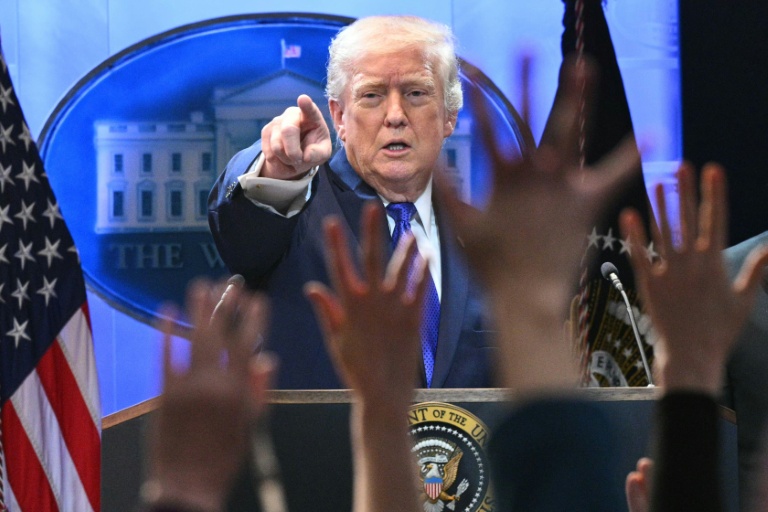

**New York (AFP)** – Stock markets slumped Monday over concerns about the global economy after US President Donald Trump announced tariffs on Canada, China, and Mexico. Wall Street’s three main indices fell sharply in early trading but clawed back ground after Trump postponed the introduction of tariffs on Mexico for one month. Trump announced on Saturday 25 percent levies on imports from Canada and Mexico and 10 percent new duties on Chinese goods. Talks were still underway on Monday with Canada.

The London, Paris, and Frankfurt stock markets finished in the red as Trump warned over the weekend that the European Union would be next in the firing line and did not rule out tariffs against Britain. Shares in European automakers were hit particularly hard, with Volkswagen shedding 3.5 percent and Jeep maker Stellantis down more than 4.5 percent. VW makes some cars for the US market in Mexico, while Stellantis has factories in both Canada and Mexico. US auto stocks were also hammered, with Tesla losing 5.2 percent and General Motors 3.2 percent. Asian stock markets finished mostly in the red.

“Investors fear that this trade war will result in a significant deterioration in the global economy,” said John Plassard, investment specialist at Swiss asset manager Mirabaud. There was also a sharp selloff across the cryptocurrency sector, with bitcoin slumping almost five percent before rebounding. Saturday’s tariff announcement “caught markets somewhat off guard, despite Trump’s prior hints,” said Daniela Sabin Hathorn, senior market analyst at brokerage Capital.com.

“The lack of a clear economic rationale behind this decision — justified primarily as a measure to curb illegal immigration and fentanyl imports — has unsettled investors,” Sabin Hathorn said. The US dollar yo-yoed against major currencies, including the Mexican peso and Canadian dollar. Analysts warn that the tariffs could fuel inflation and drag down economic growth. Trump admitted that Americans may feel economic “pain” from his tariffs, but that it would be “worth the price.”

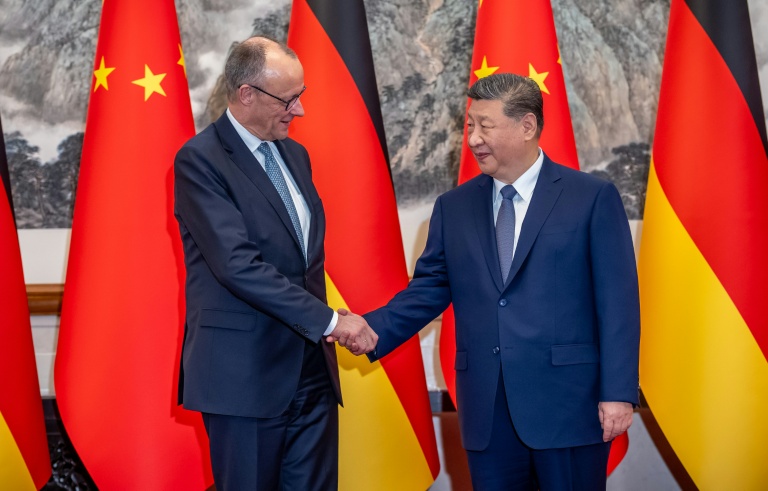

China, Mexico, and Canada are the top three US trade partners and have all vowed to retaliate if the tariffs go into effect. The tariffs are “considered a cost that will likely push prices higher and growth lower,” said Jack Ablin of Cresset Capital, who noted Trump has threatened tariffs on other countries. “The market is adapting not just to more tariffs, but more headline risk,” he said. Trump’s tariff threats against Europe overshadowed a defense summit in Brussels on Monday.

“If we are attacked in terms of trade, Europe — as a true power — will have to stand up for itself and therefore react,” French President Emmanuel Macron said as he arrived for the talks.

—

**Key figures around 2030 GMT**

– New York – Dow: DOWN 0.3 percent at 44,421.91 (close)

– New York – S&P 500: DOWN 0.8 percent at 5,994.57 (close)

– New York – Nasdaq: DOWN 1.2 percent at 19,391.96 (close)

– London – FTSE 100: DOWN 1.0 percent at 8,583.56 (close)

– Paris – CAC 40: DOWN 1.2 percent at 7,854.92 (close)

– Frankfurt – DAX: DOWN 1.4 percent at 21,428.24 (close)

– Tokyo – Nikkei 225: DOWN 2.7 percent at 38,520.09 (close)

– Hong Kong – Hang Seng Index: FLAT at 20,217.26 (close)

– Shanghai – Composite: Closed for a holiday

**Currency Exchange Rates:**

– Euro/dollar: DOWN at $1.0302 from $1.0362 on Friday

– Pound/dollar: UP at $1.2407 from $1.2395

– Dollar/yen: DOWN at 154.80 yen from 155.19 yen

– Euro/pound: DOWN at 83.03 pence from 83.59 pence

**Oil Prices:**

– Brent North Sea Crude: UP 0.4 percent at $75.96 per barrel

– West Texas Intermediate: UP 0.9 percent at $73.16 per barrel

burs-jmb/dw

© 2024 AFP