Hong Kong (AFP) – A sell-off in tech firms dragged Asian markets down Thursday after investors were left disappointed by earnings from chip titan Nvidia that stoked concerns about the outlook for all things artificial intelligence. While the report beat expectations in many areas, it took the wind out of the sails for traders, who had been enjoying a run-up on the prospect of US interest rates coming down from next month.

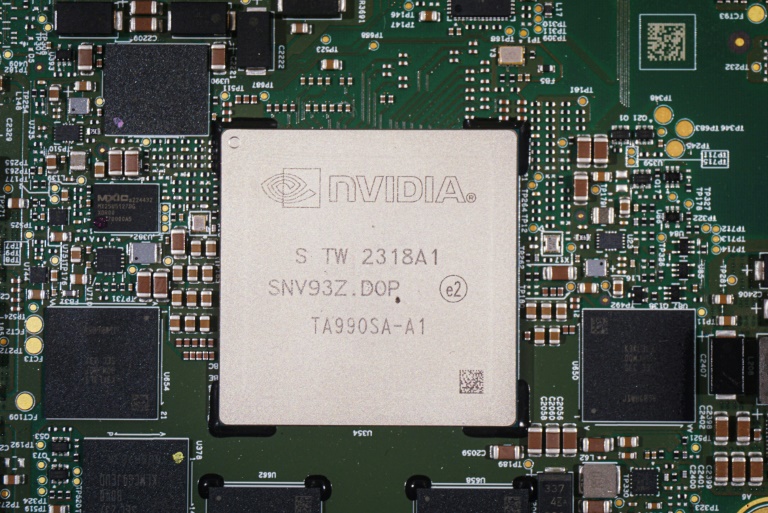

Investors had been keenly awaiting the release from California-based Nvidia, which has become a bellwether for the tech sector owing to its huge role in the development of AI chips. Analysts had warned ahead of the event that even a forecast-busting reading might not be enough to satisfy markets, which have grown used to outsized profits and revenues. Nvidia’s share price is up about 160 percent year-to-date and has accounted for a third of the broad-based S&P 500 index’s gains this year. The firm — now with a market capitalization of more than $3 trillion — said revenue and profits more than doubled in the fiscal second quarter, while it also announced an extra $50 billion in stock buybacks.

However, the growth in sales was slower than the furious pace seen in previous quarters. Dealers were also spooked by snags in the company’s new generation Blackwell line of technology, the successor to the best-selling Hopper line of AI chips that thrust the company onto the world stage. Nvidia’s share price fell more than eight percent in after-hours trading. All three main indexes on Wall Street fell ahead of the release, which came after the market closing bell.

In Asia, tech was among the worst performers, with chip-makers taking a hit. SK Hynix fell more than five percent in Seoul, where Samsung was also down more than three percent. Taipei-listed TSMC, a key producer of semiconductors, sank more than two percent and Tokyo Electron was down 1.8 percent in Tokyo. That weighed on broader markets, with Seoul, Shanghai, Sydney, Taipei, Manila, Bangkok, and Wellington all in the red. Tokyo was marginally lower, though Hong Kong, Singapore, Mumbai, and Jakarta edged up. London, Paris, and Frankfurt rose in the morning.

“As the bellwether for the tech industry, which now touches nearly every aspect of global business and our daily lives, Nvidia’s performance is scrutinised like a crystal ball for the broader market and the US economy,” said independent analyst Stephen Innes. “So when this flagship takes a hit, it has the potential to drag the entire fleet down with it.”

Nvidia continues its high-wire act, defying gravity for the seventh straight quarter by beating expectations on both the top and bottom lines. But in the topsy-turvy world of post-report trading, even a solid earnings beat wasn’t enough to keep investors smiling.

Attention now turns back to the US economy, with data this week and next possibly playing a role in how far the Federal Reserve goes in cutting interest rates. Boss Jerome Powell said Friday that they would have to start coming down as the jobs market softens and inflation eases, but he did not provide any guidance on how big an expected reduction in September will be. Readings on gross domestic product, jobless claims, and personal consumption expenditure — the Fed’s favoured gauge of inflation — are among this week’s readings, while the crucial non-farm payrolls report is due next Friday. Below-forecast results on these could firm up the case for a half-percentage-point cut, double what is expected at the moment.

– Key figures around 0810 GMT –

Tokyo – Nikkei 225: FLAT at 38,362.53 (close)

Hong Kong – Hang Seng Index: UP 0.5 percent at 17,786.32 (close)

Shanghai – Composite: DOWN 0.5 percent at 2,823.11 (close)

London – FTSE 100: UP 0.2 percent at 8,360.34

Dollar/yen: UP at 144.74 yen from 144.50 yen on Wednesday

Euro/dollar: UP at $1.1131 from $1.1119

Pound/dollar: UP at $1.3223 from $1.3194

Euro/pound: DOWN at 84.18 pence from 84.27 pence

West Texas Intermediate: UP 0.3 percent at $74.77 per barrel

Brent North Sea Crude: UP 0.2 percent at $78.83 per barrel

New York – Dow: DOWN 0.4 percent at 41,091.42 (close)

© 2024 AFP