London (AFP) – European and US stock markets dipped on Tuesday, as traders sought to ascertain the outlook for US interest rates ahead of the presidential election. Investors also focused on company earnings, as gold and oil prices continued to rise on the back of Middle East tensions. The dollar edged higher against main rivals.

“A mix of continuing unrest in the Middle East and uncertainty over the US election casts a cautious shadow over markets,” noted Derren Nathan, head of equity research at Hargreaves Lansdown. Concerns over the outcome of the US election on November 5 have weighed on investor sentiment, with recent polls and forecasts indicating that Donald Trump has “gained ground” on Kamala Harris, Deutsche Bank economists noted.

Expectations of another bumper US interest-rate cut from the Federal Reserve have been tempered slightly following a recent run of strong American data on jobs creation and as some top decision-makers suggested they would like to see a slower pace of rate cuts. Tech titans Alphabet and IBM announce their latest results over the next two days, while earnings from Boeing, Coca-Cola, and L’Oreal are also in the pipeline.

General Motors raised some of its full-year profit projections Tuesday following solid earnings as strong vehicle pricing compensated for lower auto sales. 3M, GE Aerospace, Lockheed Martin, and Verizon also beat expectations. Briefing.com analyst Patrick O’Hare said there is a bit of debate on why equities have retreated despite the generally good corporate earnings reports. One is that a rise in market interest rates has created concerns that equities are trading at levels too high compared to their earnings. “The other possibility is that stocks hit some speed bumps yesterday because the market had gone up six straight weeks and was due for a pullback,” he said.

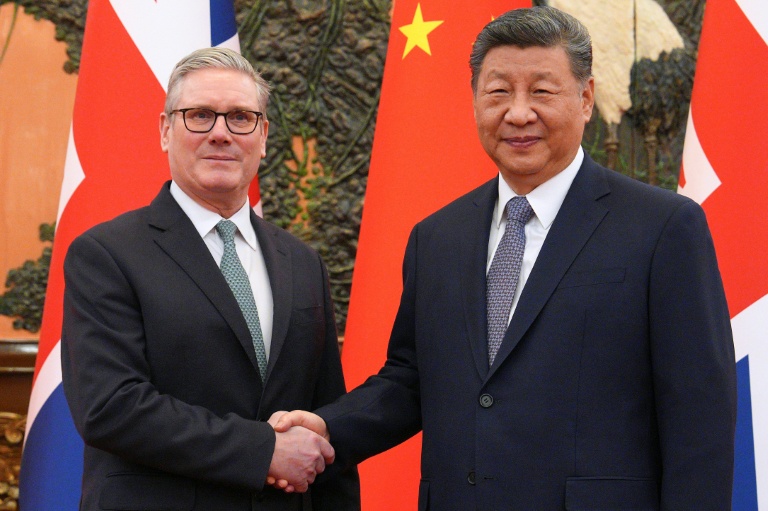

Wall Street’s main indices were down slightly in late morning trade. In Europe, London stocks dipped following data that showed UK public borrowing rose more than expected in September, as the new Labour government prepares for its first budget next week that is expected to include tax rises. Frankfurt also edged lower but was bolstered by strong third-quarter earnings for German software giant SAP, whose shares were up nearly four percent in early afternoon deals. Paris ended the day flat.

In Asia, both Shanghai and Hong Kong rose on hopes of more Chinese stimulus. Tokyo closed down more than one percent, even as the yen softened against the dollar to sit at its weakest level since early August. Gold hit a fresh record high of $2,744 per ounce as traders sought out the haven investment as Israel continues to consider its response to Iran’s missile barrage this month. Uncertainty over the US presidential election has also helped fuel the precious metal’s rally, according to analysts who added that concerns about a possible wider conflict in the Middle East were lifting oil prices.

– Key figures around 1540 GMT –

New York – Dow: DOWN 0.2 percent at 42,861.58 points

New York – S&P 500: DOWN 0.2 percent at 5,839.65

New York – Nasdaq Composite: DOWN 0.1 percent at 18,518.11

London – FTSE 100: DOWN 0.1 percent at 8,306.54 (close)

Paris – CAC 40: FLAT at 7,535.10 (close)

Frankfurt – DAX: DOWN 0.2 percent at 19,421.91 (close)

Tokyo – Nikkei 225: DOWN 1.4 percent at 38,411.96 (close)

Hong Kong – Hang Seng Index: UP 0.1 percent at 20,498.95 (close)

Shanghai – Composite: UP 0.5 percent at 3,285.87 (close)

Euro/dollar: DOWN at $1.0815 from $1.0818 on Monday

Pound/dollar: DOWN at $1.2981 from $1.2982

Dollar/yen: UP at 150.98 yen from 150.82 yen

Euro/pound: UP at 83.31 pence from 83.30 pence

Brent North Sea Crude: UP 2.0 percent at $75.74 per barrel

West Texas Intermediate: UP 2.1 percent at $71.54 per barrel

burs-rl/gv

© 2024 AFP