New York (AFP) – Stocks mostly edged downwards on Monday, after rallies in Europe and the United States fueled by comments from the US central bank chief last week where he indicated the possibility of lower interest rates. Investors were also keenly awaiting an earnings report from dominant AI chip company Nvidia due on Wednesday. The firm’s stock fell sharply last week as investors worried that enthusiasm for AI may be overcooked, which helped drag down the buoyant tech industry. But on Monday, Nvidia shares climbed 1.0 percent.

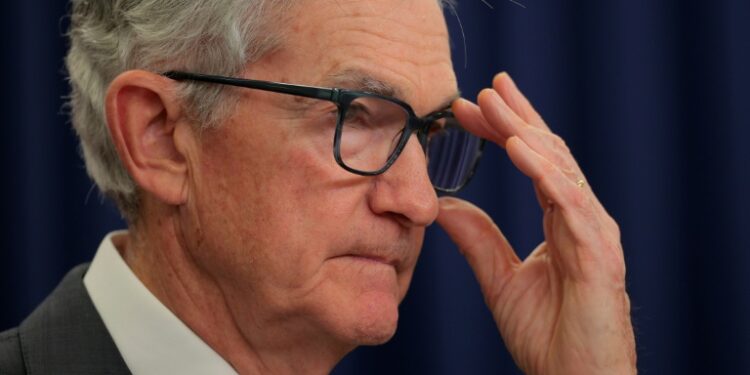

“AI has been the primary driver of the market this year,” said Christopher Low of FHN Financial, adding that Nvidia stock is particularly important as investors have used it to wager on the AI industry more broadly. Separately, Federal Reserve chief Jerome Powell told central bankers at an annual conference in Wyoming last Friday that “the balance of risks appears to be shifting” in the United States. In particular, he noted that risks to employment are rising and flagged the possibility they could materialize rapidly in the form of higher layoffs.

Investors interpreted his remarks as a sure signal of a rate cut at the Fed’s meeting next month, as inflation has not shown signs of soaring in the wake of President Donald Trump’s tariffs blitz. “Powell basically delivered the 25 basis points before the September meeting,” said Ipek Ozkardeskaya, an analyst at Swissquote Bank. While global markets soared initially and Asian markets kept their gains, Wall Street’s major indexes closed lower.

European indices fell back after a morning flurry, with a late slump on the Paris exchange after an announcement by Prime Minister Francois Bayrou that he would seek a vote of confidence in the National Assembly in a bid to push through his budget. All eyes now turn toward a US GDP report on Thursday and a key inflation gauge coming on Friday for clues on how far interest rates might fall — or not — in the coming months.

In corporate news, shares in Danish wind group Orsted plunged 16 percent after the US government halted construction at an offshore site that is 80 percent complete. It was the latest move by Trump’s administration against wind power and other renewables in favor of oil and gas. France’s Valneva tumbled 22 percent following a US suspension of its chikungunya vaccine over “serious” side-effects, raising doubts about one of the few vaccines for the virus. And stocks in sportswear manufacturer Puma leapt 15 percent after reports suggested France’s Pinault family were trying to sell their 29 percent stake in the firm.

– Key figures at around 2040 GMT –

New York – Dow: DOWN 0.8 percent at 45,282.47 points (close)

New York – S&P 500: DOWN 0.4 percent at 6,439.32 (close)

New York – Nasdaq: DOWN 0.2 percent at 21,449.29 (close)

Paris – CAC 40: DOWN 1.6 percent at 7,843.04 points (close)

Frankfurt – DAX: DOWN 0.4 percent at 24,273.12 (close)

London – FTSE 100: CLOSED for Summer Bank Holiday

Tokyo – Nikkei 225: UP 0.4 percent at 42,807.82 (close)

Hong Kong – Hang Seng Index: UP 1.9 percent at 25,829.91 (close)

Shanghai – Composite: UP 1.5 percent at 3,883.56 (close)

Euro/dollar: DOWN at $1.1624 from $1.1722 on Friday

Pound/dollar: DOWN at $1.3460 from $1.3523

Dollar/yen: UP at 147.70 yen from 146.94 yen

Euro/pound: DOWN at 86.35 pence from 86.69 pence

West Texas Intermediate: UP 1.8 percent at $64.80 per barrel

Brent North Sea Crude: UP 1.6 percent at $68.80 per barrel

burs-jxb-bys/jgc

© 2024 AFP