Hong Kong (AFP) – Asian markets extended losses with Wall Street on Tuesday as investors prepared for key US jobs and inflation data, while sentiment remains subdued by worries over a possible tech bubble. After a healthy tech-led run this year, traders appeared to be seeing it out on a tepid note amid questions over the huge sums pumped into artificial intelligence and indications the Federal Reserve will pause cutting interest rates.

All eyes are on the release later in the day of US November jobs data and the delayed reading for October, which will be followed on Thursday by consumer price index figures. The readings will be pored over for some idea about the Fed’s plans for borrowing costs as officials debate whether or not to continue lowering them in January. Comments from decision-makers show the policy board split, with recent reductions coming on the back of worries about the weakening labour market but concern now turning to stubbornly high inflation.

Governor Stephen Miran — an appointee of Donald Trump — warned that rates are still too high, while New York Fed boss John Williams said they were at about the right place and Boston president Susan Collins called the decision a “close call.” “After essentially missing the October jobs report due to a lack of survey data, the Fed will closely scrutinise the November figures when setting out the path of monetary policy through early 2026,” Matt Weller, head of market research at City Index, said. “That said, traders are currently pricing in only a one-in-four chance of another rate cut in January, meaning that the market reaction to the release may be more limited unless it shows a large deterioration in the labour market.”

With the chances of a cut appearing limited for now — with some putting them at about 25 percent for next month — equity traders were turned sellers for now. Seoul lost more than two percent, while Tokyo, Hong Kong, Shanghai and Taipei were all more than one percent lower. Sydney, Singapore, Manila, Mumbai, Bangkok and Jakarta also fell. London, Frankfurt and Paris opened lower.

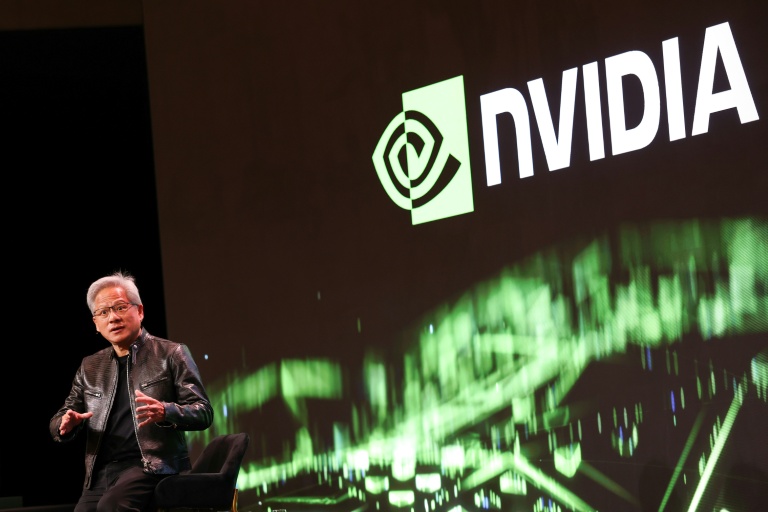

Worries over the tech sector were also weighing on sentiment, with recent warnings about an AI-fuelled bubble compounded by weak disappointing earnings last week from Oracle and Broadcom. Speculation that the hundreds of billions of AI investments will take some time to make returns, if at all, has also acted as a drag. “Jitters over the AI theme have resurfaced in recent sessions, not helped by Broadcom’s failure to provide concrete guidance for the quarter ahead, nor by reports that Oracle’s data centre construction may be delayed,” wrote Pepperstone’s Michael Brown. “Concern also lingers over the increase in debt-financed capex, especially from the likes of Oracle, though those concerns seem more likely to linger in the background into next year, as opposed to sparking significant fear in the now.”

The downbeat mood on equity markets has filtered into the crypto sphere, with bitcoin briefly falling to as low as $85,171, while gold — a go-to asset in times of uncertainty — hovered around $4,300 and close to a new record high. The yen held gains against the dollar ahead of an expected rate hike by the Bank of Japan on Friday.

– Key figures at around 0815 GMT –

Tokyo – Nikkei 225: DOWN 1.6 percent at 49,383.29 (close)

Hong Kong – Hang Seng Index: DOWN 1.5 percent at 25,235.41 (close)

Shanghai – Composite: DOWN 1.1 percent at 3,824.81 (close)

London – FTSE 100: DOWN 0.1 percent at 9,737.79

Euro/dollar: UP at $1.1751 from $1.1750 on Monday

Dollar/yen: DOWN at 154.90 yen from 155.25

Pound/dollar: DOWN at $1.3375 from $1.3372

Euro/pound: DOWN at 87.85 pence from 87.87

West Texas Intermediate: DOWN 0.6 percent at $56.50 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $60.26 per barrel

New York – Dow: DOWN 0.1 percent at 48,416.56 points (close)

© 2024 AFP