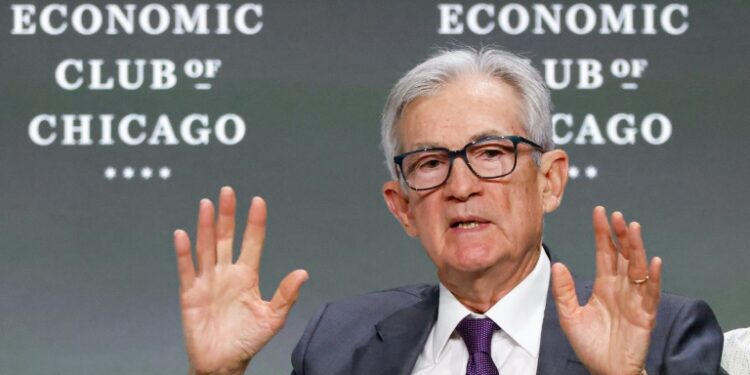

Washington (AFP) – US President Donald Trump on Thursday insisted that he could force out the head of the independent Federal Reserve, lashing out after Jerome Powell warned of tariffs-fueled inflation. Speaking to reporters at the White House, Trump said Powell would “leave if I ask him to.” He added: “I’m not happy with him. I let him know it and if I want him out, he’ll be out of there real fast, believe me.”

Earlier, in a scathing post on Truth Social, Trump repeated a demand for Powell to lower interest rates, saying his “termination…cannot come fast enough.” Sources also told the Wall Street Journal that Trump has privately discussed firing Powell for months but has not made a final decision, and raised it during private meetings at Mar-a-Lago with former Fed Governor Kevin Warsh. The US president does not have direct authority to fire Federal Reserve governors, but Trump could initiate a lengthy process to attempt to unseat Powell by proving there was “cause” to do so.

Powell warned Wednesday that Trump’s sweeping tariffs on virtually every trade partner could put the Fed in the unenviable position of having to choose between tackling inflation and unemployment. Trump’s stop-start tariff policy has unnerved investors and governments around the world, leaving them unsure about his long-term strategy and what it might mean for international trade. The US central bank has adopted a wait-and-see attitude to cutting rates, holding them steady at 4.25 to 4.5 percent since the start of this year.

Trump has frequently criticized the Fed chairman, whom he originally nominated during his first term, accusing Powell of playing politics. Trump’s earlier post suggested Powell’s decisions were “Too Late” and that he should have followed the European Central Bank’s lead, which on Thursday lowered its benchmark deposit rate by a quarter point. ECB chief Christine Lagarde expressed her confidence in Powell following Trump’s remarks, saying she had “a lot of respect for my friend and esteemed colleague.”

On the campaign trail in August, Trump suggested the White House should have a “say” in setting monetary policy. Democrats, however, have defended the independence of the institution. “An independent Fed is vital for a healthy economy — something that Trump has proved is not a priority for him,” senior Democratic Senator Chuck Schumer said on X in response to Trump’s criticism of Powell.

– Powell pledges to stay – While presidents have a long history of clashing with Fed chiefs, any move to force Powell to leave office would be unprecedented in modern US political history. Speaking on April 4, Powell insisted he had no plans to step down as Fed chairman before his term ends next year. “I fully intend to serve all of my term,” he said at an event in Virginia. At the time, Powell also suggested that the Fed was in no rush to cut its benchmark lending rate from its current elevated level.

Financial markets see a roughly two-thirds chance that policymakers will vote to keep rates unchanged again at the next Fed interest rate meeting in May, according to data from CME Group. Setting key interest rates is one of the primary levers the Fed exercises in its dual mandate of managing inflation and unemployment. Lowering interest rates serves to make borrowing cheaper and tends to kickstart the economy by encouraging investment, while raising them — or keeping them steady at higher rates — can help cool inflation. US year-on-year consumer inflation slowed to 2.4 percent in March, bringing it closer to the Fed’s long-term two-percent target. That drop was aided by a 6.3 percent fall in gasoline prices, according to official data.

© 2024 AFP