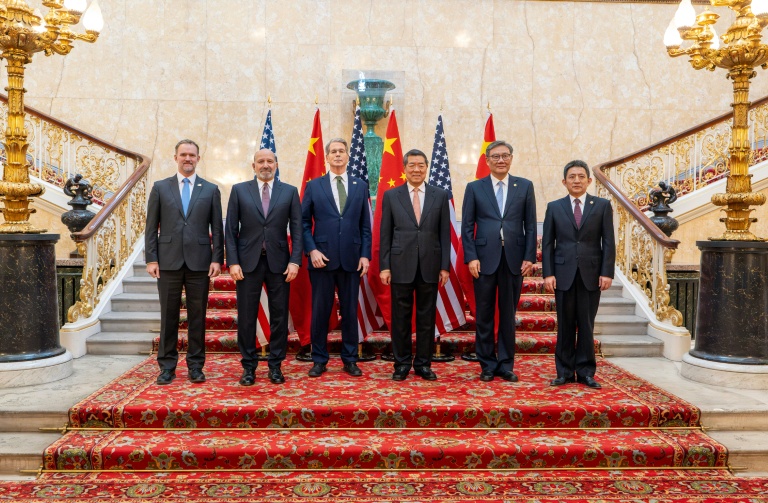

New York (AFP) – Global stock markets moved indecisively Tuesday as investors waited for the outcome of US-China talks aimed at cementing a fragile trade war truce between the world’s two biggest economies. A second day of high-level talks in London between the United States and China stretched into the evening Tuesday with no concrete announcements so far. US equities finished higher following a choppy session, while European ones closed in mixed territory, and Asia mostly closed down.

US Commerce Secretary Howard Lutnick told Bloomberg Television that the talks were “going well” and that he expected Tuesday’s discussions to last “all day.” But FHN Financial’s Chris Low said Lutnick’s upbeat appraisal was offset by “a TikTok channel associated with Chinese television suggesting that there are still some significant differences between the two sides.” Analysts said that any positive sign of agreement would fuel a rise in equities — but that it could be restrained.

“We wouldn’t bank on a big turnaround thanks to any potential trade breakthroughs,” said Thomas Mathews, head analyst of Asia Pacific markets for Capital Economics. “We doubt that the US will back off completely. That’s likely to restrain any relief rally,” he said. The talks were expected to be dominated by Chinese exports of rare earth minerals used in a wide range of products including smartphones, electric vehicle batteries, and green technology. Beijing, in return, was looking for Washington to ease controls on its exports of sensitive electronic components.

In Europe, Paris’s CAC 40 closed slightly up but Frankfurt’s DAX slipped well down. London’s FTSE 100 index closed higher after weak UK unemployment data raised the chances of the Bank of England cutting interest rates into next year, a move that often propels stock prices. It could reach a new record this week if it continues to gain. Shares in European Union markets, in contrast, could be weakened by the conspicuous lack of any deal between Washington and Brussels before a July 9 deadline for 50 percent US tariffs to take effect. Britain has already sealed an agreement.

Investors are also awaiting key US inflation data this week, which could impact the Federal Reserve’s monetary policy. Analysts warn Trump’s tariffs will refuel inflation, strengthening the argument to keep interest rates on hold instead of lowering them when the Fed meets next week. Citing trade tensions and the resulting policy uncertainty, the World Bank lowered its 2025 projection for global GDP growth to 2.3 percent in its latest economic prospects report, down from 2.7 percent expected in January. The US economy is expected to grow by 1.4 percent this year, a sharp slowdown for the world’s biggest economy from a 2.8 percent expansion in 2024.

– Key figures at around 2030 GMT –

New York – Dow: UP 0.3 percent at 42,866.87 (close)

New York – S&P 500: UP 0.6 percent at 6,038.81 (close)

New York – Nasdaq Composite: UP 0.6 percent at 19,714.99 (close)

London – FTSE 100: UP 0.2 percent at 8,853.08 (close)

Paris – CAC 40: UP 0.2 percent at 7,804.33 (close)

Frankfurt – DAX: DOWN 0.8 percent at 23,987.56 (close)

Tokyo – Nikkei 225: UP 0.3 percent at 38,211.51 (close)

Hong Kong – Hang Seng Index: DOWN 0.1 percent at 24,162.87 (close)

Shanghai – Composite: DOWN 0.4 percent at 3,384.82 (close)

Euro/dollar: UP at $1.1426 from $1.1422 on Monday

Pound/dollar: DOWN at $1.3501 from $1.3551

Dollar/yen: DOWN at 144.88 yen from 144.57 yen

Euro/pound: UP at 84.61 pence from 84.27 pence

Brent North Sea Crude: DOWN 0.3 percent at $66.87 per barrel

West Texas Intermediate: DOWN 0.5 percent at $64.98 per barrel

© 2024 AFP