London (AFP) – The Bank of England on Thursday held its key interest rate at a 16-year high, opting against a reduction as inflation remains elevated despite recent slowdowns.

But BoE governor Andrew Bailey signalled a rate-reduction later this year as inflationary pressures ease further.

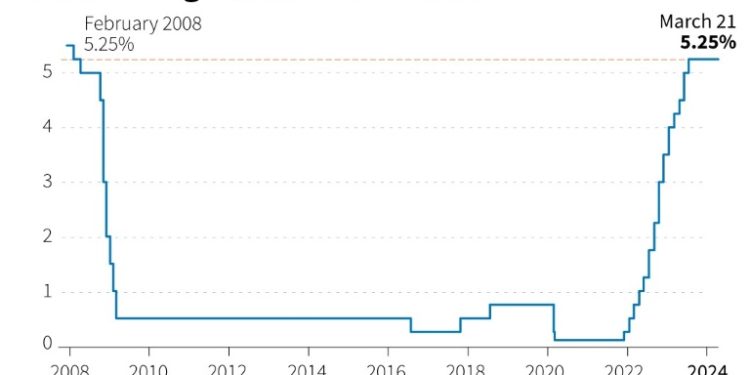

The British central bank kept its key rate steady at 5.25 percent, mirroring a similar decision by the US Federal Reserve on Wednesday.

The BoE rate call came one day after official data showed that UK annual inflation slowed more than expected, fuelling speculation that it would start cutting borrowing costs in the summer.

Inflation hit a near-2.5-year low of 3.4 percent in February.

That marked a slowdown from 4.0 percent in January and beat economists’ expectations of 3.5 percent, but it remains stubbornly above the BoE’s official two-percent target level.

“In recent weeks we’ve seen further encouraging signs that inflation is coming down,” Bailey said in remarks published alongside the decision.

“We’ve held rates again today at 5.25 percent because we need to be sure that inflation will fall back to our 2.0-percent target and stay there.

“We’re not yet at the point where we can cut interest rates, but things are moving in the right direction.”

At 5.25 percent, the key interest rate is the highest level since February 2008, hurting borrowers but boosting savers.

February’s inflation slowdown and the prospect of rate cuts may give a boost to embattled British Prime Minister Rishi Sunak and his Conservative party as they face the prospect of losing a general election this year amid a cost-of-living crisis.

High interest rates have worsened the squeeze for individuals and businesses alike, as commercial lenders put up their own interest rates on loans including mortgages.

Britain meanwhile slipped into a technical recession in the second half of last year but eked out slender growth in January.

Added to the mix, UK government borrowing overshot forecasts in February, separate official data showed Thursday.

Sunak’s administration earlier this month announced a tax cut for millions of workers as it tries to win around voters.

However, a new opinion poll on Thursday showed that support for Britain’s ruling Conservatives has plunged to a level last seen during former leader Liz Truss’s brief premiership.

The poll of more than 2,000 adults, conducted by YouGov this week, has Sunak’s Tories on just 19 percent, far behind the main opposition Labour Party on 44 percent.

“Downing Street will be hoping for rate cuts sooner rather than later,” noted Laith Khalaf, head of investment analysis at stockbroker AJ Bell.

“Whether lower mortgage rates will shift the electoral calculus is questionable, but they can’t hurt.”

© 2024 AFP