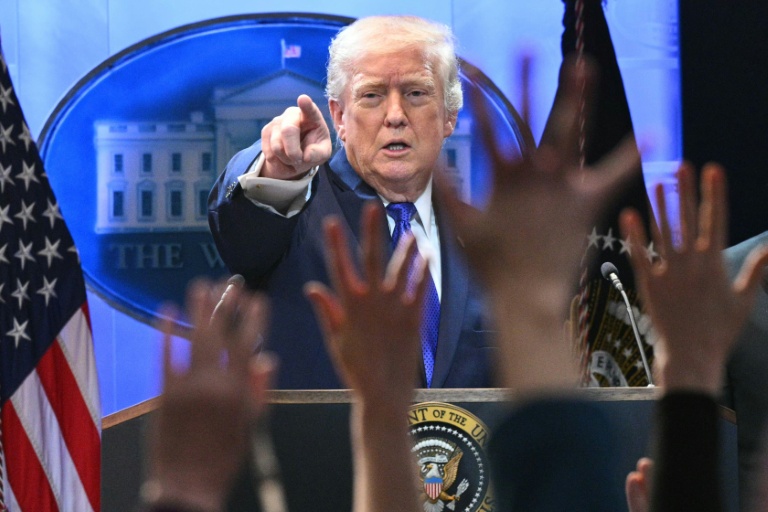

New York (AFP) – Stock markets fell Friday after US President Donald Trump threatened China with “massive” new tariffs, while oil prices retreated as Middle East tensions eased following the Gaza ceasefire. Trump, in an angry and lengthy social media post, slammed China for “very hostile” trade practices, including imposing new export controls on rare earths. In addition to “a massive increase of Tariffs,” other major countermeasures were “under consideration,” he said, adding that he no longer felt it necessary to meet China’s President Xi Jinping at a summit later in the month.

Trump’s sharp pivot sent Wall Street’s major indices sharply lower, with the Nasdaq leading the major benchmarks lower, down 3.6 percent. The dollar fell against its main rival currencies. Trump’s message “has been disrupting the market calm,” said Angelo Kourkafas of Edward Jones, who also noted that markets have been poised for a pullback after a heady rally. Washington and Beijing had been de-escalating trade tensions after a tit-for-tat tariffs war earlier this year, with the Trump-Xi meeting expected to help prolong a shaky truce.

However, China on Thursday announced new controls on the export of rare-earth technologies and items, adding to regulations on a critical industry that has been a key source of tension between Beijing and Washington. Oil prices had already fallen more than two percent as the Gaza ceasefire took effect, easing concerns about a wider regional conflict that could disrupt supply. But trade war worries pushed prices down more, with the US benchmark West Texas Intermediate ending down 4.2 percent at $58.90, its lowest closing price since April.

European markets also slid after Trump’s comments. Paris finished the day down 1.5 percent amid focus on French President Emmanuel Macron’s handling of a rolling political crisis. The president late Friday reappointed his outgoing Prime Minister Sebastien Lecornu, just four days after he gave his resignation. The week was marked by a raft of new records in several markets, with the tech-heavy Nasdaq index, the Frankfurt stock exchange, and gold prices reaching new heights. Silver also surged to a decades-long high.

Buying sentiment won a boost earlier this week from news that ChatGPT-maker OpenAI had signed multi-billion-dollar chip deals with US firm AMD as well as South Korean titans Samsung and SK hynix. However, there are rumblings that the rally could run out of steam, causing jitters on trading floors. “The AI bubble debate remains a hot topic: some argue this is the new internet bubble 2.0 waiting to burst, others think it’s a bubble that still has room to inflate,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank. Such worries have been part of the reason behind the rally in gold to a record price above $4,000 an ounce Wednesday.

– Key figures at around 2010 GMT –

New York – Dow: DOWN 1.9 percent at 45,479.60 (close)

New York – S&P 500: DOWN 2.7 percent at 6,552.51 (close)

New York – Nasdaq Composite: DOWN 3.6 percent at 22,204.43 (close)

London – FTSE 100: DOWN 0.9 percent at 9,427.47 (close)

Paris – CAC 40: DOWN 1.5 percent at 7,918.00 (close)

Frankfurt – DAX: DOWN 1.5 percent at 24,241.46 (close)

Tokyo – Nikkei 225: DOWN 1.0 percent at 48,088.80 (close)

Hong Kong – Hang Seng Index: DOWN 1.7 percent at 26,290.32 (close)

Shanghai – Composite: DOWN 0.9 percent at 3,897.03 (close)

Euro/dollar: UP at $1.1615 from $1.1564 on Thursday

Pound/dollar: UP at $1.3352 from $1.3304

Dollar/yen: DOWN at 151.57 yen from 153.07 yen

Euro/pound: UP at 86.98 pence from 86.93 pence

Brent North Sea Crude: DOWN 3.8 percent at $62.73 per barrel

West Texas Intermediate: DOWN 4.2 percent at $58.90 per barrel

© 2024 AFP