Washington (AFP) – The US Federal Reserve shrugged off concerns about the impact of Donald Trump’s election victory on interest rates and moved ahead with a quarter point cut on Thursday, looking to continue easing borrowing costs on the back of cooling inflation. The Fed sits just a short walk from the White House, where Democratic President Joe Biden will in January hand back the keys to Donald Trump following the Republican’s election win.

But as expected, Fed policymakers ignored the political drama playing out up the road, voting unanimously to reduce interest rates by 25 basis points to between 4.50 percent and 4.75 percent. The decision should help ease the costs of mortgages and other loans — welcome news for consumers, who had widely cited the cost of living as a top concern ahead of Tuesday’s vote.

However, the cost of borrowing will also depend on what the financial markets think a Trump victory means for the economy over the longer term, and where the Fed’s interest rates will need to settle to ensure inflation remains low. “Labor market conditions have generally eased” since earlier in the year, the Fed said in a statement, noting ongoing progress to bring inflation down toward the bank’s long-term target of two percent.

Trump’s victory came, at least in part, because of his ability to blame Biden’s administration for a post-pandemic surge in inflation which pushed up consumer prices by more than 20 percent. Thursday’s cut builds on the Fed’s action in September, when it kicked off its easing cycle with a large cut of half a percentage point, and penciled in additional rate reductions this year. The Fed’s favored inflation gauge has since eased to 2.1 percent in September, while economic growth has remained robust.

The labor market has also stayed strong overall, despite a sharp hiring slowdown last month attributed in large part to adverse weather conditions and a labor strike. “Generally speaking, the US economy looks quite resilient, and the labor market still looks very good,” Jim Bullard, the long-serving former St Louis Fed president, told AFP ahead of Election Day. Bullard, now dean of the Daniels School of Business at Purdue University, predicted a 25 basis point cut this week, and another cut of a similar size in December.

Futures traders place a probability of just over 65 percent that the Fed will cut by a quarter of a percentage-point next month, according to data from CME Group. But analysts remain split over what the Fed will do next month.

With a Trump victory assured, a lot still depends on whether Republicans can win the House of Representatives, as they appear on track to do — giving them a “Red Sweep” of both houses of Congress along with the White House. “Markets tend to like divided government as a way to control spending and keep deficits down,” said Bullard.

“What’s distressing to an economist like me is that, really, fiscal discipline has broken down for both political parties,” he said. The bond markets reacted sharply to Trump’s victory, with the yield on the widely traded 10-year US Treasury note jumping as traders predicted the Fed might need to keep rates higher for longer to accommodate some of the former president’s policy proposals.

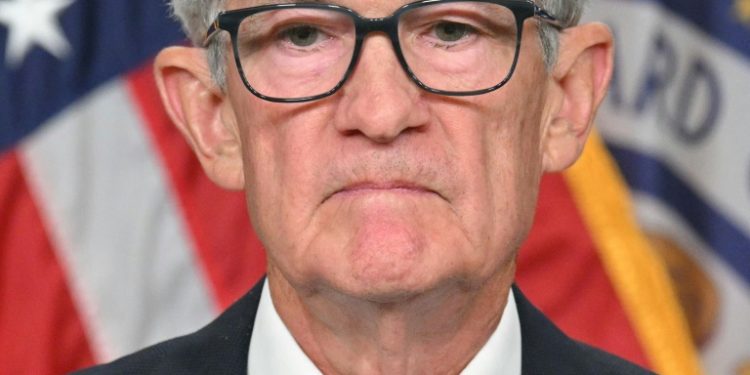

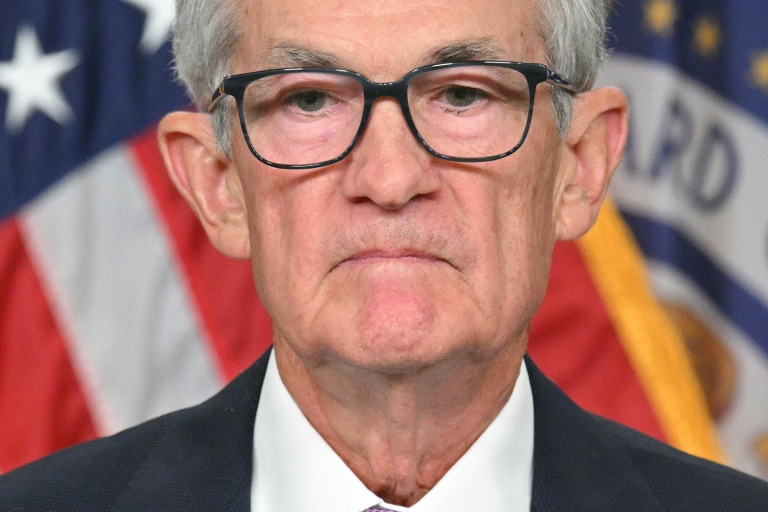

Fed Chair Jerome Powell is expected to be quizzed by reporters about the economic impact of Trump’s victory later Thursday. Trump has repeatedly accused Powell — whom he first appointed to run the US central bank — of working to favor the Democrats and has suggested he would look to replace him once his term expires in 2026. The president-elect has also said he would like “at least” a say over setting the Fed’s interest rate — something that runs against the Fed’s current mandate to act independently of Congress and the White House to tackle inflation and unemployment.

© 2024 AFP