London (AFP) – Global stock markets rose Thursday, with Tokyo breaking its record-high that had stood since 1989, as investors cheered bumper profits from US chip giant Nvidia, seen as the bellwether for artificial intelligence.

Highly-anticipated results from Nvidia after the Wall Street close Wednesday saw the company post quarterly profit of $12.3 billion on record revenue, driven by demand for its AI-powering chips.

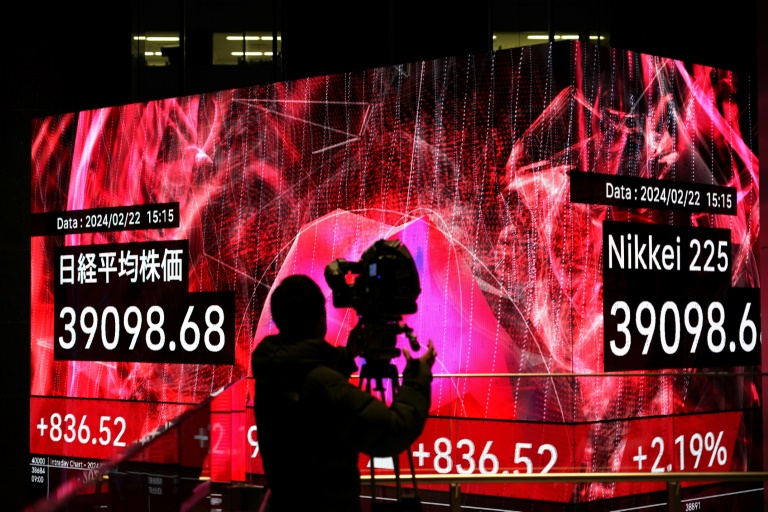

Japan’s Nikkei 225 jumped 2.2 percent to end at an all-time high of 39,098.68 points as tech shares rallied.

Eurozone indices also rallied Thursday awaiting European Central Bank minutes of its most recent meeting on interest rates.

Ahead of the release, a survey showed eurozone business activity fell for a ninth month running, but the rate of decline eased further.

Some economists said the data showed the 20-nation single currency area was moving slowly towards recovery, while others said the figures mean the ECB will not cut interest rates soon.

The HCOB Flash Eurozone purchasing managers’ index (PMI), published by S&P Global, recorded a figure of 48.9 in February from 47.9 in January. A figure below 50 indicates contraction, and this is the smallest rate of decline since June 2023.

Separate PMI data for Britain firmed belief that its economy could already be out of recession.

Official data earlier this month showed it had contracted in the second half of last year as high inflation weighed.

In the US, minutes Wednesday from the Federal Reserve’s most recent policy meeting showed officials were at odds on when to start cutting US interest rates as inflation comes down.

“Policymakers are concerned about the potential risks of cutting interest rates too soon,” noted Stephen Innes of SPI Asset Management.

– Key figures around 1130 GMT –

London – FTSE 100: UP 0.3 percent at 7,683.61 points

Paris – CAC 40: UP 1.0 percent at 7,890.38

Frankfurt – DAX: UP 1.4 percent at 17,358.78

EURO STOXX 50: UP 1.3 percent at 4,838.83

Tokyo – Nikkei 225: UP 2.2 percent at 39,098.68 (close)

Hong Kong – Hang Seng Index: UP 1.5 percent at 16,742.95 (close)

Shanghai – Composite: UP 1.3 percent at 2,988.36 (close)

New York – Dow: UP 0.1 percent at 38,612.24 points (close)

Euro/dollar: UP at $1.0851 from $1.0817 on Wednesday

Dollar/yen: DOWN at 150.23 yen from 150.24 yen

Pound/dollar: UP at $1.2672 from $1.2630

Euro/pound: DOWN at 85.62 pence from 85.67 pence

West Texas Intermediate: FLAT at $77.93 per barrel

Brent North Sea Crude: FLAT at $8303 per barrel

burs-bcp