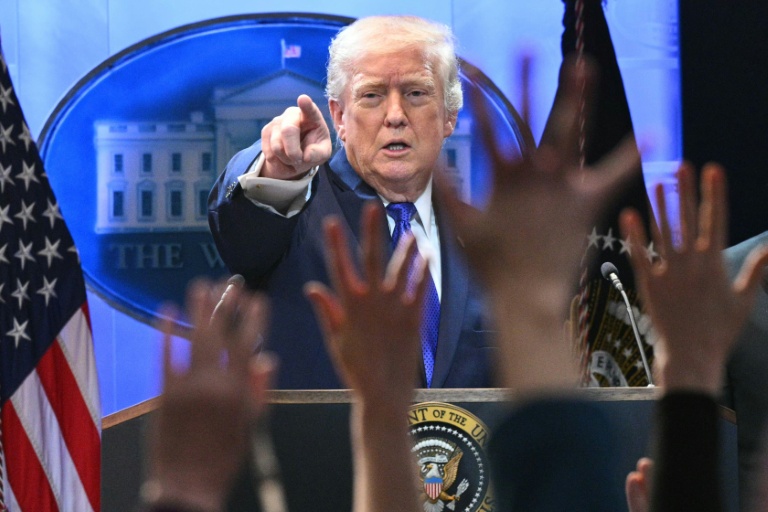

London (AFP) – US stock markets edged lower and gold retreated from a record high on Tuesday as traders steeled themselves for a possible US government shutdown. A White House meeting Monday with congressional leaders ended without a breakthrough, raising the odds of a shutdown starting at midnight on Tuesday, Washington time (0400 GMT Wednesday).

While shutdowns are not usually painful in investor terms, markets remained cautious, analysts said. “Usually, markets ignore shutdowns — most last only a few days and investors seem to take a long-term view of the situation, and the short duration of most incidents has little impact on company profits,” said Neil Wilson, investor strategist at Saxo. However, Wilson warned: “It could be different this time. Deep political divisions could see this drag on. A longer shutdown could have serious consequences for stocks.” He pointed to the White House threatening mass firings while recent changes to economic policy added to uncertainty and raised the prospect of a potential recession.

Gold, a safe haven investment in times of uncertainty, reached yet another peak above $3,871 an ounce before falling later in the day. Speculation is growing that it could soon hit $4,000, having piled on almost 50 percent since the turn of the year. “The longer-term case is still supportive of further increases in the gold price,” said Kathleen Brooks, research director at XTB trading platform. “Dollar weakness, rising inflation expectations and the prospect of Fed rate cuts are all driving this gold rally.”

There are concerns that a shutdown could delay this week’s release of government statistics on the labour market, including non-farm payrolls, which could provide clues about the Federal Reserve’s next move on interest rates. Recent indicators have supported investor expectations that the US central bank will cut borrowing costs twice more this year after reducing them this month as the labour market softens. “A delay to the release of the Non-Farm Payrolls report this week could trigger some volatility as this report was considered the last piece of the puzzle before the October Fed rate cut,” Brooks said. “However,” she added, “we do not think that it will derail a rate cut next month.”

Oil prices dropped further on fears of a glut amid talk of OPEC+ hiking output again when officials meet on Sunday. Trump’s Gaza peace plan was also weighing on prices, analysts said. Europe’s leading indices rose. European Central Bank chief Christine Lagarde said Tuesday US tariffs had not hit the eurozone as badly as feared, but warned: “New trade and geopolitical shocks will remain a constant feature of our environment.”

Key figures at around 1530 GMT:

New York – Dow: DOWN 0.4 percent at 46,138.55 points

New York – S&P 500: DOWN 0.3 percent at 6,664.63

New York – Nasdaq: DOWN 0.3 percent at 22,520.21

London – FTSE 100: UP 0.5 percent at 9,350.43 (close)

Paris – CAC 40: UP 0.2 percent at 7,895.94 (close)

Frankfurt – DAX: UP 0.6 percent at 23,880.72 (close)

Tokyo – Nikkei 225: DOWN 0.3 percent at 44,932.63 (close)

Hong Kong – Hang Seng Index: UP 0.9 percent at 26,855.56 (close)

Shanghai – Composite: UP 0.5 percent at 3,882.78 (close)

Euro/dollar: UP at $1.1730 from $1.1725 on Monday

Pound/dollar: UP at $1.3445 from $1.3434

Dollar/yen: DOWN at 147.97 yen from 148.68 yen

Euro/pound: DOWN at 87.24 pence from 87.28 pence

Brent North Sea Crude: DOWN 1.6 percent at $66.01 per barrel

West Texas Intermediate: DOWN 1.6 percent at $62.43 per barrel

© 2024 AFP