New York (AFP) – European stock markets fell while Wall Street edged higher with investors awaiting more signs on the direction of interest rates and an earnings update from US tech giant Nvidia.

With markets having reached record highs in recent sessions, some traders took the opportunity to lock in gains in the absence of fresh impetus.

“There was little to influence market direction following all the excitement from last week’s ever-so-slightly positive, although just-as-expected” US consumer inflation data, said David Morrison, senior analyst at Trade Nation.

“It looks as if investors are choosing to take some money off the table now.”

Stock markets hit fresh record highs last week after figures showed US inflation slowed to 3.4 percent in April, raising hopes that the Federal Reserve will cut interest rates in the coming months.

All major European markets fell Tuesday.

Trading was a bit more buoyant in New York, although gains were modest.

But a 0.2 percent increase in the Nasdaq still translated to a second straight record for the tech-focused index.

“One can see that there isn’t a lot of conviction” in the market, said Patrick O’Hare, an analyst at Briefing.com.

There’s an “expectation of consolidation activity given the run the major indices have enjoyed since their mid-April lows.”

Eyes are on the release later in the day of minutes from the Federal Reserve’s May policy decision for clues on the outlook for cuts to US interest rates.

Fed governor Christopher Waller welcomed last week’s consumer price index report that showed moderating inflation, while adding that “several” months of additional data were needed before interest rates should be cut.

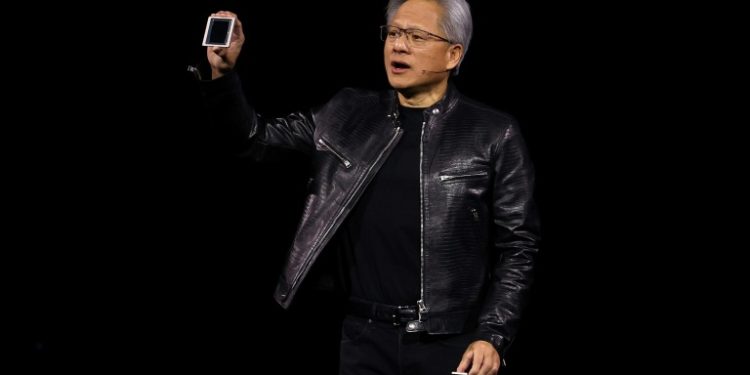

On Wednesday, investors will closely watch earnings results from US chip-maker and stock market star Nvidia — now the third largest US company by market capitalization — whose high-end processors are prized by artificial intelligence companies.

“Nvidia’s earnings report is important for overall market sentiment in the near term,” said Kathleen Brooks, research director at XTB.

“However, there are signs that interest in Nvidia could be waning as the share price approaches a record high and after it has rallied more than 90 percent so far this year.”

Chinese property firms, which soared Friday on news of new government support measures, sank in Hong Kong, which led other Asian markets lower.

China’s announcement Tuesday that local governments took in the least amount of revenue for land sales in eight years underscored the difficult path to bring China’s property sector back to health.

Copper, a key gauge of the state of the economy owing to its widespread use, held near the record above $11,400 it set on Monday, while gold fell back marginally from its own peak touched on the same day.

Silver was around an 11-year high.

Oil prices fell and the dollar was little changed.

– Key figures around 2040 GMT –

New York – Dow: UP 0.2 percent at 39,872.99 (close)

New York – S&P 500: UP 0.3 percent at 5,321.41 (close)

New York – Nasdaq Composite: UP 0.2 percent at 16,832.62 (close)

London – FTSE 100: DOWN 0.1 percent at 8,416.45 points (close)

Paris – CAC 40: DOWN 0.7 percent at 8,141.46 (close)

Frankfurt – DAX: DOWN 0.2 percent at 18,726.76 (close)

EURO STOXX 50: DOWN 0.5 percent at 5,046.99 (close)

Tokyo – Nikkei 225: DOWN 0.3 percent at 38,946.93 (close)

Hong Kong – Hang Seng Index: DOWN 2.1 percent at 19,220.62 (close)

Shanghai – Composite: DOWN 0.4 percent at 3,157.97 (close)

Dollar/yen: DOWN at 156.18 yen from 156.26 yen on Friday

Euro/dollar: UP at $1.0858 from $1.0857

Pound/dollar: UP at $1.2708 from $1.2706

Euro/pound: DOWN at 85.41 from 85.44 pence

West Texas Intermediate: DOWN 0.3 percent at $79.80 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $83.71 per barrel

© 2024 AFP