New York (AFP) – Stock markets mostly rose Monday as traders geared up for an expected interest rate cut by the US Federal Reserve this week. Sentiment was also boosted by news that the United States and China have reached a framework deal over their TikTok dispute, which the US side said will be finalized by President Donald Trump and Chinese leader Xi Jinping on Friday.

On Wall Street, the S&P 500 and Nasdaq pushed to fresh records, while Europe’s main markets ended mostly higher. Equities have enjoyed a strong run-up over recent weeks as a string of data on jobs and inflation is seen as having provided the US central bank with enough leeway to resume its rate reductions. Wednesday’s policy decision would follow figures showing the labor market has continued to soften, while prices have not spiked as much as feared in the wake of Trump’s tariff war. The Fed is expected to lower borrowing costs by 25 basis points, although some observers predict it could go to 50 points.

“Overall, today’s price action suggests that there is optimism across financial markets,” said Kathleen Brooks, research director at XTB trading platform. “Stocks look to be rallying into this Fed meeting, as hopes remain high that the Fed will burnish their dovish credentials and signal multiple rate cuts in the coming months on Wednesday,” she added. The dollar slid against its major rivals, and City Index and FOREX.com analyst Fawad Razaqzada said traders will be listening for phrases from the Fed like inflation being “well anchored” or the labor market “cooling more than expected,” signaling more cuts ahead. The central banks of Canada, Britain, and Japan are also due to meet this week.

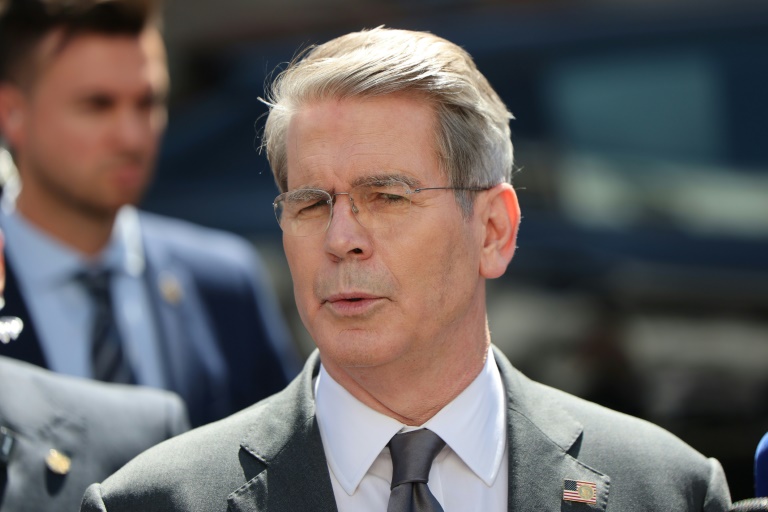

Prospects for defusing trade tensions between the world’s top two economies improved as US Treasury Secretary Scott Bessent said Monday that a “framework” for a deal to settle a dispute over TikTok had been reached with China. He said Trump and Xi will speak on Friday to “complete” the agreement, after Washington’s pressure to have the video-sharing app find a non-Chinese buyer or face a US ban. Bessent was speaking after a second day of talks with Chinese officials in Madrid that included discussions on the US-China trade dispute. Trump said the talks were going “VERY WELL” in a Truth Social post, adding that he would speak to Xi on Friday.

Trade tensions between Beijing and Washington escalated sharply earlier this year, with tit-for-tat tariffs reaching triple digits and snarling supply chains. Both governments have since agreed to a de-escalation, with the United States imposing 30-percent duties on imports of Chinese goods and China hitting US products with a 10-percent levy. But the temporary truce expires in November.

Asia equities fluctuated and Shanghai edged down after data showed further weakness in China’s economy — with growth in retail sales and industrial production much slower than forecast. Shares in Tesla closed 3.6 percent up after regulatory filings showed CEO Elon Musk bought about $1 billion worth of shares in the electric car manufacturer.

– Key figures at around 2015 GMT –

New York – Dow: UP 0.1 percent at 45,883.45 points (close)

New York – S&P 500: UP 0.5 percent at 6,615.28 (close)

New York – Nasdaq Composite: UP 0.9 percent at 22,348.75 (close)

London – FTSE 100: DOWN less than 0.1 percent at 9,277.03 (close)

Paris – CAC 40: UP 0.9 percent at 7,896.93 (close)

Frankfurt – DAX: UP 0.2 percent at 23,748.86 (close)

Tokyo – Nikkei 225: Closed for a holiday

Hong Kong – Hang Seng Index: UP 0.2 percent at 26,446.56 (close)

Shanghai – Composite: DOWN 0.3 percent at 3,860.50 (close)

Euro/dollar: UP at $1.1768 from $1.1731 on Friday

Pound/dollar: UP at $1.3609 from $1.3560

Dollar/yen: DOWN at 147.38 yen from 147.67 yen

Euro/pound: DOWN at 86.47 pence from 86.52 pence

West Texas Intermediate: UP 1.0 percent at $63.30 per barrel

Brent North Sea Crude: UP 0.7 percent at $67.44 per barrel

© 2024 AFP