New York (AFP) – Global equities were sluggish Thursday as US Treasury bond yields moderated following House passage of President Donald Trump’s mammoth tax cut legislation. A spike on Wednesday in yields on 10- and 30-year US bonds sent stocks sharply lower amid revived worries about a sell-off in US assets comparable to one earlier this spring before Trump retreated from some of his most onerous tariffs. But bond yields retreated somewhat later Thursday, boosting stocks a bit. Major US indices finished mixed after a choppy session with the Dow flat, the Nasdaq up slightly and the S&P 500 down slightly. The rise in yields had “gone a little bit too far,” said Victoria Fernandez, chief market strategist at Crossmark Global Investments.

European key indexes ended their session just in the red as London, Frankfurt, and Paris all shed around 0.5 percent as investors noted weak business activity data out of the eurozone and Britain. The HCOB Flash Eurozone purchasing managers’ index published by S&P Global registered a figure of 49.5 compared to 50.4 in April. “May’s snapshot is not pretty,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. “Looking ahead, companies are only cautiously optimistic. The expectations index is still well below its long-term average.” But he said there were reasons for confidence in the longer term, pointing to a rebound in manufacturing “with encouraging signs coming out of both Germany and France,” more interest rate cuts expected this year, and lower oil prices compared to last year.

Back in Washington, focus now turns to the Senate, which will consider parallel tax legislation after the House approved Trump’s measure by a single vote. The bill extends for 10 years tax cuts introduced under Trump’s 2017 legislation, while enacting cuts to social safety net programs. While investors welcome the tax cuts, they have been unnerved by forecasts that the proposal will add trillions of dollars in US debt. The yield on 30-year US government bonds climbed to 5.15 percent following the House vote, nearing levels last seen in 2007 at the start of the global financial crisis. But yields pulled back later in the session, hitting 5.07 percent near 2030 GMT.

Jack Ablin of Cresset Capital Management said the shift in the bond market Thursday reflects short-term dynamics after Wednesday’s poor US Treasury auction sent yields sharply higher. “Investors are turning their attention back to the day rather than the structural dynamics,” Ablin said.

– Key figures at around 2030 GMT –

New York – Dow: FLAT at 41,859.09 (close)

New York – S&P 500: DOWN 0.1 percent at 5,842.01 (close)

New York – Nasdaq Composite: UP 0.3 percent at 18,925.73 (close)

London – FTSE 100: DOWN 0.5 percent at 8,739.26 (close)

Paris – CAC 40: DOWN 0.6 percent at 7,864.44 (close)

Frankfurt – DAX: DOWN 0.5 percent at 23,999.17 (close)

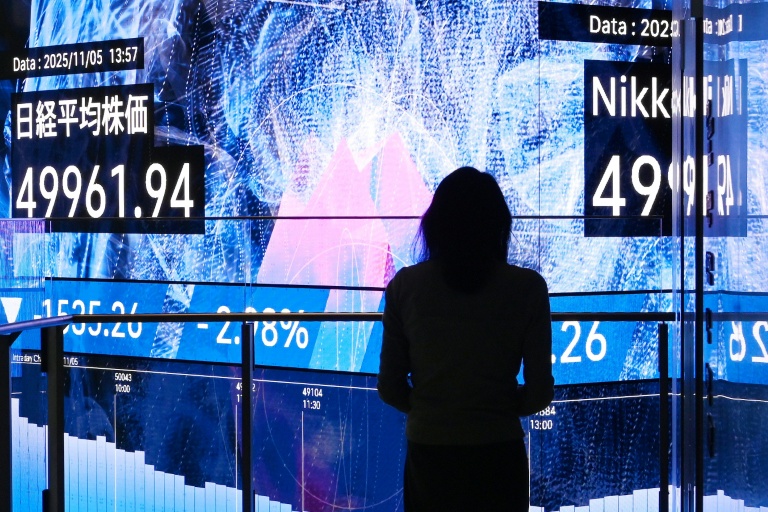

Tokyo – Nikkei 225: DOWN 0.8 percent at 36,985.87 (close)

Hong Kong – Hang Seng Index: DOWN 1.2 percent at 23,544.31 (close)

Shanghai – Composite: DOWN 0.2 percent at 3,380.19 (close)

Euro/dollar: DOWN at $1.1281 from $1.1331 on Wednesday

Pound/dollar: DOWN at $1.3419 from $1.3420

Dollar/yen: UP at 143.99 yen from 143.68 yen

Euro/pound: DOWN at 84.07 pence from 84.41 pence

West Texas Intermediate: DOWN 0.6 percent at $61.20 per barrel

Brent North Sea Crude: DOWN 0.7 percent at $64.44 per barrel

© 2024 AFP