Hong Kong (AFP) – Asian markets sank Tuesday as worries about the impact of a possible trade war between China and the United States when Donald Trump takes office compounded disappointment about Beijing’s lack of extra measures to boost its stuttering economy. The sell-off came despite another record close on Wall Street, fueled by expectations that Trump will push through promised business-friendly policies and hopes that his administration will be pro-crypto, which saw bitcoin push to a new record close to $90,000.

While US investors are gearing up for another strong four years as Trump cuts taxes and eases regulations, their Asian counterparts — particularly in China — are keeping a wary eye on developments amid fears of another debilitating trade war. During his election campaign, the Republican told crowds that he would impose tough tariffs on imports into the United States, including as much as 60 percent on goods from China. Trump’s decision to pick China hawks for key positions in his cabinet has added to fears the next few years could be bumpy.

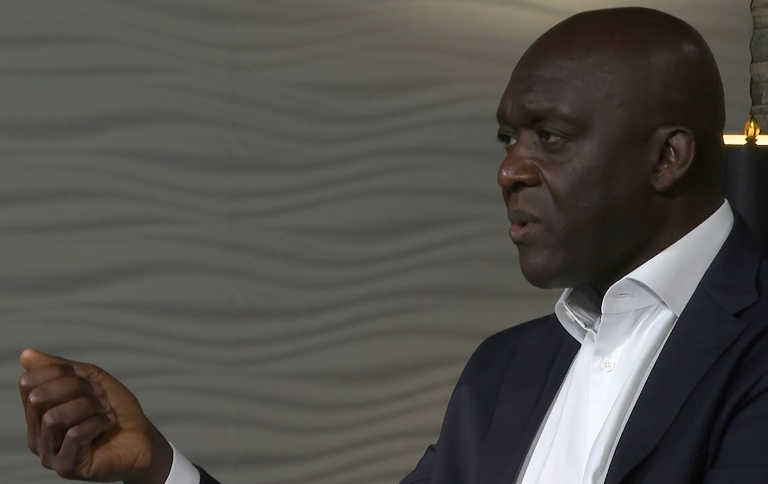

“The real question circulating among FX players: when will Trump’s trade agenda charge out of the gate?” asked Stephen Innes, managing partner of SPI Asset Management. “Wall Street is tentatively banking on a late 2025 or early 2026 timeline, allowing his team time to attempt diplomacy before reaching for the tariff stick. But word on the street hints that Trump could fast-track his tariff push, possibly leaning on current trade data from China to justify earlier action. And with China’s trade surplus on track to hit record highs this year, that showdown may not be too far off.”

Asian markets sank, with Hong Kong giving up more than three percent at one point, while Shanghai shed more than one percent. Tokyo, Sydney, Seoul, Singapore, Taipei, Mumbai, Bangkok, and Manila all lowered. Jakarta and Wellington edged up. London, Frankfurt, and Paris fell at the open. Beijing’s failure to announce any new stimulus at Friday’s much-anticipated news conference also continued to dampen sentiment, taking the wind out of investors’ sails after a raft of measures unveiled at the end of September fueled a market rally.

A Bloomberg report that officials were looking to slash taxes on home purchases to help the ailing real estate sector did little to assuage traders. However, some observers said the decision to come up short on stimulus last week may have been down to Chinese officials keeping their powder dry in order to react to the impacts caused by any Trump measures, such as tariffs. The dollar extended gains against its peers that started after news of Trump’s election, which has sparked bets on a pick-up in inflation that could complicate the Federal Reserve’s plans to lower interest rates.

US consumer price index data due Wednesday will be closely watched as investors try to ascertain the bank’s plans for next month’s monetary policy meeting. “We assume the Trump administration will deliver on their key policy proposals with the degree and timing of these policies the bigger uncertainty,” said National Australia Bank’s Rodrigo Catril. “Most of these policies (lower taxes, tariffs, immigration, deregulation, unfunded expansionary fiscal policy) can be regarded as pro-growth and or inflationary. This means, all else equal, a shallower Fed easing cycle and a stronger dollar.”

In the crypto sphere, bitcoin hit a peak just above $89,968, putting it well within range of the key $100,000 marker.

– Key figures around 0810 GMT –

Tokyo – Nikkei 225: DOWN 0.4 percent at 39,376.09 (close)

Hong Kong – Hang Seng Index: DOWN 2.8 percent at 19,846.88 (close)

Shanghai – Composite: DOWN 1.4 percent at 3,421.97 (close)

London – FTSE 100: DOWN 0.4 percent at 8,093.03

Dollar/yen: UP at 153.87 yen from 153.81 yen on Monday

Euro/dollar: DOWN at $1.0630 from $1.0648

Pound/dollar: DOWN at $1.2811 from $1.2872

Euro/pound: UP at 82.97 pence from 82.73 pence

West Texas Intermediate: UP 0.1 percent at $68.11 per barrel

Brent North Sea Crude: UP 0.2 percent at $71.94 per barrel

New York – Dow: UP 0.7 percent at 44,293.13 (close)

© 2024 AFP