Washington (AFP) – The US central bank is expected to keep interest rates unchanged for a fourth straight policy meeting this week, despite President Donald Trump’s push for rate cuts, as officials contend with uncertainty sparked by the Republican’s tariffs. While the independent Federal Reserve has started lowering rates from recent highs, officials have held the level steady this year as Trump’s tariffs began rippling through the world’s biggest economy. The Fed has kept interest rates between 4.25 percent and 4.50 percent since December, while it monitors the health of the jobs market and inflation.

“The hope is to stay below the radar screen at this meeting,” KPMG chief economist Diane Swonk told AFP. “Uncertainty is still very high.” “Until they know sufficiently, and convincingly that inflation is not going to pick up” either in response to tariffs or related threats, “they just can’t move,” she said.

Since returning to the presidency, Trump has slapped a 10 percent tariff on most US trading partners. Higher rates on dozens of economies are due to take effect in July, unless an existing pause is extended. Trump has also engaged in a tit-for-tat tariff war with China and imposed levies on imports of steel, aluminum, and automobiles, rattling financial markets and tanking consumer sentiment. But economists expect it will take three to four months for tariff effects to show up in consumer prices.

Although hiring has cooled slightly and there was some shrinking of the labor force according to government data, the unemployment rate has stayed unchanged. Inflation has been muted too, even as analysts noted signs of smaller business margins — meaning companies are bearing the brunt of tariffs for now. At the end of the Fed’s two-day meeting Wednesday, analysts will be parsing through its economic projections for changes to growth and unemployment expectations — and for signs of the number of rate cuts to come.

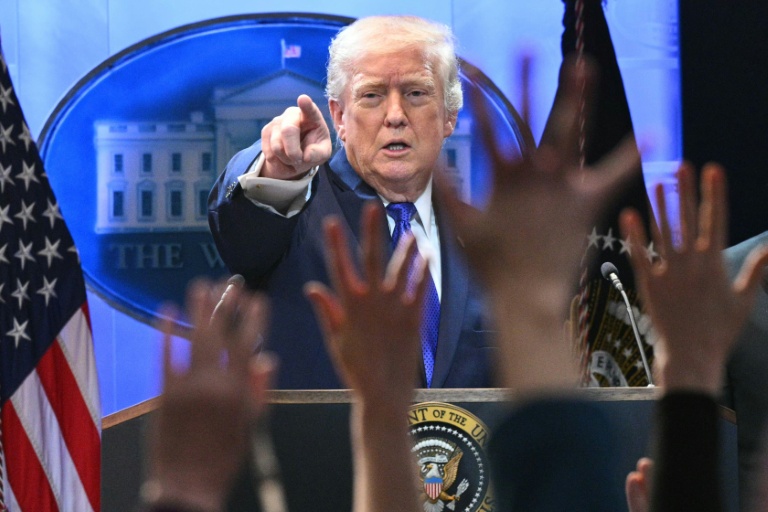

The Fed faces growing pressure from Trump — citing benign inflation data — to lower rates more quickly, a move the president argues will help the country “pay much less interest on debt coming due.” On Wednesday, Trump urged Fed Chair Jerome Powell to slash interest rates by a full percentage point, and on Thursday, he called Powell a “numbskull” for not doing so. He said Powell could raise rates again if inflation picked up then. But Powell has defended US central bank independence over interest rates when engaging with Trump.

– ‘Cautious patience’ – For their part, Fed policymakers have signaled “little urgency” to adjust rates, said EY chief economist Gregory Daco. He believes they are unwilling to get ahead of the net effects from Trump’s trade, tax, immigration, and regulation policy changes. Powell “will likely strike a tone of cautious patience, reiterating that policy remains data dependent,” Daco said.

While economists have warned that Trump’s tariffs would fuel inflation and weigh on economic growth, supporters of Trump’s policies argue the president’s plans for tax cuts next year will boost the economy. On the Fed’s path ahead, HSBC Global Research said: “Weak labor market data could lead to larger cuts, while elevated inflation would tend to imply the opposite.” For now, analysts expect the central bank to slash rates two more times this year, beginning in September.

The Fed is likely to be eyeing data over the summer for inflationary pressures from tariffs, said Ryan Sweet, chief US economist at Oxford Economics. “They want to make sure that they’re reading the tea leaves correctly,” he said. Swonk warned the US economy is in a different place than during the Covid-19 pandemic, which could change how consumers react to price increases. During the pandemic, government stimulus payments helped households cushion the blow from higher costs, allowing them to keep spending.

It is unclear if consumers, a key driver of the economy, will keep their dollars flowing this time, meaning demand could collapse and complicate the Fed’s calculus. “If this had been a world without tariffs, the Fed would be cutting right now. There’s no question,” Swonk said.

© 2024 AFP