London (AFP) – Stock markets struggled for direction Wednesday as traders awaited key US inflation data, with the Federal Reserve expected to cut interest rates next week. Traders were also keeping tabs on China to see if it will announce further measures to support its struggling economy.

Seoul extended Tuesday’s rebound, though political uncertainty after South Korean President Yoon Suk Yeol’s brief imposition of martial law kept the won around two-year lows against the dollar. All three main Wall Street indexes ended in the red Tuesday, with analysts pointing to profit-taking from a string of records, and the focus now on the consumer price index release due later in the day.

“Today’s US CPI print for November is pivotal for markets,” said Kathleen Brooks, research director at trading group XTB. The reading is expected to show a slight pick-up in inflation, but there is still a strong expectation that the US central bank will cut rates for a third straight meeting next week. Brooks added that higher-than-expected inflation could lead to questions over future rate cuts, especially with the possibility that US president-elect Donald Trump’s planned policies could reignite inflation.

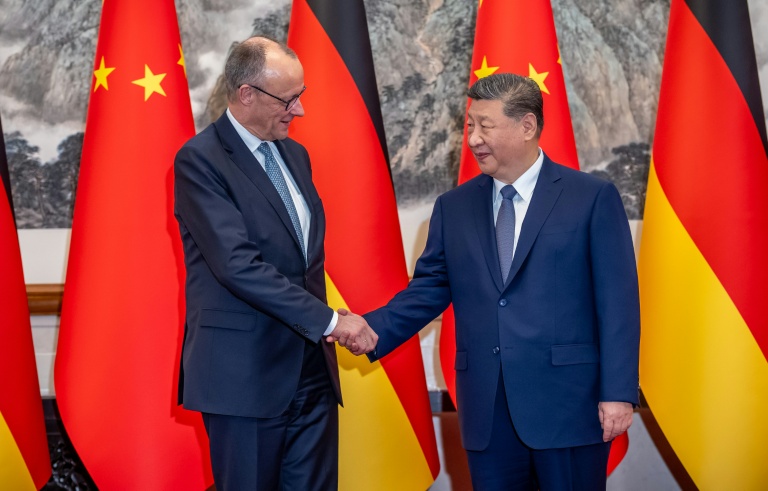

Beijing’s attempts to kickstart growth are also in view, with China’s leaders gathering for a conference aimed at hammering out next year’s agenda. President Xi Jinping and other top leaders on Monday announced their first major shift in policy for more than a decade, saying they would “implement a more active fiscal policy and an appropriately relaxed” strategy. The remarks sparked hopes for more interest rate cuts and the freeing up of more cash for lending. The announcement comes as officials prepare for a second term for Trump, who has indicated he will reignite his hardball trade policies, fuelling fears of another standoff between the superpowers.

Shares in Shanghai rose Wednesday, but Hong Kong gave up an early rally to end in the red. Paris and Frankfurt stocks edged up, awaiting Thursday’s expected rate cut from the European Central Bank as it seeks to help boost eurozone growth. Investors are also eyeing political developments in France, where officials said President Emmanuel Macron aims to name a new prime minister “within 48 hours” as he seeks to end political deadlock following the ouster of Michel Barnier.

In company news, shares in German retail giant Zalando shed around five percent on Frankfurt’s DAX index after it acquired domestic rival About You in a deal worth around 1.1 billion euros ($1.2 billion). Shares in Zara owner Inditex slid six percent after a record quarterly profit for the group fell short of market estimates.

Oil prices gained one percent on supply worries, as the US considers new sanctions against Russia, the world’s second-largest oil producer.

– Key figures around 1100 GMT –

– London – FTSE 100: UP 0.1 at 8,285.07 points

– Paris – CAC 40: UP 0.1 percent at 7,404.20

– Frankfurt – DAX: UP 0.1 percent at 20,347.47

– Tokyo – Nikkei 225: FLAT at 39,372.23 (close)

– Hong Kong – Hang Seng Index: DOWN 0.8 percent at 20,155.05 (close)

– Shanghai – Composite: UP 0.3 percent at 3,432.49 (close)

– Seoul – Kospi: UP 1.0 percent at 2,442.51 (close)

– New York – Dow: DOWN 0.4 percent at 44,247.83 (close)

– Euro/dollar: DOWN at $1.0497 from $1.0529 on Tuesday

– Pound/dollar: DOWN at $1.2724 from $1.2773

– Dollar/yen: UP at 152.63 yen from 151.92 yen

– Euro/pound: UP at 82.49 from 82.42 pence

– Brent North Sea Crude: UP 1.0 percent at $72.91 per barrel

– West Texas Intermediate: UP 1.1 percent at $69.31 per barrel

© 2024 AFP