New York (AFP) – Wall Street stocks finished at fresh records again Thursday as a US government shutdown dragged into a second day. President Donald Trump signaled he plans mass layoffs of US federal workers amid the stalemate in budget talks. A Senate vote is expected Friday on a House-passed resolution to keep the government funded at current levels through November 21.

Following an up day on leading bourses in Europe and Asia, US stocks dipped into negative territory during the session, but all three major US indices finished at records after ending the day in positive territory. Both the Dow and S&P 500 also finished at records on Wednesday, due in part to expectations the Federal Reserve will cut interest rates later this month. “Investors don’t really expect a shutdown to be concluded anytime soon, and as a result, the Fed will likely have to go to the more cautious approach, which means cut rates in October,” said Sam Stovall of CFRA Research.

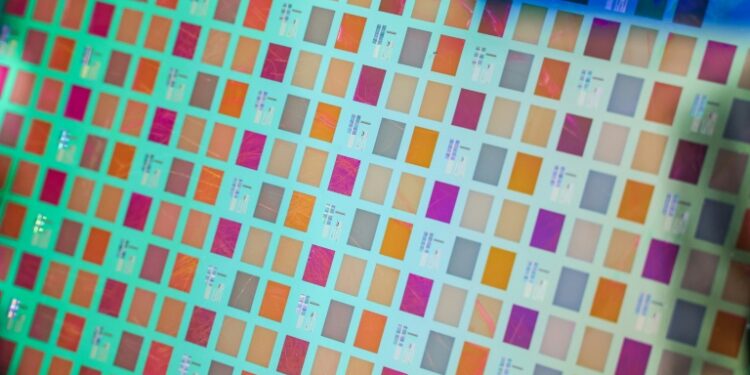

The shutdown is expected to delay the release of the September US jobs report, which was scheduled for Friday. Earlier, the trading day started off positively in Asia, with tech stocks surging as South Korea’s biggest chip firms agreed to supply chips and other equipment to OpenAI’s Stargate project for AI infrastructure.

South Korea’s Kospi index climbed 2.7 percent to a record high, thanks to Samsung and SK hynix shares soaring to one-year highs after the firms signed a preliminary deal with the ChatGPT developer OpenAI. Tokyo rose, as did Hong Kong’s tech-heavy Hang Seng index. Shanghai was closed for a week-long holiday. The positive trend continued into European trading, with Europe’s tech companies also rising. Shares in ASML gained 4.5 percent, and STMicroelectronics and Schneider Electric adding more than two percent.

Both Paris and Frankfurt stock markets finished the day up more than one percent, with automakers also rallying, while London dipped. Among individual companies, Tesla fell 5.1 percent despite reporting a seven percent jump in third-quarter auto deliveries, snapping a series of declines in recent quarters. Analysts attributed the uptick in sales to the September 30 expiration of a US electric vehicle tax credit, adding that they expect Tesla to struggle to maintain the sales momentum.

Berkshire Hathaway fell 0.5 percent after announcing it will acquire Occidental’s chemical business, OxyChem, in an all-cash transaction for $9.7 billion. Occidental dropped 7.3 percent.

– Key figures at around 2010 GMT –

New York – Dow: UP 0.2 percent at 46,519.72 points (close)

New York – S&P 500: UP less than 0.1 percent at 6,715.35 (close)

New York – Nasdaq Composite: UP 0.4 percent at 22,844.05 (close)

London – FTSE 100: DOWN 0.2 percent at 9,427.73 (close)

Paris – CAC 40: UP 1.1 percent at 8,056.63 (close)

Frankfurt – DAX: UP 1.3 percent at 24,422.56 (close)

Tokyo – Nikkei 225: UP 0.9 percent at 44,936.73 (close)

Hong Kong – Hang Seng Index: UP 1.6 percent at 27,287.12 (close)

Shanghai – Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1720 from $1.1732 on Wednesday

Pound/dollar: DOWN at $1.3446 from $1.3478

Dollar/yen: UP at 147.19 yen from 147.07 yen

Euro/pound: UP at 87.17 pence from 87.04 pence

West Texas Intermediate: DOWN 2.1 percent at $60.48 per barrel

Brent North Sea Crude: DOWN 1.9 percent at $64.11 per barrel

burs-jmb/jgc

© 2024 AFP