New York (AFP) – Wall Street stocks rallied to fresh records Monday behind enthusiasm over artificial intelligence, while European markets bounced despite political uncertainty in France.

Both the tech-rich Nasdaq and the broad-based S&P 500 pushed to all-time closing highs.

“It’s not a broad rally but it’s a rally with the index up for sure,” said Art Hogan of B. Riley Wealth Management, who pointed to the recent share price gains of Apple, Microsoft and Nvidia as a source of momentum.

Hogan also noted that the outlook for US monetary policy had improved somewhat following last week’s US inflation data, which kept alive the chance of interest rate cuts in 2024.

Bourses in Paris and Frankfurt also climbed despite angst following President Emmanuel Macron’s move last week to call an early general election after his party lost out to the far-right National Rally (RN) in EU parliament elections a week ago.

“European markets have risen off the lows of last week but there’s little enthusiasm among investors for the region given the prevailing political uncertainty,” said Chris Beauchamp, chief market analyst at online trading platform IG.

The move has fanned fears about instability in Europe’s second-biggest economy, and observers said France could be on course for a standoff with the EU if extremists win.

“Uncertainty over the extent to which the far right RN party will have effective control of the next French parliament after July 7 will be an ongoing source of market angst,” said Ray Attrill of National Australia Bank.

Worries about the election hammered Paris’s CAC 40 index last week, pushing it down six percent. It closed up 0.9 percent higher on Monday.

The head of the European Central Bank, Christine Lagarde, said Monday in response to questions on the negative market fallout from the early French election, that the ECB was “attentive to the proper functioning of financial markets.” Lagarde stressed her aim to see inflation brought back down to the ECB’s two percent target, as “price stability is of course understood in parallel with financial stability.”

Across the Channel, London stocks ended the day down less than 0.1 percent. The Bank of England is expected to sit tight on interest rates on Thursday, as is customary ahead of UK elections. Britons vote for a new government on July 4, with the cost-of-living crisis one of the major factors fueling a likely defeat for the ruling Conservatives.

In Asia, Tokyo closed down nearly two percent as investors took a risk-averse stance and fresh data fueled worries about the US economy. “Investors are conscious of slowdown concerns surrounding the US economy” following data last week showing a fall in consumer sentiment, noted IwaiCosmo Securities.

– Key figures around 2040 GMT –

New York – Dow Jones: UP 0.5 percent at 38,778.10 (close)

New York – S&P 500: UP 0.8 percent at 5,473.23 (close)

New York – Nasdaq: UP 1.0 percent at 17,902.25 (close)

Paris – CAC 40: UP 0.9 percent at 7,571.57 (close)

Frankfurt – DAX: UP 0.4 percent at 18,068.21 (close)

EURO STOXX 50: UP 0.9 percent at 4,880.42 (close)

London – FTSE 100: DOWN 0.1 percent at 8,142.15 (close)

Tokyo – Nikkei 225: DOWN 1.8 percent at 38,102.44 (close)

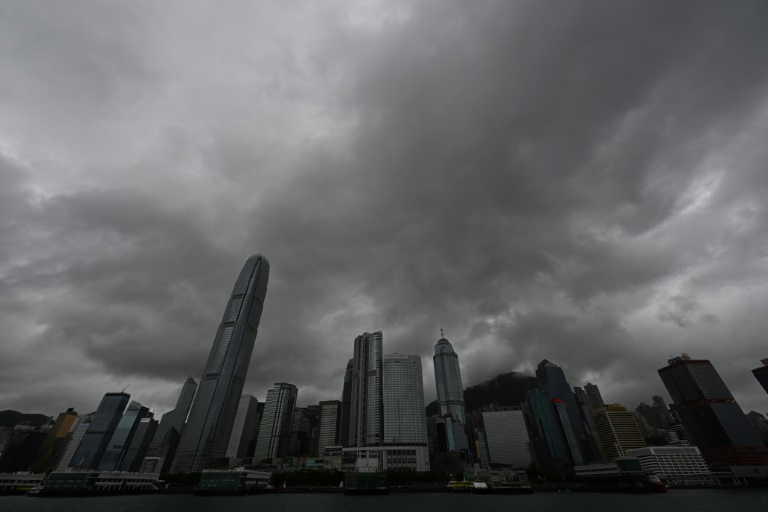

Hong Kong – Hang Seng Index: FLAT at 17,936.12

Shanghai – Composite: DOWN 0.6 percent at 3,015.89 (close)

Euro/dollar: UP at $1.0738 from $1.0703 on Friday

Euro/pound: UP at 84.49 pence from 84.36 pence

Dollar/yen: UP at 157.72 yen from 157.40 yen

Pound/dollar: UP at $1.2706 from $1.2687

West Texas Intermediate: UP 2.3 percent at $80.33 per barrel

Brent North Sea Crude: UP 2.0 percent at $84.25 per barrel

burs-jmb/bjt

© 2024 AFP