London (AFP) – Global stock markets marked time and the dollar steadied Wednesday with investors’ eyes on a highly anticipated Federal Reserve policy announcement later in the day. On Wall Street, the tech-heavy Nasdaq was off 0.2 percent two hours into the session. The Dow rose 0.5 percent but the S&P 500 index was flat. Europe was little changed as London closed 0.1 percent in the green but Frankfurt and Paris were just off, while Asia saw a lacklustre session.

With US central bankers expected to cut interest rates for the third straight session on Wednesday, the main focus is on their post-meeting statement, Fed boss Jerome Powell’s news conference, and the “dot plot” forecast for 2026 policy. “While there is a 90-percent chance of a rate cut at this meeting, the outlook is less clear,” said Kathleen Brooks, research director at traders XTB. “In the lead up to this meeting, bond traders are scaling back their expectations for future rate cuts, with only two further reductions expected throughout 2026,” she added. Traders were generally expecting a “hawkish” 25-basis-point trim.

After November’s tech-led swoon, stock markets have enjoyed a healthy run in recent weeks as weak jobs figures reinforced expectations for another step lower in borrowing costs. But that has cooled heading into the Fed gathering following the release of US inflation data that was slightly higher than expected. US data on Tuesday showing an uptick in job openings — against estimates for a drop — further tempered expectations for a string of cuts next year. Still, there is some hope that the Fed will turn more dovish next year, with US President Donald Trump’s top economic aide Kevin Hassett — the frontrunner to succeed Powell in May — saying he sees plenty of room to substantially lower rates.

After a weak showing Tuesday in New York, where the S&P 500 and Dow dropped, Asia fared no better Wednesday with Tokyo, Sydney, Singapore, Seoul, Mumbai, Wellington, Jakarta, and Manila all down, though Hong Kong and Taipei edged up. The price of silver hit a record high at $61.6145 an ounce owing to high demand for the metal used by industry as well as for making jewellery. It topped $60 for the first time Tuesday also thanks to supply constraints.

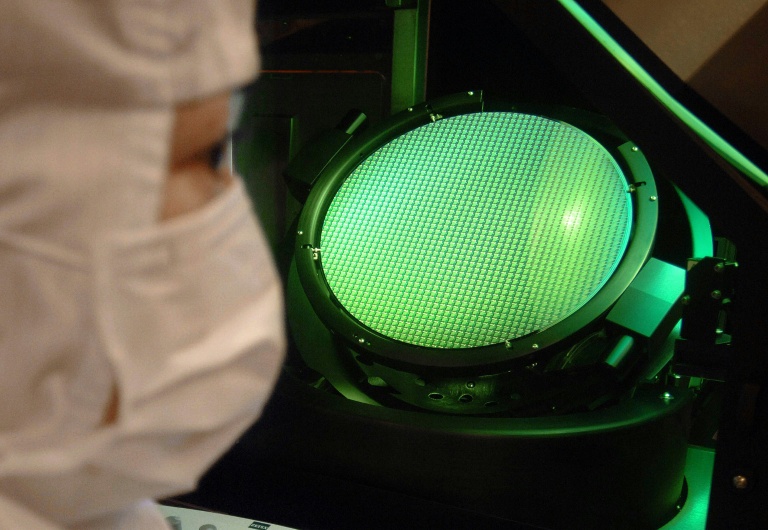

Investors are also keenly awaiting earnings from software giant Oracle and chipmaker Broadcom, which will be used to judge the outlook for the tech sector in the wake of huge investments in artificial intelligence. Markets have been pumped higher for the past two years by the surge into all things AI, though there has been some concern of late that the hundreds of billions splashed out might not see returns as early as hoped.

– Key figures at around 1650 GMT –

New York – Dow: UP 0.5 percent at 47,790.81 points

New York – S&P 500: UP 0.1 percent at 6,845.34

New York – Nasdaq Composite: DOWN 0.2 percent at 23,519.10

London – FTSE 100: UP 0.1 percent at 9,655.02 (close)

Paris – CAC 40: DOWN 0.4 percent at 8,022.69 (close)

Frankfurt – DAX: DOWN 0.1 percent at 24,130.14 (close)

Tokyo – Nikkei 225: DOWN 0.1 percent at 50,602.80 (close)

Hong Kong – Hang Seng Index: UP 0.4 percent at 25,540.78 (close)

Shanghai – Composite: DOWN 0.2 percent at 3,900.50 (close)

Dollar/yen: DOWN at 156.52 yen from 156.90 yen on Tuesday

Euro/dollar: UP at $1.1636 from $1.1630

Pound/dollar: UP at $1.3317 from $1.3300

Euro/pound: DOWN at 87.33 pence from 87.43 pence

Brent North Sea Crude: DOWN 0.7 percent at $61.49 per barrel

West Texas Intermediate: DOWN 0.7 percent at $57.80 per barrel

© 2024 AFP