Hong Kong (AFP) – Asian stocks resumed their losses Thursday after a sell-off on Wall Street in a sign that the volatility that has roiled markets this week still has some time to run as traders fret over the global economy. Data last Friday showing that fewer US jobs than expected were created in July continues to reverberate as it fanned fears that the world’s top economy was heading for recession.

While a soft labour market reading would usually have been taken as a positive, giving more ammunition for the Federal Reserve to cut interest rates, investors are beginning to fear it shows the central bank may have waited too long to move. Weak earnings from Disney, Airbnb, and TripAdvisor added to the sense of concern that American consumers were tightening their belts as the impact of elevated inflation and two-decade-high borrowing costs bite.

Fed boss Jerome Powell last week indicated that officials could cut at its September meeting, with 25 basis points seen as the likely move, but traders are now eyeing as many as 50 points, with another 50 possibly before the end of the year. However, the prospect of several reductions has been offset by a risk-off mood, which has been exacerbated by profit-taking in the tech sector, which has soared this year on the back of a rush for all things related to artificial intelligence.

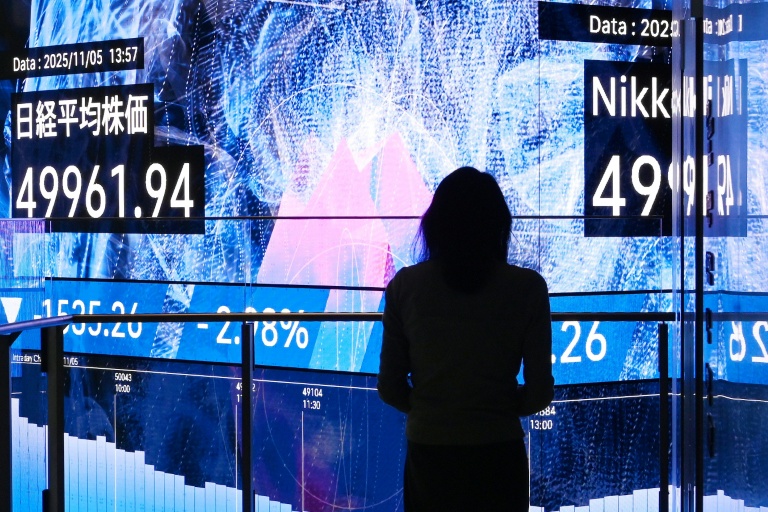

All three main indexes on Wall Street ended in the red, having given up big gains at the start of the day, with a poorly received US Treasury bond auction adding to the downbeat mood. And Asia followed suit, having bounced back over the previous two days from Monday’s collapse. Hong Kong, Shanghai, Seoul, Sydney, Singapore, Taipei, Wellington, Manila, and Jakarta were all sharply lower. However, Tokyo managed to eke out a gain heading into the break.

Analyst Stephen Innes warned the rollercoaster ride for markets might not yet be over. “The potential for a broader U.S. economic slowdown, misaligned global monetary policies, and the bubbling geopolitical tensions in the Middle East cast long, ominous shadows across financial markets,” he wrote in his Dark Side Of The Boom newsletter. “Furthermore, the US political election looms, potentially turning the markets into more of a chaotic mosh pit than a graceful waltz.”

The yen edged back up against the dollar after tumbling Wednesday in reaction to a dovish signal from the Bank of Japan that it will not further hike interest rates while markets remain volatile. The BoJ’s decision to hike rates last week, hours before the Fed hinted at its September cut, sent the Japanese unit surging, just weeks after it hit a nearly four-decade low. Analysts said the move had sparked a massive reversal of the “carry trade” in which traders took advantage of the weaker currency to buy higher-yielding assets such as equities.

– Key figures around 0230 GMT –

Tokyo – Nikkei 225: UP 0.2 percent at 35,148.10 (break)

Hong Kong – Hang Seng Index: DOWN 0.4 percent at 16,806.13

Shanghai – Composite: DOWN 0.4 percent at 2,858.26

Dollar/yen: DOWN at 146.27 yen from 146.83 yen on Wednesday

Euro/dollar: UP at $1.0927 from $1.0925

Pound/dollar: DOWN at $1.2683 from $1.2692

Euro/pound: UP at 86.15 pence from 86.06 pence

West Texas Intermediate: UP 0.3 percent at $75.42 per barrel

Brent North Sea Crude: UP 0.1 percent at $78.43 per barrel

New York – Dow: DOWN 0.6 percent at 38,763.45 (close)

London – FTSE 100: UP 1.8 percent at 8,166.88 (close)

© 2024 AFP