New York (AFP) – Capital One’s proposed merger with the US credit card specialist Discover has reshuffled the deck in a fast-growing sector in the United States, where cash is gradually disappearing from the landscape.

The all-stock deal is worth around $35.3 billion, and is expected to close in late 2024 or early 2025.

The deal, which will be subject to antitrust scrutiny, values Discover’s shares at a 27 percent premium, and would create a US banking behemoth. Under the terms of the agreement, around 60 percent of the new company will be owned by Capital One’s shareholders, with the remainder going to those of the financial services company.

Discover shareholders will receive 1.0192 Capital One shares for each Discover share, representing a premium of 26.6 percent on Discover’s closing share price on 16 February of just over $110.

Although the merger still has to be approved by the US regulatory authorities, Capital One’s founder and chief executive Richard Fairbank sounded optimistic in a conference call on Tuesday, telling investors that the two companies “are well positioned for approval.” “Discover adds $218 billion in annual spend and $102 billion in loans to Capital One’s credit card franchise, increasing our scale where it matters,” he said. “These additional revenue synergies have not been included in our deal model,” he added.

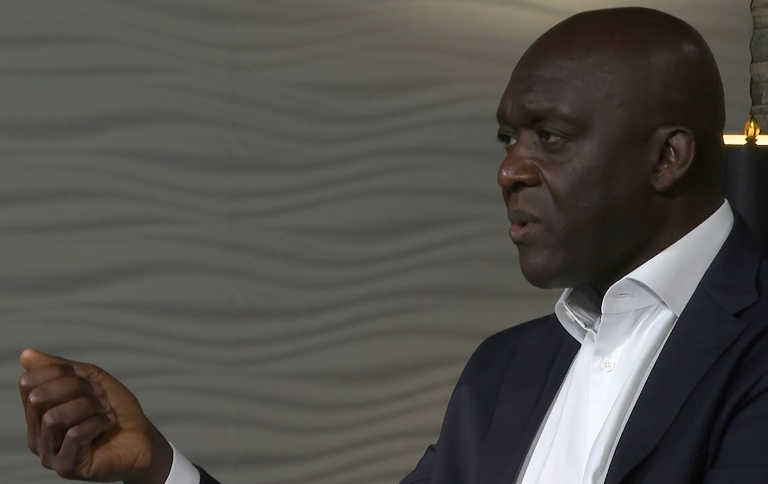

Discover’s chief executive Michael Rhodes said the deal gave his firm “the opportunity to scale at a very rapid pace, and much more so than we could certainly do on organic basis.” “And if I look at the organizations that have the most synergistic impact, with Discover, it is Capital One,” he added.

Capital One saw a relatively modest market reaction after the deal was announced: at noon local time (1700 GMT), shares were up 0.7 percent. By contrast, Discover shares surged almost 15 percent on the news.

– Competitors and partners –

Originally a financial subsidiary of the Sears retail chain, Discover developed in the early 1990s as a credit card network, before being acquired in 1997 by Morgan Stanley, which made it an independent company again in 2005.

Discover is the fourth largest credit card network, behind the three other American groups: Visa, Mastercard and American Express. Based mainly in the US, it is present in over 200 countries, and its cards are accepted in 70 million points of sale.

“They show up in nearly every physical point of sale across the United States and on nearly every online checkout page,” Fairbank from Capital One said Tuesday. “We intend to preserve the Discover brand,” he continued, adding that Capital One “would lean in to build and strengthen the network brand.”

The company made a name for itself by being the first in the United States to develop the principle of “cashback,” which enables credit card users to recoup a fraction of the money they spend, and gives banks and credit card networks valuable data on customers’ spending habits.

The acquisition will result in a number of Capital One’s credit cards being transferred to Discover’s network, while the bank is expected to continue working with Visa and Mastercard — particularly given their much more extensive networks abroad.

In effect, the company would be both a partner and competing with Visa and MasterCard at the same time, Fairbank acknowledged. “We’ve had a strong relationship with both of them since we started; it’s not unusual for companies to be both competitors and customers of each other,” he added. “We’re talking about taking a network that is way, way smaller than those, and giving it a chance to get more threshold scale pick up momentum.”