar but the political shenanigans keep the risks tilted toward the upside” for the greenback, noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

Trudeau’s popularity has waned in recent months, with his government narrowly surviving a series of no-confidence votes and critics calling for his resignation. He has vowed to stay on to guide the Liberals to national elections due this year but has faced further pressure from Trump, who has threatened a 25-percent tariff on Canadian goods after he takes office on January 20. Dollar support has come in recent weeks from Trump’s pledges to cut taxes and remove regulations that could reignite inflation. The prospect of prices spiking again has caused traders to pare bets on how many rate cuts the Federal Reserve will make this year. A hawkish pivot last month took the wind out of the sails of an equities rally. US jobs data at the end of this week will provide the latest snapshot of the world’s top economy and could play a key role in officials’ decision-making.

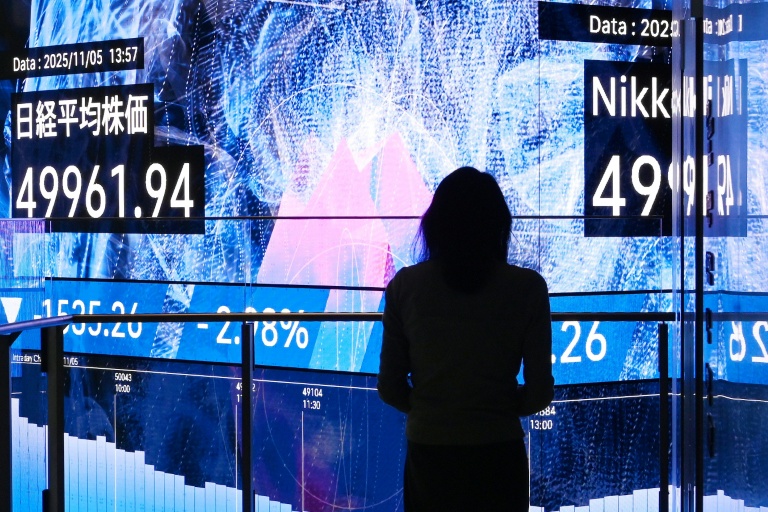

In Asia, the Seoul stock market piled on 1.9 percent Monday even as South Korea remains gripped by political uncertainty following last month’s brief martial law attempt by President Yoon Suk Yeol. Anti-graft investigators have asked police to arrest the impeached and suspended leader. Tokyo retreated, with Nippon Steel taking a hit after departing US President Joe Biden blocked its proposed $14.9 billion purchase of US Steel, citing “national security” risks. Focus is also on Beijing as it tries to kickstart China’s growth with a series of stimulus measures aimed particularly at boosting consumption and supporting the battered property sector. However, analysts pointed out that their work could be made harder by Trump. “For 2025, China’s economy will likely be stuck between the rock of higher trade tariffs and the hard place of a domestic crisis of confidence,” analysts at Moody’s Analytics wrote.

– Key figures around 1045 GMT –

London – FTSE 100: DOWN 0.1 percent at 8,215.12 points

Paris – CAC 40: UP 0.5 percent at 7,317.18

Frankfurt – DAX: UP 0.3 percent at 19,971.48

Tokyo – Nikkei 225: DOWN 1.5 percent at 39,307.05 (close)

Hong Kong – Hang Seng Index: DOWN 0.4 percent at 19,688.29 (close)

Shanghai – Composite: DOWN 0.1 percent at 3,206.92 (close)

New York – Dow: UP 0.8 percent at 42,732.13 (close)

Euro/dollar: UP at $1.0342 from $1.0307 on Friday

Pound/dollar: UP at $1.2475 from $1.2423

Dollar/yen: UP at 157.88 yen from 157.33 yen

Euro/pound: DOWN at 82.90 pence from 82.95 pence

West Texas Intermediate: DOWN 0.1 percent at $74.01 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $76.56 per barrel

© 2024 AFP