New York (AFP) – Stock markets mostly rose Wednesday on both sides of the Atlantic as investors shrugged off Washington’s latest tariffs to focus on cooling US inflation and a Ukraine ceasefire plan. Global markets have endured severe swings this month as US President Donald Trump looks to ramp up pressure on global partners by imposing or threatening hefty duties on their goods, citing trade imbalances and other concerns.

Markets have worried that the tariffs could spark a surge in US inflation and drive a stake into the chances that the Federal Reserve cuts interest rates further. But government data released Wednesday showed US consumer inflation had slowed slightly to 2.8 percent in February — the first full month of Trump’s White House return. That was slightly better than analysts expected. Core inflation, which excludes volatile food and energy prices, dipped to an annual rate of 3.1 percent.

“The inflation data are a bright spot in the Federal Reserve’s battle against rising prices. They reinforce the expectation of three rate cuts later in 2025,” said Jochen Stanzl, chief market analyst at CMC Markets. “Sentiment on Wall Street is so negative that these positive inflation figures could spark a broader recovery in stock prices,” he added. Wall Street’s main stock indices mostly closed higher, with the tech-heavy Nasdaq Composite rising 1.2 percent. But the Dow dipped into the red, losing 0.2 percent. The “momentum has struggled to sustain itself,” said Daniela Sabin Hathorn, senior market analyst at Capital.com.

In Europe, Frankfurt stocks jumped 1.6 percent, while Paris gained 0.6 percent and London added 0.5 percent. Analysts said support also came from Ukraine endorsing an American proposal for a 30-day ceasefire, with Russia yet to issue a response. Stanzl said further developments in US trade policy could shift sentiment “as many investors link tariffs with higher inflation, which could soon undo the hard-won declines achieved by the Federal Reserve.”

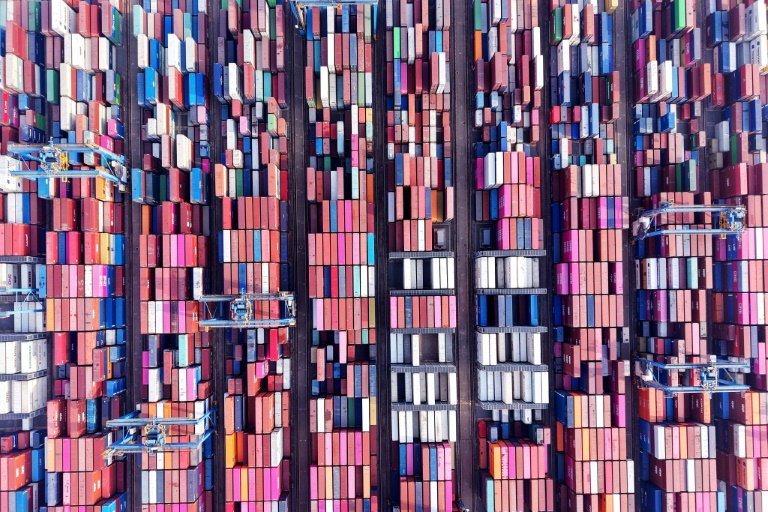

In Trump’s latest move, sweeping 25 percent levies on all US aluminum and steel imports came into effect, hitting numerous nations from Brazil to South Korea, as well as the European Union. Trump had threatened to double those tariffs on Canada after Ontario imposed an electricity surcharge on three US states, but he called that off after the province halted the charge. The move nonetheless brought swift ripostes from Canada, which announced nearly $21 billion in additional tariffs on US goods, while the EU said it would target $28 billion in US imports starting April.

China vowed to strike back, but Brazil, Britain, and Mexico held off taking countermeasures. The on-off nature of Trump’s trade policies has fueled uncertainty in markets and has sent the VIX “fear index” of volatility to its highest level since August. Analysts said high uncertainty in US stock markets made other regions more attractive as investors seek stability. “Investors are increasingly looking overseas as concerns mount over US stock valuations, monetary policy, and economic uncertainty,” said Charu Chanana, chief investment strategist at Saxo.

Asian markets ended mostly lower on Wednesday.

– Key figures around 2030 GMT –

New York – Dow: DOWN 0.2 percent at 41,350.93 points (close)

New York – S&P 500: UP 0.5 percent at 5,599.30 (close)

New York – Nasdaq Composite: UP 1.2 percent at 17,648.45 (close)

London – FTSE 100: UP 0.5 percent at 8,540.97 (close)

Paris – CAC 40: UP 0.6 percent at 7,988.96 (close)

Frankfurt – DAX: UP 1.6 percent at 22,676.41 (close)

Tokyo – Nikkei 225: UP 0.1 percent at 36,819.09 (close)

Hong Kong – Hang Seng Index: DOWN 0.8 percent at 23,600.31 (close)

Shanghai – Composite: DOWN 0.2 percent at 3,371.92 (close)

Euro/dollar: DOWN at $1.0890 from $1.0915 on Tuesday

Pound/dollar: UP at $1.2969 from $1.2954

Dollar/yen: UP at 148.32 yen from 147.70 yen

Euro/pound: DOWN at 83.97 pence from 84.26 pence

Brent North Sea Crude: UP 2.0 percent at $70.95 per barrel

West Texas Intermediate: UP 2.2 percent at $67.68 per barrel

© 2024 AFP