London (AFP) – Stock markets diverged on Thursday as traders reacted to the US Federal Reserve’s plan to only cut interest rates once this year.

Europe was trading firmly in the red, with Paris and Frankfurt shedding more than one percent each as investors continued to track fallout from far-right gains in last weekend’s EU elections.

Wall Street had a mixed opening as the tech-heavy Nasdaq and the S&P 500 climbed while the Dow slipped back.

The euro recovered from sharp losses against the dollar in recent sessions, after French President Emmanuel Macron said he would not resign should his party lose snap elections he called after its drubbing by the far right in EU-wide polls.

In the United States, the Federal Reserve left its key lending rate unchanged on Wednesday and pencilled in just one rate cut this year, down from the three expected in March.

Despite US annual inflation dipping to 3.3 percent last month, the fall was below expectations, while the consumer price index remains comfortably above the Fed’s two-percent target.

“Fed chair Jerome Powell didn’t give a huge amount away, although it felt telling that he was fairly cautious about the cooler-than-expected inflation figures from earlier in the day,” noted AJ Bell investment director Russ Mould. The Fed “wants further signs inflation is on the path to the magic two-percent level before it is prepared to start cutting rates. One major sticking point being the continued tight labour market conditions”.

Fresh US government data released on Thursday showed that wholesale prices unexpectedly declined last month by 0.2 percent, providing further indications inflation is cooling in the world’s top economy.

The improved producer price figures come on the heels of Wednesday’s better consumer price data, which together are “net bullish” for stocks, said Adam Sarhan, chief executive of 50 Park Investments. “It means the Fed has more room to cut rates if it wants to,” Sarhan said.

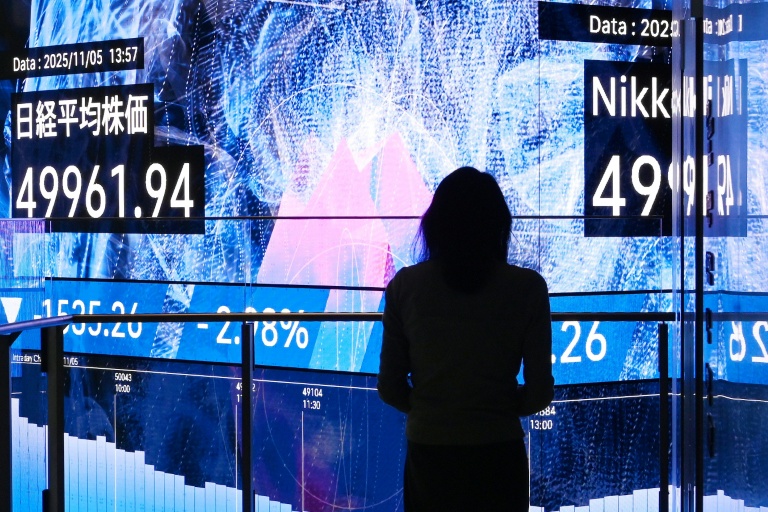

Investors were also keeping an eye on the yen as the Bank of Japan started a two-day policy meeting, with speculation swirling that it is preparing the ground for a further tightening after lifting interest rates in March for the first time in 17 years.

Japan has been an outlier in recent years, deciding against raising interest rates to fight high inflation. And just as major central banks are looking to cut borrowing costs, the BoJ has decided to start hiking.

– Key figures around 1345 GMT –

New York – Dow Jones: DOWN 0.4 percent at 38,574.74 points

London – FTSE 100: DOWN 0.5 percent at 8,178.49

Paris – CAC 40: DOWN 1.4 percent at 7,754.78

Frankfurt – DAX: DOWN 1.1 percent at 18,410.78

EURO STOXX 50: DOWN 1.2 percent at 4,975.11

Tokyo – Nikkei 225: DOWN 0.4 percent at 38,720.47 (close)

Hong Kong – Hang Seng Index: UP 1.0 percent at 18,112.63 (close)

Shanghai – Composite: DOWN 0.3 percent at 3,028.92 (close)

Euro/dollar: DOWN at $1.0808 from $1.0811 on Wednesday

Euro/pound: UP at 84.50 pence from 84.45 pence

Pound/dollar: DOWN at $1.2789 from $1.2797

Dollar/yen: UP at 157.13 yen from 156.86 yen

West Texas Intermediate: UP 0.2 percent at $78.64 per barrel

Brent North Sea Crude: UP 0.3 percent at $82.84 per barrel

burs-imm/lth

© 2024 AFP