New York (AFP) – Wall Street stocks finished lower Wednesday after a rally that lifted European and Asian bourses petered out amid lingering unease following recent turbulence. Major US indices began the session solidly higher following a trend in Paris, Frankfurt, Tokyo, and other exchanges as the Bank of Japan issued a dovish signal it will not further hike interest rates amidst market volatility.

But the S&P 500 and other major US indices tumbled into the red after midday, with analysts pointing to a poorly received US Treasury bond auction as a catalyst for further selling after Monday’s rout. “This is what happens when you have a big risk-off type of event,” Steve Sosnick of Interactive Brokers said of Monday’s equity market plunge. “It’s normal to see the market display uncertainty.” Major Wall Street indices sank more than 2.5 percent on Monday amid worries over a potential US recession and the unwinding of the so-called “carry trade” that took advantage of the weak yen prior to last week’s interest rate hike by the Bank of Japan.

Stocks rebounded somewhat on Tuesday, but many analysts expect more effects from the unwinding, extending a period of volatility. “This volatility is typical of more prolonged and chaotic market downturns, which could prompt investors to adopt a cautious stance, hold on tight, and keep the antacids ready,” said independent analyst Stephen Innes. BoJ deputy governor Shinichi Uchida earlier Wednesday sought to allay fears of further interest rate hikes, indicating that the central bank would not raise them further during a period of high market volatility. This dovish signal on rates sparked a nearly two percent drop in the yen, while the Tokyo stock market closed up 1.2 percent.

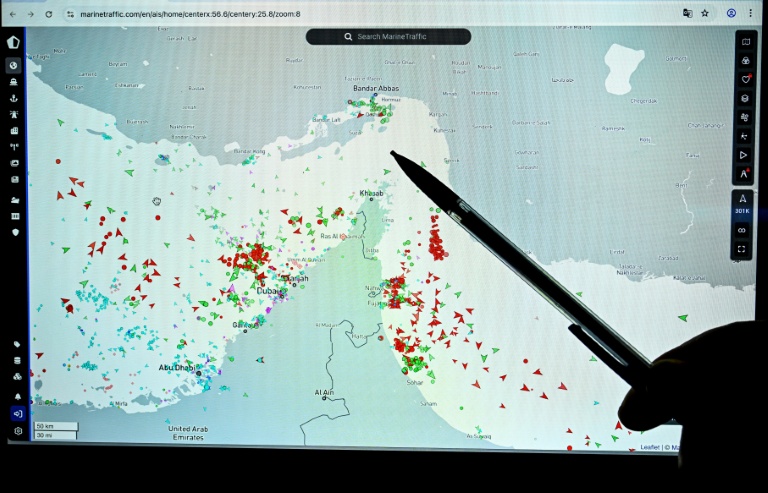

The retreat in the yen “should take some pressure off those still exposed to the yen carry-trade, of which there are still significant numbers,” said Trade Nation analyst David Morrison. Elsewhere, oil prices climbed more than two percent on Middle East tensions, supply constraints in Libya, and weekly data pointing to a drop in US crude inventories. Among individual companies, Disney fell 4.5 percent despite reporting better than expected earnings as investors digested commentary that a weakening of demand in the parks business “could impact the next few quarters.” Airbnb slumped 13.4 percent after reporting lower than expected profits and cautioning of “some signs of slowing demand from US guests.”

– Key figures around 2030 GMT –

New York – Dow: DOWN 0.6 percent at 38,763.45 (close)

New York – S&P 500: DOWN 0.8 percent at 5,199.50 (close)

New York – Nasdaq Composite: DOWN 1.1 percent at 16,195.81 (close)

London – FTSE 100: UP 1.8 percent at 8,166.88 (close)

Paris – CAC 40: UP 1.9 percent at 7,266.01 (close)

Frankfurt – DAX: UP 1.5 percent at 17,615.15 (close)

EURO STOXX 50: UP 2.0 percent at 4,668.88 (close)

Tokyo – Nikkei 225: UP 1.2 percent at 35,089.62 (close)

Hong Kong – Hang Seng Index: UP 1.4 percent at 16,877.86 (close)

Shanghai – Composite: UP 0.1 percent at 2,869.83 (close)

Dollar/yen: UP at 146.83 yen from 144.34 yen on Tuesday

Euro/dollar: DOWN at $1.0925 from $1.0931

Pound/dollar: UP at $1.2692 from $1.2691

Euro/pound: DOWN at 86.06 pence from 86.13 pence

Brent North Sea Crude: UP 2.4 percent at $78.33 per barrel

West Texas Intermediate: UP 2.8 percent at $75.23 per barrel

burs-jmb/des

© 2024 AFP